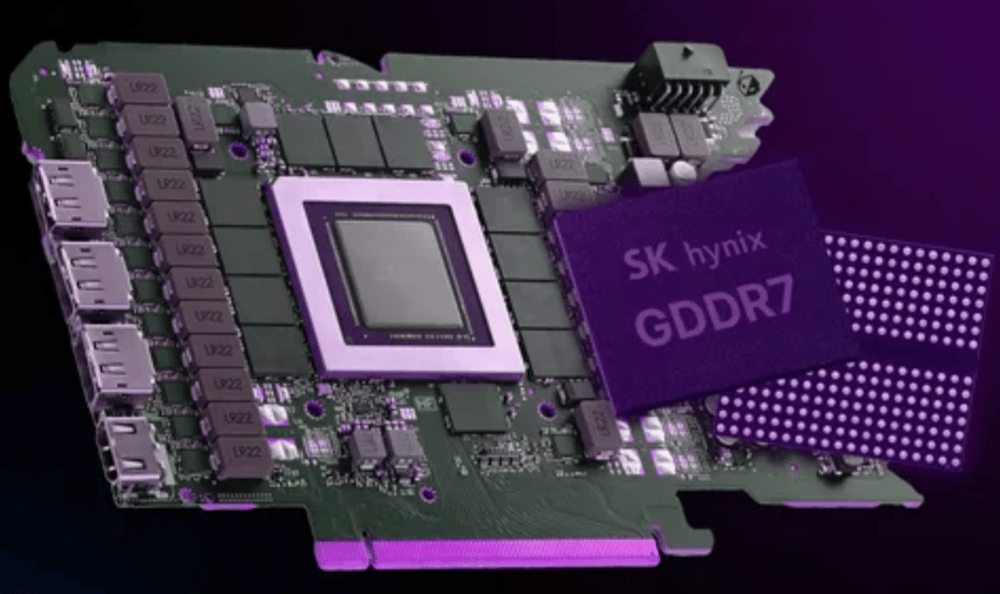

SK Hynix $000660.KS, a key supplier of high-performance memory processors for Nvidia $NVDA, reported a quarterly profit surge that more than doubled its previous performance. The robust demand for AI chips has played a central role in this achievement, with indications suggesting that potential US tariffs may only have a limited effect on these specialized products. The company’s positive outlook contrasts sharply with broader concerns in the semiconductor industry about the impact of regulatory pressures on international trade.

SK Hynix $000660.KS, a global leader in the semiconductor industry, has reported more than a twofold increase in its quarterly profits. This remarkable financial leap is primarily driven by sustained and rapidly growing demand for memory chips used in artificial intelligence (AI) applications. A vital component of this success is SK Hynix’s strong partnership with US-based tech giant Nvidia $NVDA, which has reinforced the company’s standing across global markets.

Recently, South Korean company SK Hynix, the world's second-largest manufacturer of memory chips, reported a shift in order timing among some of its customers. Anticipating new US tariffs, certain clients have advanced their schedules, prompting significant market adjustments. This article explores the implications of these developments for the semiconductor industry and examines the key factors influencing current market dynamics.

Shares of South Korea's $000660.KS have seen an impressive rise of 26% this year, driven by the growing demand for artificial intelligence (AI) technologies. However, despite this growth, threats are emerging on the horizon, related to political instability and company valuations. This situation is shifting local investors' focus towards companies that are more domestically oriented.