What Is an AI Trading Robot and How Does It Work?

What Is an AI Trading Robot and How Does It Work?

Artificial intelligence (AI) is rapidly entering the world of trading. In the past, traders relied mainly on simple trading advisors (Forex robots) with fixed algorithms, but today AI robots for automated trading are taking the lead.

These solutions can not only follow predefined rules but also learn from data, adapt to the market, and make more flexible trading decisions.

In this article, we’ll cover:

what an AI trading robot is,

how it works,

how it differs from classic trading bots,

and the advantages it offers traders.

What Is an AI Trading Robot?

An AI trading robot is an automated trading program that uses machine learning and big data analysis.

Unlike classic bots that follow fixed rules (e.g., “if the price is above MA — buy”), an AI bot can:

analyze massive amounts of historical data,

identify hidden patterns,

forecast the probability of price movements,

adjust its strategy to changing market conditions.

📊 Such robots are used in:

Forex trading,

cryptocurrency trading (Binance, Bybit, etc.),

stock markets.

How Does an AI Trading Robot Work?

AI trading robots rely on machine learning (ML) and artificial intelligence (AI) principles.

Key stages:

Data collectionAnalyzes quotes, indicators, volumes, news, social media, and even market sentiment.

Processing and trainingThe AI algorithm “learns” from historical data to understand which conditions led to rising or falling prices.

PredictionBased on current data, the robot forecasts the probability of market movements.

Decision-makingThe AI robot automatically opens or closes trades within the set risk management parameters.

AdaptationOver time, the algorithm adjusts to the market, fine-tuning the strategy without manual intervention.

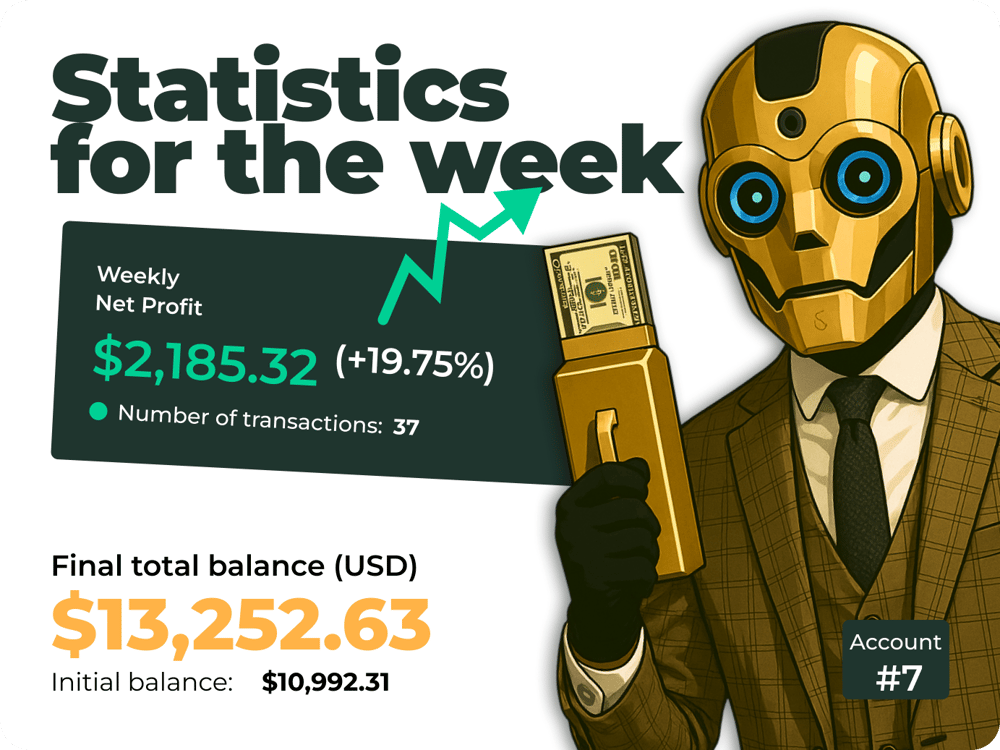

Benefits of AI Trading Robots

Adaptability — adjusts behavior based on market conditions.

Big data analysis — considers more factors than a human can.

Speed — makes decisions in milliseconds.

Emotion-free — unaffected by fear or greed.

Versatility — works on Forex, crypto, and stock markets.

Limitations and Risks

Complex development — requires significant resources.

Transparency — AI is often seen as a “black box.”

Doesn’t eliminate losses — even the smartest models can be wrong.

Conclusion

AI trading robots represent the next level of automated trading. They don’t just execute a script — they learn, analyze, and adapt to the market.

👉 For traders, this means:

less manual work,

more objectivity,

new opportunities for profit.

But keep in mind: an AI robot is a tool, not a magic “get rich” button. Its effectiveness depends on the quality of the model, correct configuration, and proper oversight.

Comments