How to Buy a Trading Robot for Forex, Stocks, and Crypto

According to reports from Deloitte and Bloomberg, retail investors have increased their use of trading robots—also known as algorithmic trading systems or automated strategies—by over 45% since 2020. At the same time, institutional players across equities (SPX), forex (USD, EUR, JPY), and cryptocurrencies (BTC, ETH) now rely on automation for over 70% of executed trades. In this context, purchasing a trading robot is becoming a strategic investment decision rather than just a technical one.

However, buying a trading algorithm involves more than just a financial transaction. It requires evaluating strategy efficiency, legal clarity, broker compatibility, and the ability to optimize performance parameters over time.

Choosing and Buying a Trading Bot—What to Look For

Purchasing a trading robot begins with understanding its underlying strategy and the conditions under which it was developed. The most critical evaluation criteria include:

Strategy Type: Trend-following, scalping, arbitrage, or market-making;

Platform Compatibility: MetaTrader 4/5, cTrader, NinjaTrader, Interactive Brokers (IBKR);

License Terms: One-time payment, subscription, or white-label solutions;

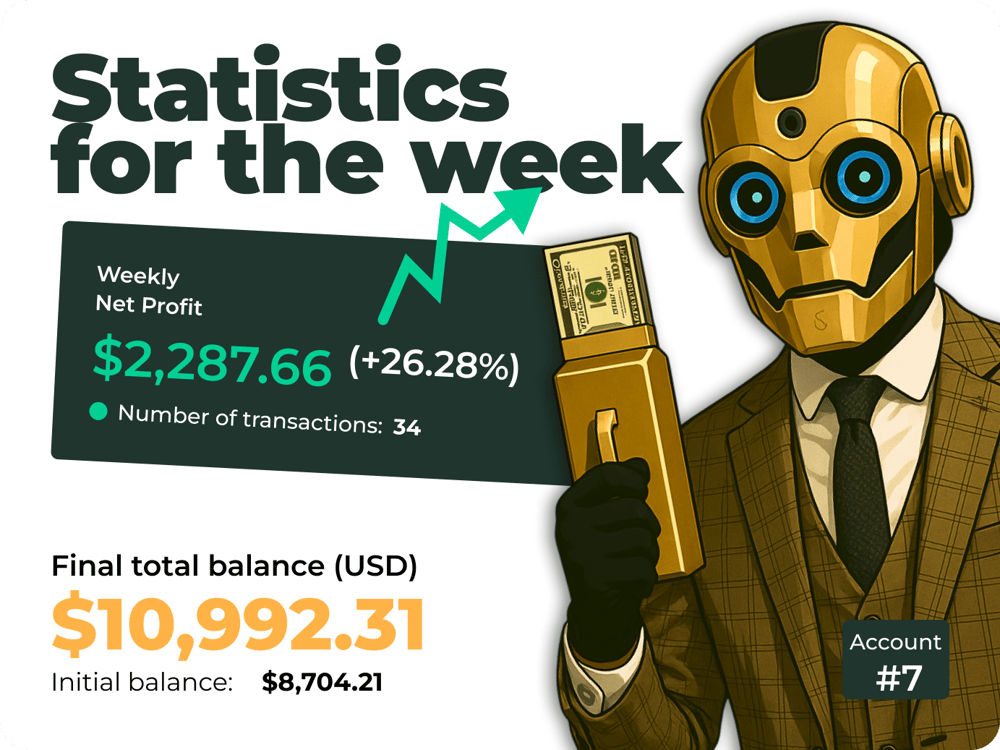

Performance History: Verified backtesting and forward testing (e.g., through Myfxbook);

Support & Updates: Technical support, regular updates, and customization capabilities.

Quick Facts:

High-quality bots typically range from $200 to $2,000 depending on features;

Reputable developers provide detailed trade histories and performance reports;

Bots with customizable parameters offer more flexibility;

Demo mode or paper trading is essential before going live;

Some bots perform poorly under high volatility—especially on USD/JPY or NASDAQ (IXIC) instruments.

Market Reactions and Expert Commentary

Financial analysts note the rapid institutionalization of trading automation. JPMorgan data shows that over 80% of SPX trades now involve automated systems, including high-frequency trading (HFT) and retail bots.

Platforms like the MetaTrader Marketplace, TradingView, and cAlgo are expanding their trading strategy marketplaces, with growing demand for both plug-and-play bots and advanced customization tools.

Experts emphasize that choosing a bot is only half the equation—broker integration is just as crucial. Key factors include API availability, order execution types, latency, and spreads—all of which significantly affect algorithm performance.

Key Considerations:

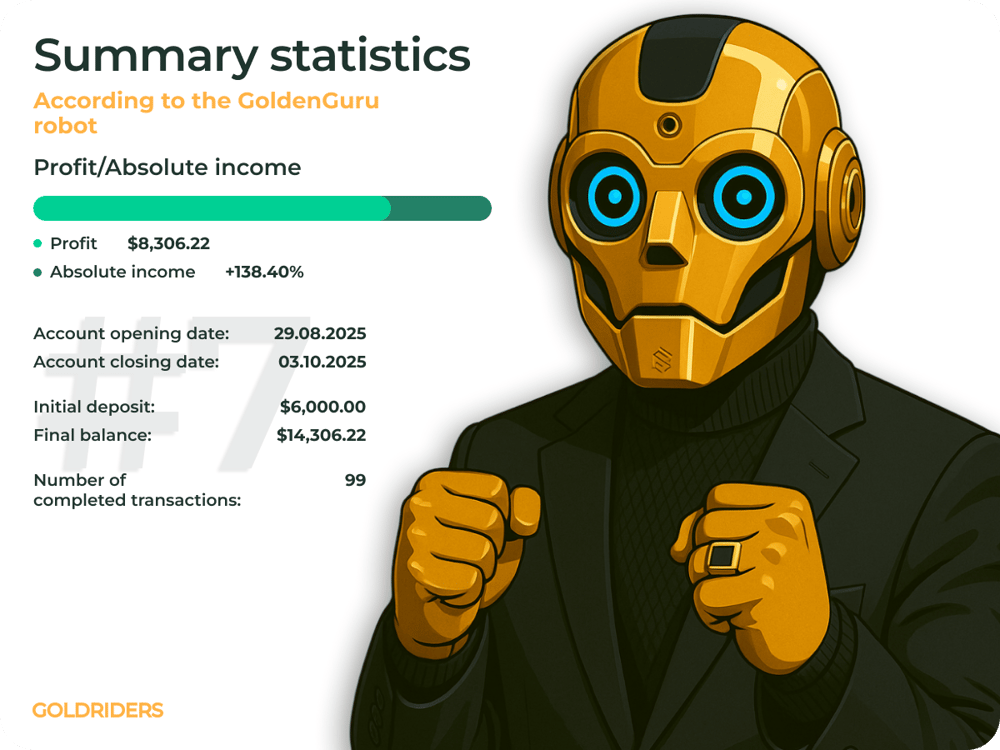

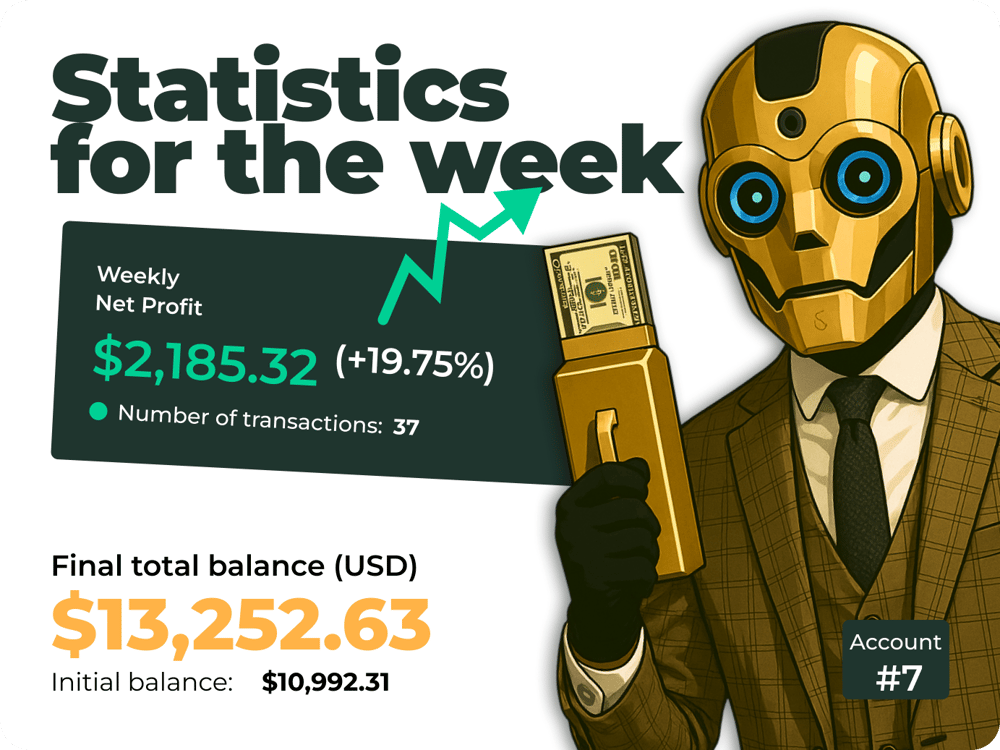

The most trustworthy bots come with full statistical breakdowns and verified performance.

Bots lacking risk management features pose elevated capital risks.

Always confirm broker compatibility—especially for latency-sensitive markets.

Avoid bots sold without forward tests or publicly available trade logs.

Advanced users prefer bots with automated parameter optimization (e.g., genetic algorithms).

Why Buying a Bot Is a Strategic Investment

Buying a trading robot is not merely a technical purchase but a strategic decision with long-term implications. Successful algorithmic trading requires a strong, transparent strategy, continuous optimization, and careful integration with brokerage infrastructure. A well-chosen robot can streamline trading and reduce manual workload, while a poorly selected one may compromise capital efficiency and lead to suboptimal outcomes.

FAQ

What should I consider before buying a trading robot?

You should evaluate the strategy type, licensing terms, supported platforms, verified performance records, and the quality of developer support.

Is it safe to buy a paid trading bot?

It depends on the transparency and credibility of the seller. Choose bots that offer backtests, forward tests, and customization features to reduce risk.

How do I evaluate a trading bot’s performance?

Use tools like Myfxbook for independent verification. Backtesting and live demo testing are essential before using real capital.

Can I adjust the bot’s parameters after purchase?

Yes, if the bot allows it. Flexibility in settings is crucial to adapting to market changes and personal risk tolerance.

Comments