How to Connect a Trading Bot to a Broker

Algorithmic trading is rapidly transforming global financial markets, increasingly replacing traditional trading methods. According to Bloomberg, by 2025, over 80% of trading volumes across major asset classes will be executed by trading algorithms. A key technical element in this shift is the correct connection between a trading bot and a broker, which ensures real-time market data access, accurate order execution, and uninterrupted strategy deployment

The Integration Process and Its Impact on Trading Performance

Connecting a trading bot to a broker typically requires using Application Programming Interfaces (APIs) — standardized communication protocols that allow the bot to send and receive data from the broker's system. These APIs come in various formats such as REST, WebSocket, FIX, or proprietary SDKs. The integration involves several critical steps:

Authentication and Access Key Management – Ensures secure connections;

Execution Environment Configuration – Involves choosing between a Virtual Private Server (VPS), cloud server, or local machine;

API Integration – Setting up data feeds, order submission, account monitoring, and position management;

Risk Management Logic Implementation – Includes trade volume limits, stop-loss settings, and rate limit protection.

Platforms like MetaTrader 5 rely on MQL5 scripts, while brokers such as Interactive Brokers (IBKR) and Alpaca offer flexible APIs compatible with Python, C++, Java, and other languages.

Quick Facts:

REST and WebSocket APIs are widely used for retail and crypto trading;

FIX API remains the institutional standard due to its high execution speed;

VPS hosting reduces latency to 1–3 ms, critical for high-frequency trading;

Most brokers offer sandbox or paper trading modes to test integrations;

Broker infrastructure (servers, data centers) directly impacts latency and slippage.

Market Response and Technological Transformation

As algorithmic tools become more widespread, markets are adapting to accommodate automated trading. Brokers are investing in low-latency infrastructure, exchanges are offering colocation services in data centers, and traders are increasingly leveraging machine learning and quantitative strategies.

Some of the top broker platforms supporting trading bot integration include:

Interactive Brokers (IBKR) – Advanced FIX and TWS API access for institutional and retail traders;

Binance – High-frequency REST and WebSocket API, widely used in crypto markets (supports USD, USDT, BTC, ETH);

MetaTrader 5 (MetaQuotes) – Popular in Forex and CFD trading with robust automation support.

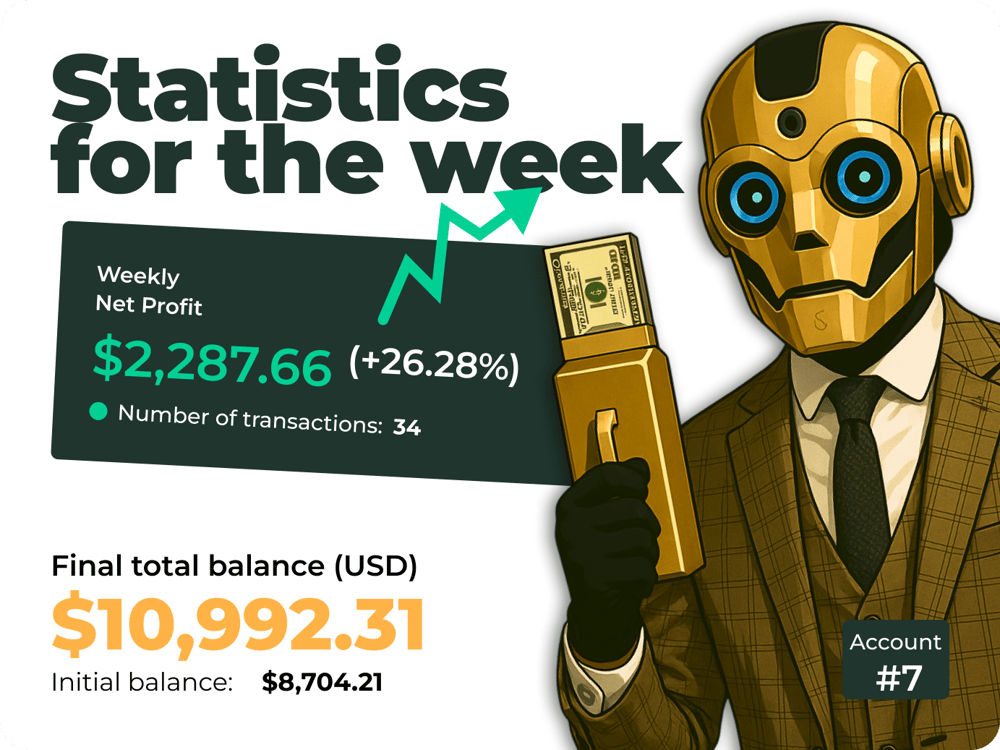

According to Deloitte, algorithmic strategies connected via broker APIs improve order execution quality by 15–25% compared to manual trading — particularly in volatile or high-frequency environments.

Key Takeaways:

API integration is essential for automated trading: REST, FIX, WebSocket, or SDKs are the primary formats.

MetaTrader 5 and Interactive Brokers provide the most comprehensive and stable interfaces.

Using a VPS or colocation service minimizes latency and improves trade execution precision.

Real-time API feedback enables dynamic strategy monitoring and trade quality control.

Regulatory bodies like the SEC and ESMA are increasing scrutiny on API access and automated trading systems, especially those engaged in high-frequency trading (HFT).

Strategic Importance of Broker Integration in Automated Trading

Properly connecting a trading bot to a broker is the foundation of any effective algorithmic trading system. The choice of protocol, hosting environment, and API structure directly affects the system's profitability, scalability, and resilience. As competition intensifies and regulations tighten, broker connectivity is no longer just a technical detail — it’s a mission-critical component that defines the success and safety of any trading operation.

FAQ

What type of API is best for connecting a trading bot?

REST or WebSocket APIs are ideal for retail and crypto markets (e.g., Binance, Alpaca). FIX API is best for institutional-grade trading (e.g., Interactive Brokers).

Do I need a VPS to run a trading bot?

Yes — especially for time-sensitive or 24/7 strategies. A VPS reduces latency and ensures stable uptime.

Can I connect a bot to MetaTrader 5?

Absolutely. MetaTrader 5 supports MQL5-based expert advisors and custom scripts for automated trading.

Is there a way to test the connection before trading live?

Yes, most brokers provide demo accounts or paper trading environments to simulate real conditions without risk.

How can I avoid common integration mistakes?

Ensure API compatibility, respect rate limits, test extensively on demo environments, and implement risk controls in the trading logic.

Comments

The future of trading is undoubtedly algorithmic, but precision in tuning is the key to staying ahead.

The rise of algorithmic trading is not just a trend; it's a revolution that could redefine how we approach investment.