How to Choose a Trading Strategy in Forex: A Guide to Navigating Volatile Markets

Choosing the right trading strategy is one of the most critical decisions a trader can make—especially in the dynamic world of the foreign exchange market (Forex). Whether trading currency pairs like EUR/USD $EURUSD or USD/JPY $USDJPY, or engaging in broader macro-driven moves, a well-defined strategy provides structure, discipline, and a framework for managing both risk and market uncertainty.

In an environment shaped by economic data releases, geopolitical shifts, and central bank policies, a trader’s success often hinges on their ability to align their strategy with the prevailing market regime.

Strategy Types and Their Implications

Broadly speaking, trading strategies can be grouped into four categories: trend-following, counter-trend, scalping, and algorithmic. Each has its own set of risk parameters, time commitments, and market suitability.

Trend-following strategies aim to capture momentum in a clear direction. These approaches perform best in directional markets with strong liquidity.

Counter-trend strategies involve trading against the dominant move, seeking reversals. While potentially profitable, they carry higher risks in trending environments.

Scalping targets minor price movements on lower timeframes (e.g., 1-minute or 5-minute charts). Success depends on tight execution, minimal latency, and emotional control.

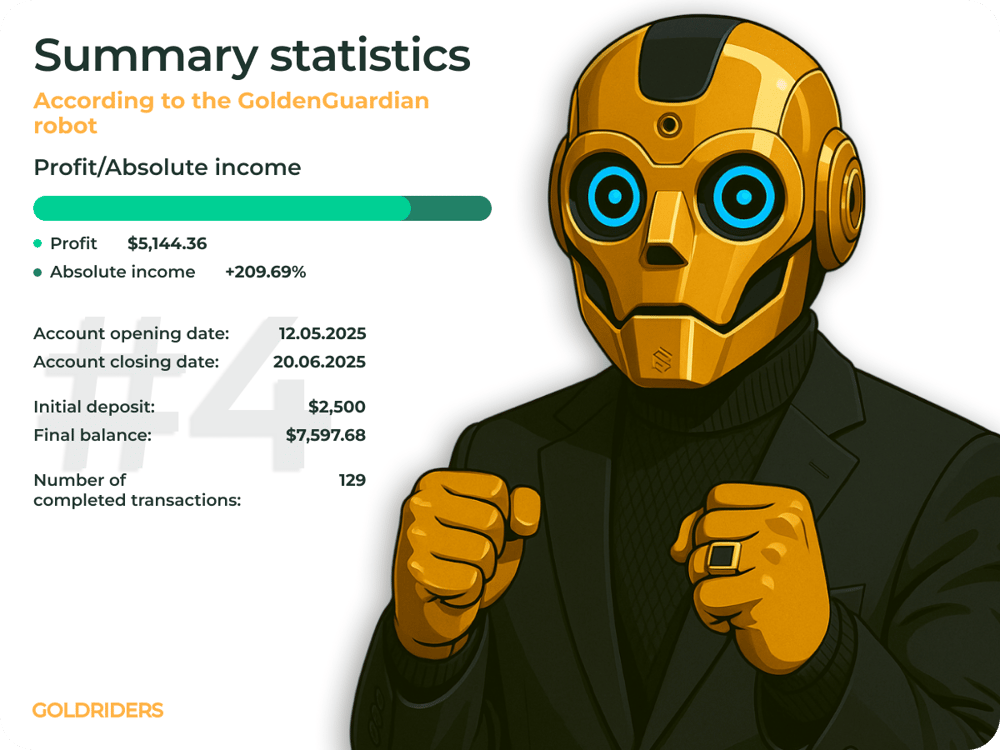

Algorithmic trading uses automated systems or bots to execute trades based on predefined parameters. This approach is widely used by institutional desks and increasingly by retail traders via platforms like MetaTrader.

Quick Facts:

A trading strategy defines your entry, exit, and position management framework

Trend-following systems align well with directional moves in indices such as the S&P 500 (SPX)

Scalping requires ultra-fast order execution and low spreads

Counter-trend methods are best for range-bound conditions but risky during breakouts

Algorithmic strategies rely on coding, backtesting, and statistical modeling

Market Behavior and Expert Views

Recent shifts in global monetary policy—particularly rate decisions by the Federal Reserve (Fed) and European Central Bank (ECB)—have increased volatility, prompting institutional investors to lean more heavily on systematic and trend-based strategies. This trend is reflected in higher volumes on exchanges like the CME Group (CME) and growing interest in rule-based algorithmic models.

According to analysts, flexibility and adaptability matter more than rigid adherence to a single method. Hedge funds, for example, may rotate between strategies depending on macroeconomic cycles. In inflationary phases, trend systems may dominate; ahead of key events like FOMC meetings, more neutral or hedged approaches often take precedence.

Key Considerations:

Assess market conditions: Identify whether the market is trending, consolidating, or highly volatile.

Match strategy to capital base: Not all strategies are suitable for small accounts.

Define risk tolerance: Understand expected drawdowns and volatility.

Conduct backtesting: Validate performance across historical datasets.

Adapt to macroeconomics: Monitor CPI data, NFP reports, and rate expectations.

Test across cycles: Use demo or micro accounts to simulate various market environments.

The Strategic Edge in Trading

A trading strategy is more than a checklist—it's a tool for capital allocation, emotional control, and risk containment. The right strategy provides consistency and helps reduce the randomness of market decisions. Effective strategies are those that can be tested, adjusted, and refined as conditions change.

Whether trading currency pairs, equity indices, or crypto assets, success in today’s markets depends not on predicting the future, but on managing the present with a strategy tailored to your resources, goals, and market view.

FAQ

What’s the most profitable trading strategy?

There is no one-size-fits-all solution. Profitability depends on market conditions, timeframe, risk tolerance, and trader discipline.

Can I combine multiple strategies?

Yes. Many traders blend approaches—for example, combining a trend-following base with occasional scalping opportunities.

How long should I test a strategy before using it live?

Backtesting across 1–2 years of historical data is ideal, followed by live demo trading for real-time validation.

Do strategies work equally well across markets?

Not always. A strategy that performs well in Forex may not suit equities or crypto markets due to different volatility and liquidity structures.

What’s a good strategy for beginners?

Beginner traders often benefit from simple trend-following strategies on higher timeframes (e.g., H1 or H4), which reduce noise and decision fatigue.

Comments

Capital reallocation toward automation signals confidence in its role as a long-term growth driver