Recently, South Korean company SK Hynix, the world's second-largest manufacturer of memory chips, reported a shift in order timing among some of its customers. Anticipating new US tariffs, certain clients have advanced their schedules, prompting significant market adjustments. This article explores the implications of these developments for the semiconductor industry and examines the key factors influencing current market dynamics.

At the annual shareholders’ meeting, SK Hynix’s Head of Global Sales and Marketing, Lee Sang-Rak, highlighted that a "pull effect" combined with reduced customer inventories has created favorable conditions in the market. However, the durability of this positive trend remains uncertain.

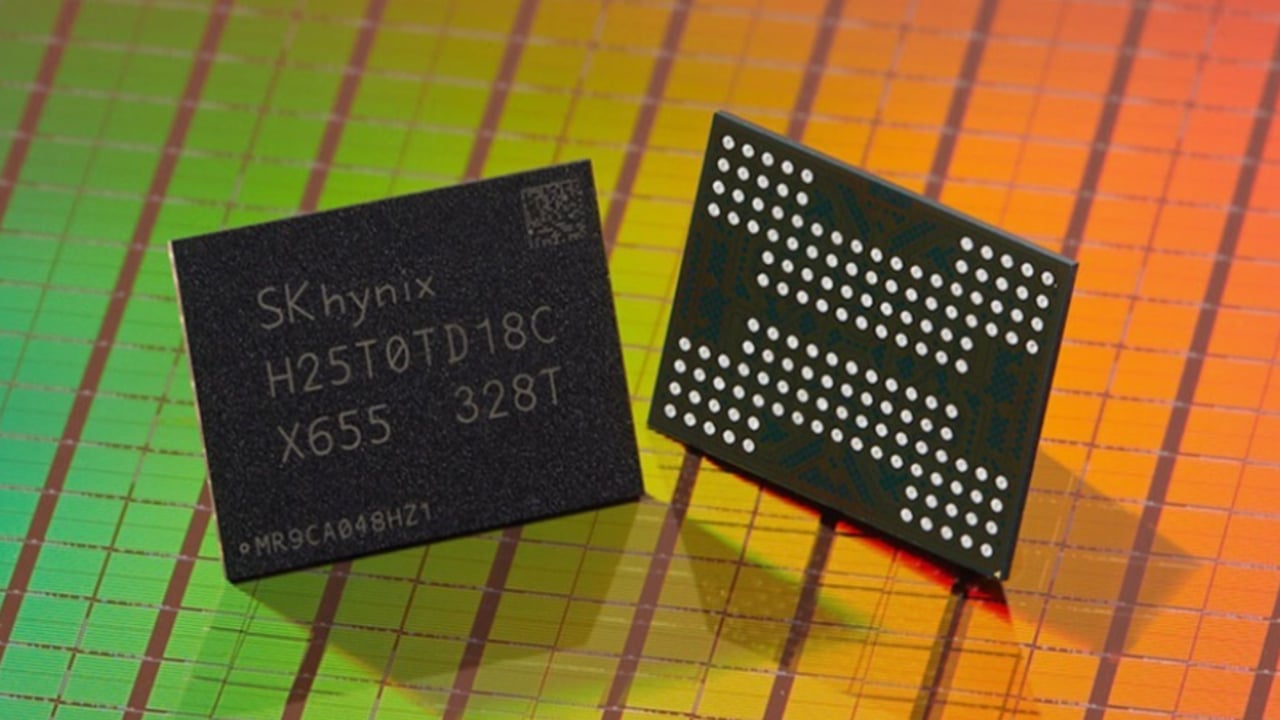

Earlier this year, SK Hynix announced that deliveries of DRAM and NAND flash memory would decline by 10–20% in the first quarter compared to the previous quarter. Additionally, a statement by former US President Donald Trump, who proposed tariffs of approximately 25% on imported semiconductors and other products, set the stage for increased market volatility.

For clarity, the following numbered points summarize the milestones and trends observed:

1. Customers accelerated orders in anticipation of upcoming US tariffs.

2. A "pull effect" boosted market conditions for SK Hynix.

3. Lower inventory levels among clients enhanced demand pressures.

4. A reported 10–20% reduction in the shipment of DRAM and NAND flash memory signals potential market slowdowns.

- Emphasis on reducing client inventory levels, resulting in shifts in demand distribution.

- Anticipated tariff changes influencing ordering strategies among major semiconductor manufacturers.

- Potential adjustments in supply chain dynamics and production volumes in response to evolving market conditions.

In an environment marked by economic uncertainty and fluctuating trade policies, global semiconductor players are compelled to adjust their strategies rapidly. The critical issue remains whether the market can absorb the impact of new US tariffs while maintaining the stability of memory chip supplies. Given the complexity of international trade relations and policy-driven market shifts, forecasts for future demand remain varied.

It is noteworthy that companies adapting successfully to market changes are increasingly modernizing their production processes and enhancing inventory management flexibility. SK Hynix’s capacity to facilitate earlier order placements exemplifies the strategic agility required in a volatile trade environment.

The evolving tariff landscape and resultant trade barriers are driving continuous adjustments in the memory chip market. Shifts in order planning and supply optimization strategies are likely to impact financial performance while prompting deeper evaluations of internal logistics.

This evolution underscores the importance of timely adaptation to economic shifts and the strategic management of inventories. The market's future trajectory will depend on forthcoming international policy decisions and the global response to new tariff measures.

It is interesting to observe how global events are shaping the semiconductor market and influencing customer strategies.

It is interesting to observe how global events are shaping the semiconductor market and influencing customer strategies.

It's fascinating how geopolitical factors can influence such critical sectors like the semiconductor industry!