Singapore Hedge Fund Highlights Suzuki Strategy in India

Kings Court Capital Pte, a Singapore-based hedge fund that boasted an impressive 33% return last year, has shared insights on future investment opportunities. According to Chief Investment Officer Yu Liu, the reliable strategy of Japanese automaker Suzuki Motor Corp. $7269.T in India may play a crucial role in protecting the fund's portfolio from global trade risks.

Suzuki's Potential in India

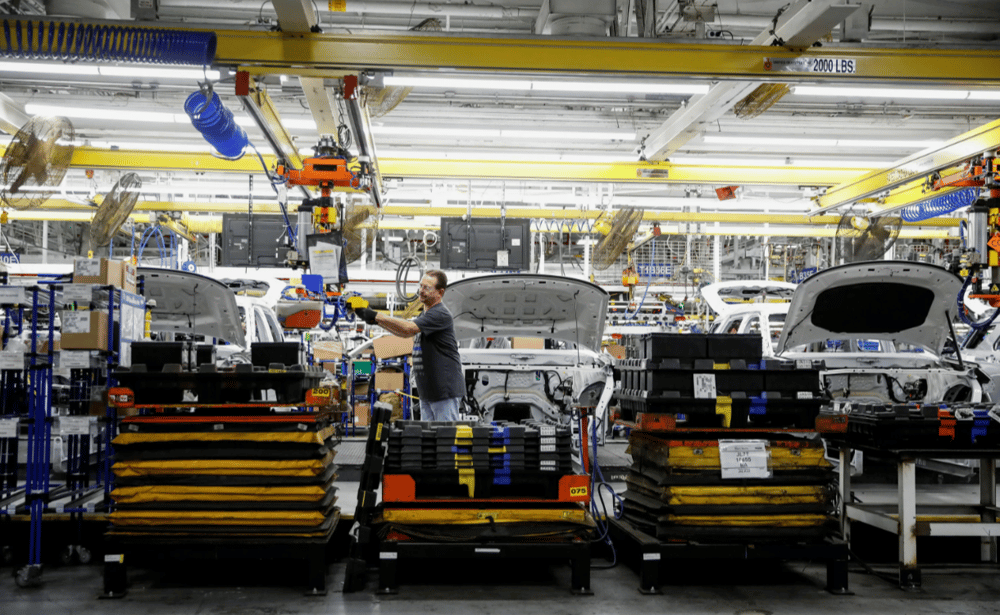

In the midst of fluctuating global trade dynamics, Suzuki is formulating its strategy by focusing on the rapidly growing Indian market. Understanding local realities and actively participating in the growth of the country's automotive sector makes Suzuki an attractive investment option, especially against the backdrop of uncertainty in other markets such as the U.S. and China.

Market Position

Suzuki's limited presence in critical markets like the U.S. and China offers the automaker several advantages should tariffs actually come into effect. President Donald Trump has proposed a 25% tariff on imported cars, which could negatively impact many major automotive brands with significant market shares in these regions.

Protection Against Trade Wars

With the increasing dominance of Chinese companies in electric vehicle manufacturing, such as BYD Co. $1211.HK, Suzuki is poised to avoid price wars that have affected many global automakers. This positions the company favorably, as the downward pressure on prices from Chinese competitors could strengthen Suzuki's market share in regions where it actively operates.

Factors Supporting Suzuki

Several reasons contribute to an optimistic outlook for Suzuki Motor Corp. in the context of global trade:

Limited tariff exposure: A restricted presence in vulnerable tariff-impacted regions helps mitigate risks.

Steady growth in India: Active development of manufacturing capacity and high consumer demand for vehicles.

Competitive strategy: A focus on affordable models, which continues to attract consumer interest.

Investment Strategies of Kings Court Capital Pte

Kings Court Capital Pte is actively exploring opportunities to safeguard and enhance capital through diverse investment strategies aimed at risk minimization. The approach to asset selection generally relies on comprehensive analysis and scenario planning.

Key principles of the hedge fund's strategic approach include:

Analysis of corporate strategies: Examining business models in local markets.

Geographical diversification: Investing in regions with minimal political and economic risks.

Focus on sustainable companies: Selecting firms that have already proven their strategic effectiveness.

According to Kings Court Capital Pte, Suzuki Motor Corp. represents an intriguing asset amid the complex landscape of global trade risks. The company's reliable strategy in India combined with its limited exposure to more volatile markets positions it as an attractive long-term investment option. With the increasing competition from Chinese manufacturers, strategic actions by Suzuki could promote its success and further increase its market share.

Comments