Trump–Starmer Trade Pact Eases Tariffs on UK Autos and Aerospace

On the sidelines of the G7 Summit in Canada, U.S. President Donald Trump and UK Prime Minister Keir Starmer signed a limited trade agreement aimed at reducing specific tariffs between the two economies. The deal, which comes as both nations work toward a broader bilateral trade pact, notably removes U.S. import duties on British aerospace products and reaffirms existing tariff quotas on UK-made automobiles.

While the accord signals renewed transatlantic economic cooperation, unresolved disputes over steel and aluminum tariffs underscore persistent trade tensions. The limited scope of the agreement reflects both progress and friction, highlighting the sector-specific approach currently favored by U.S. trade policy.

Analyzing the Scope and Implications of the US–UK Tariff Reduction

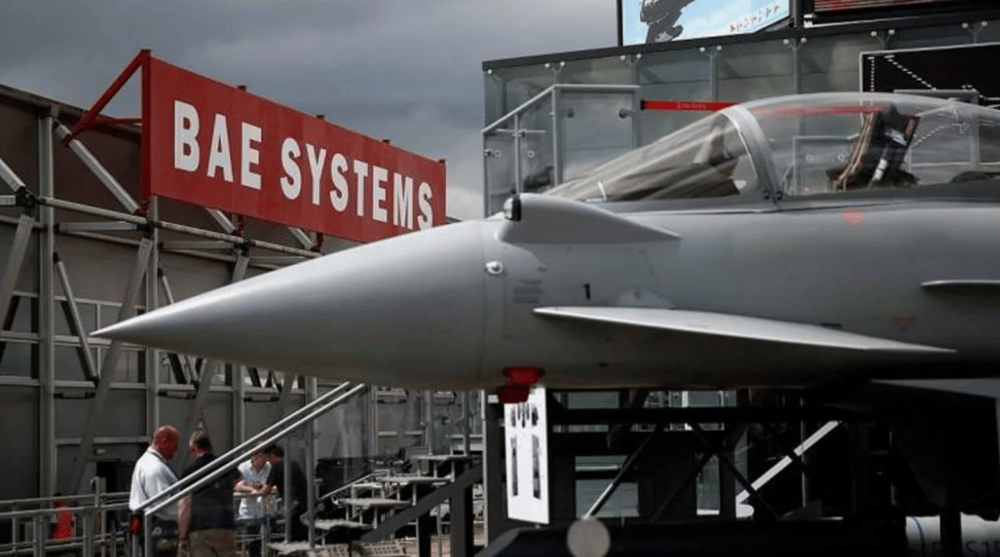

The newly signed agreement is seen as a step forward in dismantling remnants of post-Brexit trade frictions. The removal of U.S. tariffs on UK aerospace goods benefits companies like Rolls-Royce Holdings plc $RR.L and BAE Systems plc $BAESY, while reaffirmed auto quotas will help maintain market access for Jaguar Land Rover and other UK automakers.

However, the ongoing disagreement over tariffs on steel and aluminum imports—originally imposed under Section 232 of the U.S. Trade Expansion Act—remains unresolved, affecting UK-based producers and transatlantic supply chains.

Key Highlights of the Agreement

✅ U.S. removes tariffs on British aerospace exports

🚗 Quotas and tariff rates on UK automotive exports reaffirmed

🛑 No resolution on Section 232 steel and aluminum tariffs

📍 Pact signed during G7 Summit in Canada by Trump and Starmer

🇬🇧 Signals ongoing effort toward a full UK–US free trade agreement (FTA)

Market Reaction and Strategic Commentary

The immediate market response was muted but measured. Aerospace and defense stocks listed in London saw modest intraday gains following the announcement, with analysts noting the long-term strategic benefits for UK exporters. Foreign exchange markets $GBPUSD remained stable, reflecting broader macroeconomic factors rather than the limited scope of this trade development.

From a strategic standpoint, the move is viewed as an effort by Washington to rebuild alliances while maintaining a protectionist posture on core industrial sectors like steel. The deal also signals a more pragmatic UK trade strategy under the new Labour government, prioritizing incremental gains over sweeping trade reforms.

Strategic Implications and Stakeholder Perspectives

Positive signal for aerospace sector: Tariff removal benefits UK aerospace exporters with high U.S. exposure.

Automotive industry stability: Retention of tariff quotas ensures continuity for UK carmakers.

Section 232 still unresolved: Steel and aluminum tariffs remain a major barrier to full normalization.

FTA negotiations ongoing: The limited pact is seen as a precursor to a more comprehensive agreement.

Political optics: Announcement at G7 underscores alignment in optics if not yet in trade policy substance.

A Tactical Step Forward in UK–US Trade Relations

The UK–U.S. tariff agreement marks a meaningful but incomplete advance in transatlantic trade normalization. By eliminating duties in targeted high-tech sectors and reaffirming key quotas, the accord offers tactical relief to exporters while leaving thornier issues for future negotiation.

As both nations navigate domestic political priorities and global trade headwinds, the path toward a full-fledged Free Trade Agreement (FTA) will likely be gradual. Nonetheless, this accord sets a cooperative tone that may pave the way for broader structural deals in the near term.

Comments

This limited trade agreement is a promising step forward, but the real challenge will be finalizing a comprehensive deal.

Such strategic positioning highlights the transformative potential of automation in global markets