How to Make Money with a Trading Robot Amid Market Volatility

Increased volatility across global financial markets—from swings in the S&P 500 (SPX) to fluctuations in major currency pairs like USD/EUR—has accelerated the adoption of algorithmic trading. Trading robots, also known as expert advisors (EAs), allow for systematized execution, reduced emotional bias, and consistent application of complex strategies.

Today, using a trading bot is not just a technological add-on but a core part of many retail and institutional trading operations. However, turning a bot into a revenue-generating tool requires a disciplined approach—from strategy selection and platform compatibility to risk control and continuous performance monitoring.

How to Generate Income Using a Trading Bot — Key Methods

Earning with a trading robot relies on three core elements:

Algorithm Effectiveness: Profitability hinges on the quality of the embedded strategy—trend-following, scalping, or mean-reversion. Bots with dynamic risk management and adaptable logic tend to outperform during volatile periods.

Broker and Platform Compatibility: Even the most robust strategy can fail under poor execution conditions. Bots must be calibrated to the broker’s environment—spread, slippage, and latency. Platforms like MetaTrader 4/5 (MT4/MT5), cTrader, or broker APIs (for example, those supporting SPX or equities) require specific setup to perform optimally.

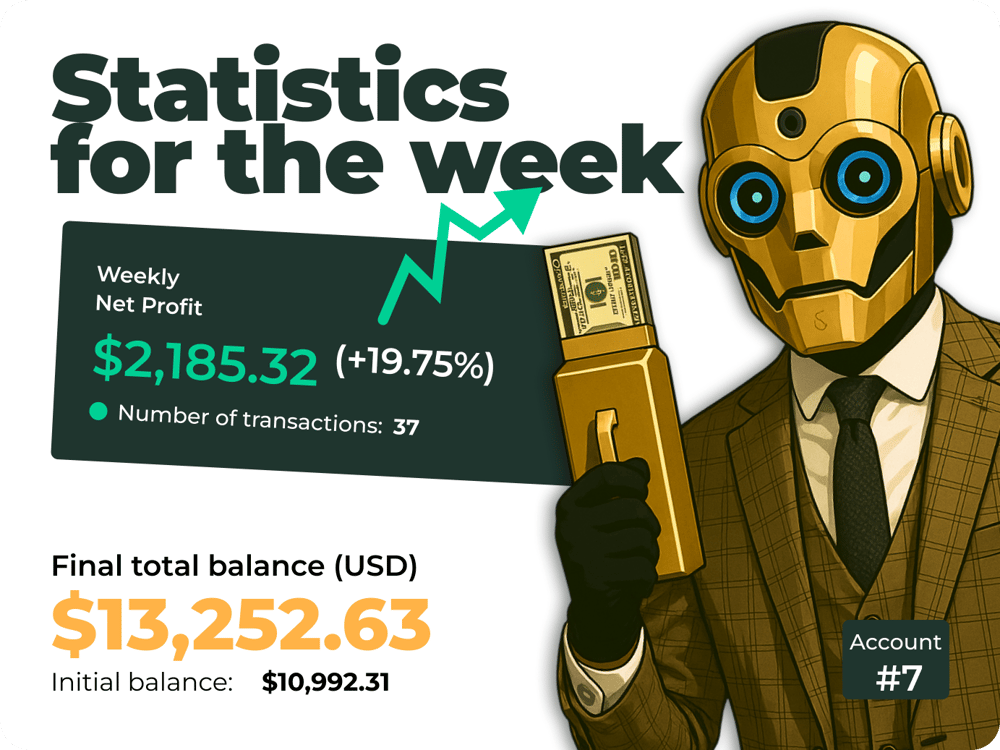

Ongoing Monitoring and Parameter Adjustment: Despite being automated, bots still require human oversight. Periodic performance reviews based on metrics such as PnL, Sharpe Ratio, and drawdown help ensure the system remains aligned with current market conditions.

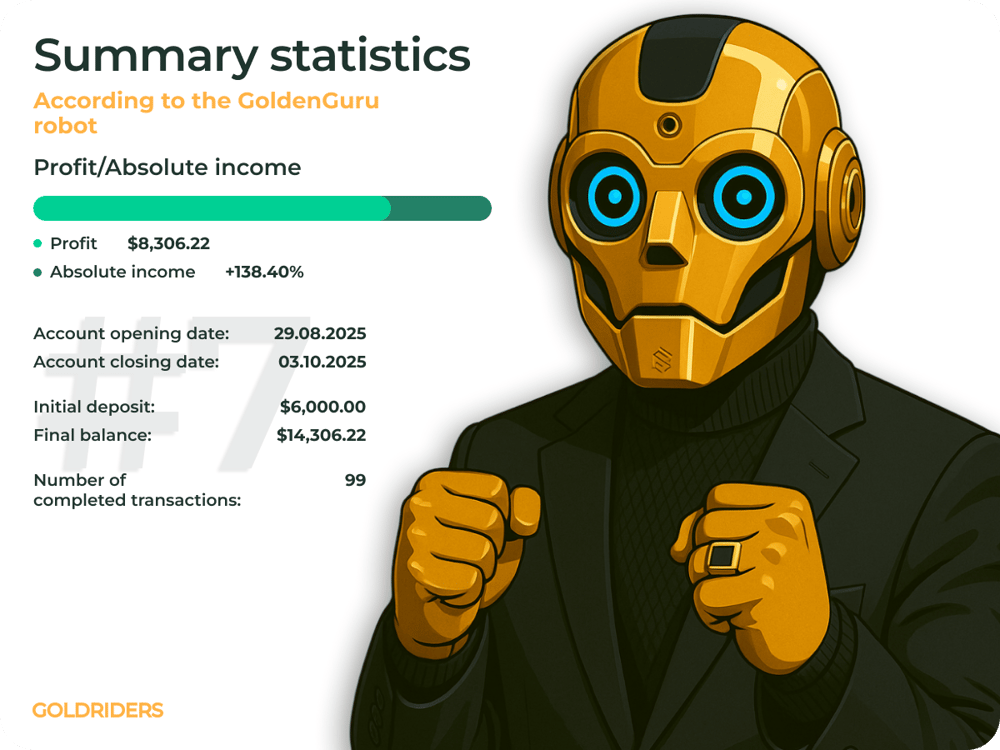

Quick Facts:

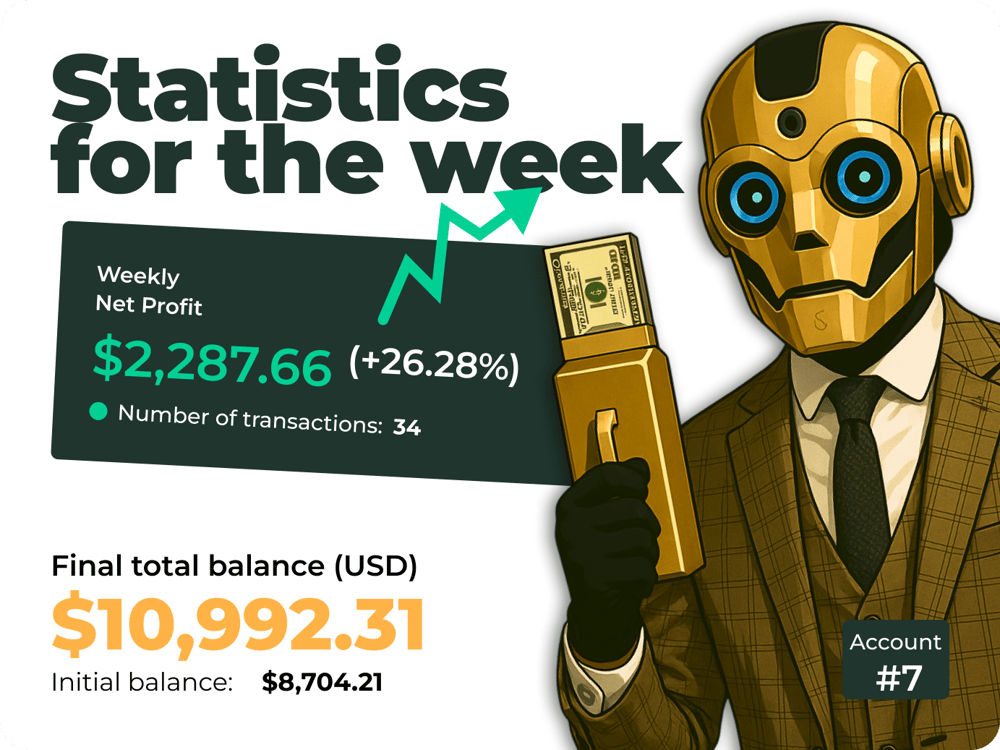

High-performing bots can deliver annual returns of 15%–40% with drawdowns under 20%

Forex bots targeting USD, EUR, JPY often use volatility-based or trend algorithms

Bots trading indices like SPX or NASDAQ typically need direct market access (DMA) for optimal execution

Some bots can auto-switch between strategies based on volatility thresholds or macroeconomic triggers

The main risk is “overfitting” — where a strategy is overly optimized for past data but fails in live markets

Market Reactions and User Experience

As retail traders increasingly adopt automated systems, clear behavioral trends have emerged across the industry.

Many users highlight the psychological benefits of algorithmic trading—freedom from emotional pressure, consistent strategy execution, and better time management. However, this advantage only materializes when users rigorously evaluate bot performance based on real-time metrics, not marketing claims.

There is also a growing preference for bots that incorporate AI elements, such as machine learning, especially in crypto markets where price action is less predictable and more data-driven.

Developers are responding by creating multi-asset bots that can switch between forex (USD, GBP), indices (SPX, DAX), and crypto pairs based on volatility regimes and liquidity filters.

Key Takeaways:

Strategy quality outweighs branding — always review forward-testing results and risk metrics.

Adaptive bots that respond to volatility shifts tend to perform better in uncertain markets.

Live performance tracking and forward testing are more relevant than historical backtests alone.

Compatibility with brokers—especially execution speed, commissions, and access to APIs—impacts profitability.

Regular optimization, reconfiguration, and news-based filters enhance long-term sustainability.

Trading Bots as a Scalable Source of Income — With Oversight

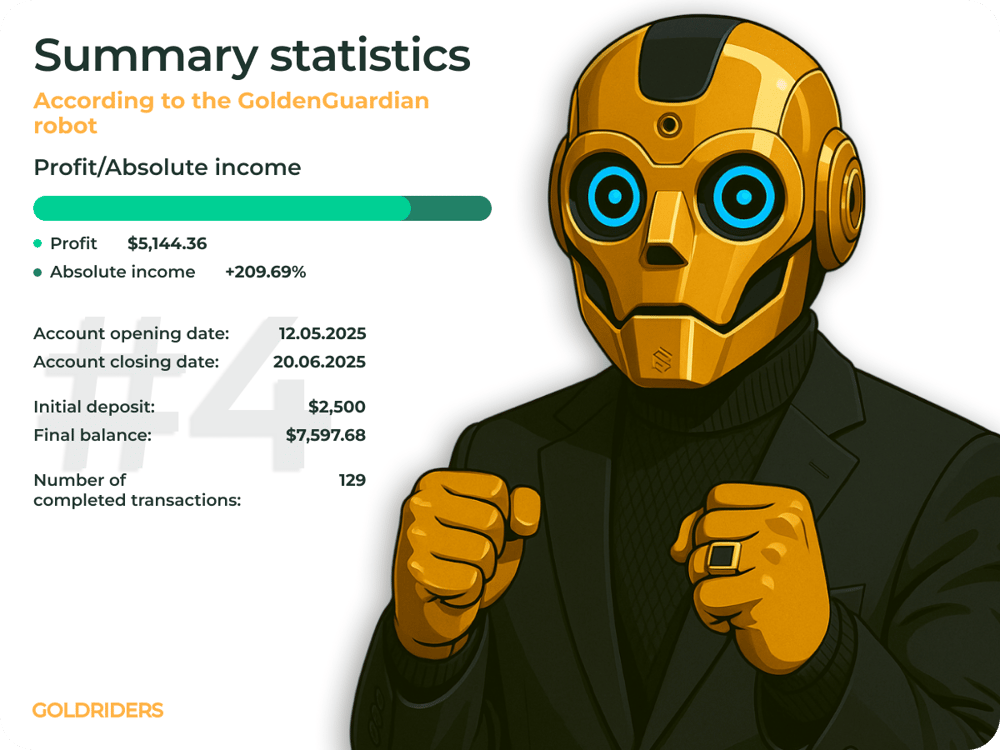

A trading robot can be a reliable income-generating tool when treated as part of a structured trading system. Profits are possible when the strategy is sound, execution is stable, and performance is actively monitored and adjusted.

As the digitization of financial markets continues, algorithmic tools will only grow in relevance—both for retail traders and institutional investors. A bot won’t replace a human trader, but when used strategically, it significantly extends what a trader can achieve.

FAQ

Can a trading bot generate consistent profits?

Yes, with a robust strategy, proper broker setup, and regular performance monitoring, a trading bot can deliver steady returns.

What strategies work best for bots?

It depends on the market. Trend-following and volatility-based models perform well on forex; arbitrage and pattern-based systems are effective on indices like SPX.

Do bots require active management?

Yes. Even automated bots need human oversight for risk control, market alignment, and performance tracking.

What platform is best for running a trading bot?

MT5 for forex, cTrader for scalping, and broker APIs for equities and indices like SPX.

How can I reduce risk when using a bot?

Use position size limits, diversify assets, forward test in demo environments, and avoid strategies that are overly optimized for historical data.

Comments

Algorithmic trading is rapidly becoming essential for navigating today's unpredictable market landscape effectively.