U.S. Manufacturing Output Stagnates in May: Aircraft and Auto Gains Offset Broader Sector Weakness

U.S. manufacturing output showed minimal growth in May, signaling continued fragility in the industrial sector despite solid gains in motor vehicle and aircraft production. According to the latest report from the Federal Reserve, factory output rose by just 0.1% month-over-month, missing market expectations, as trade-related uncertainties and elevated input costs weighed on broader manufacturing performance.

The data reflects a mixed picture: while headline sectors such as automotive and aerospace posted robust rebounds, tariff-related disruptions, weakening global demand, and elevated financing costs limited gains across other industries.

Production Dynamics: Sectoral Gains Mask Structural Headwinds

The 0.1% increase in factory output during May followed a downwardly revised -0.5% contraction in April, suggesting the manufacturing recovery remains shallow. On a year-over-year basis, factory output was up 0.5%, a modest increase underscoring subdued momentum compared to historical post-pandemic averages.

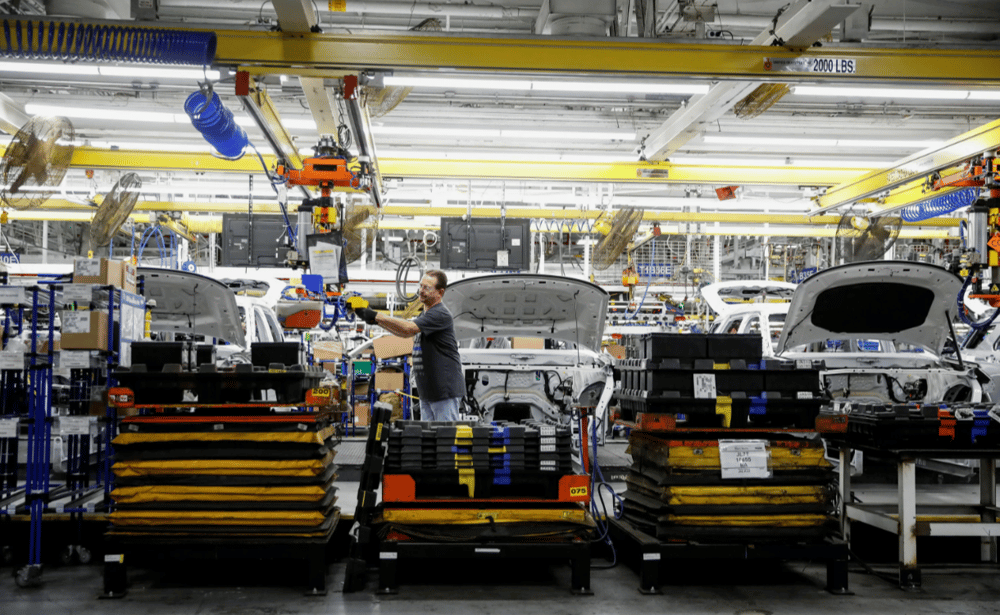

Motor vehicle and aircraft manufacturing led the monthly gains, supported by recovering supply chains and pent-up demand. However, production of machinery, textiles, and primary metals continued to struggle, reflecting ongoing cost pressures, labor constraints, and cautious business investment amid tariff concerns.

Key Manufacturing Data — May Overview

🔹 Factory output (MoM): +0.1%

🔹 April revision: -0.5% (previously -0.4%)

🔹 Manufacturing YoY growth: +0.5%

🔹 Vehicle and aircraft production: strong monthly rebound

🔹 Machinery, textiles, and metals: continued weakness

🔹 Fed manufacturing index: highlights divergence across subsectors

Market Reaction and Analyst Commentary: Tariffs Continue to Cloud Outlook

Financial markets showed limited reaction to the report, with major indices such as the S&P 500 $^SPX and Dow Jones Industrial Average $^DJI remaining relatively stable post-release. However, bond yields dipped slightly, reflecting subdued inflationary implications from the soft manufacturing figures.

Analysts point to a confluence of factors hindering a robust rebound: persistent tariffs on industrial inputs, particularly steel and aluminum; a slowing global economy; and cautious capital expenditure from U.S. firms amid Federal Reserve (Fed) uncertainty. With interest rates still elevated and tariff regimes unresolved, manufacturers remain hesitant to scale output.

Core Takeaways for Industrial Sentiment

Weak headline growth: +0.1% monthly gain reflects sectoral imbalances

Durables outperform: aerospace and auto offset machinery drag

April contraction revised deeper, emphasizing the volatility

Tariffs remain a key constraint on capital goods and inputs

Policy clarity needed for sustained manufacturing recovery

U.S. Factory Recovery Uneven as Trade Policy Overshadows Sectoral Strength

The latest data from the Federal Reserve reveals a fragile manufacturing environment, with headline gains driven by a few high-performing sectors and broader stagnation elsewhere. The continued presence of trade barriers and elevated input costs underscore the challenges facing U.S. industrial firms, even as selective areas such as transportation manufacturing demonstrate resilience.

Unless trade uncertainties and cost pressures ease, the manufacturing sector is unlikely to regain consistent momentum. For policymakers, the mixed data reinforces the need to address structural trade issues and support long-term industrial investment strategies.

Comments

It's concerning to see such sluggish growth in manufacturing when we need a stronger recovery.

This tepid manufacturing output is a stark reminder that the sector is still struggling under the weight of external pressures.