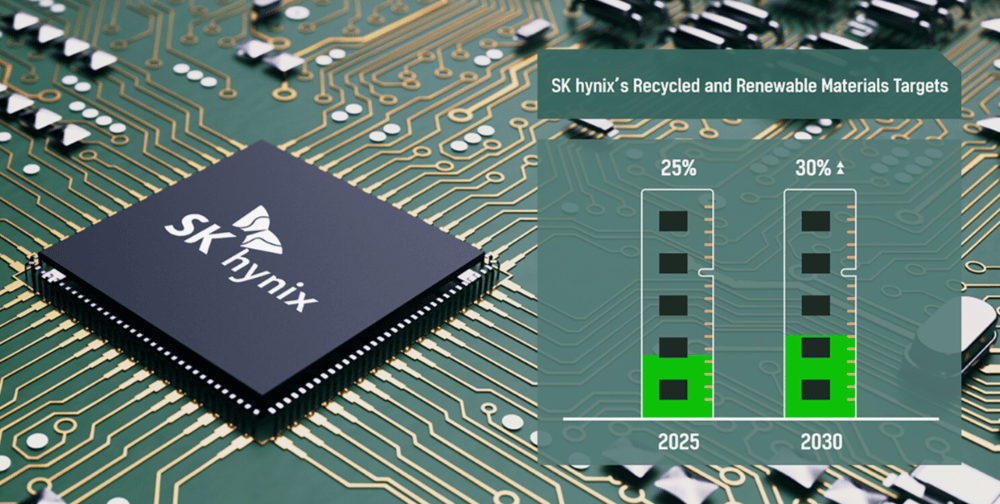

SK Hynix Rides High on AI Demand Amid US Export Policy Challenges with Nvidia Under Scrutiny

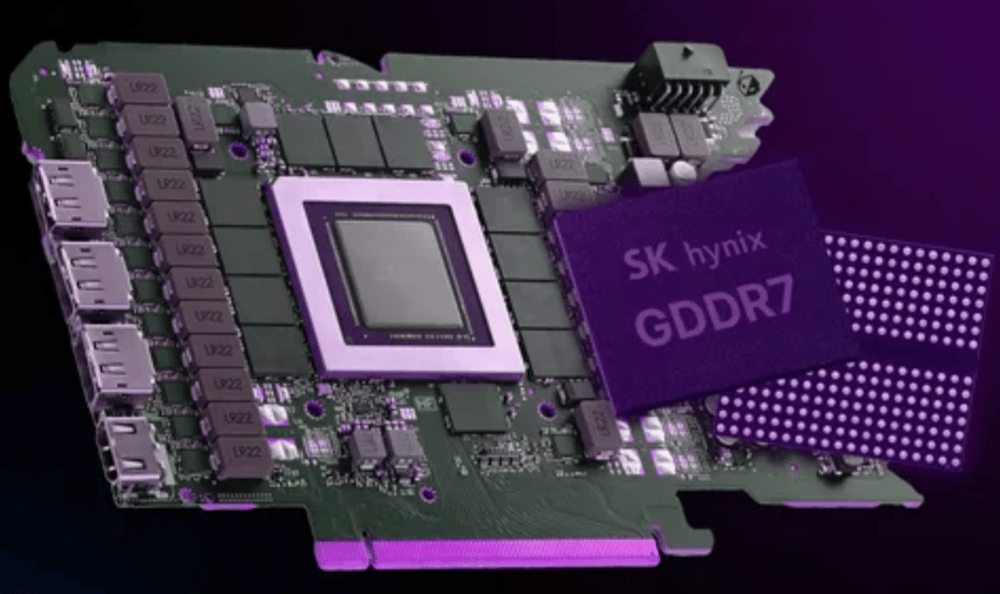

SK Hynix $000660.KS, a key supplier of high-performance memory processors for Nvidia $NVDA, reported a quarterly profit surge that more than doubled its previous performance. The robust demand for AI chips has played a central role in this achievement, with indications suggesting that potential US tariffs may only have a limited effect on these specialized products. The company’s positive outlook contrasts sharply with broader concerns in the semiconductor industry about the impact of regulatory pressures on international trade.

Dynamic Regulatory Environment and Market Reactions

In parallel, Washington has initiated an investigation into semiconductor imports over concerns that excessive reliance on overseas production could compromise national security. These regulatory developments have added complexity to the global semiconductor landscape. Notably, tightening export controls by the US—aimed at chips shipped to China—resulted in significant financial setbacks for Nvidia, with losses amounting to 5.5 billion dollars. This evolving policy environment raises questions about potential long-term repercussions for other semiconductor players, including SK Hynix.

Steps to Navigate Policy and Market Shifts

Below is a numbered overview of the measures that SK Hynix is likely to consider to mitigate regulatory uncertainties and press forward with its growth strategy:

1. Strategic assessment of supply chain resilience against evolving trade policies.

2. Continuous monitoring of US tariffs and export control regimes to anticipate market shifts.

3. Leveraging strong AI chip demand to offset regulatory risks and secure sustained profit margins.

4. Engaging with industry stakeholders to gauge broader impacts on semiconductor production and international trade.

The Semiconductor Industry in Flux

Several factors contribute to the current dynamics in the semiconductor market:

- The robust demand for AI chips driving exceptional profit growth for SK Hynix.

- US-led investigations and trade policies aimed at reducing reliance on foreign semiconductor production.

- The significant financial blow to Nvidia due to export restrictions impacting shipments to China.

- An overall environment where policy measures and market demand are intricately linked, shaping strategic responses from industry players.

Industry Outlook and Strategic Considerations

SK Hynix’s impressive profit increase against a backdrop of high chip demand illustrates its ability to navigate an increasingly complex regulatory landscape. While the heightened focus on national security and export controls poses challenges—with notable impacts observed in Nvidia’s financial performance—the chipmaker’s optimistic forecast underscores a resilient business model. The company exemplifies how a well-positioned player in the semiconductor field can harness market momentum despite ongoing global trade uncertainties.

Comments