Related Articles

Woodside Energy’s North West Shelf LNG Extension Faces Extended Consultation

Woodside Energy Group Ltd $WDS, Australia’s leading oil and gas producer, and the federal government have agreed to extend the consultation period for the North West Shelf (NWS) LNG extension project. This development follows last month’s conditional environmental approval, as stakeholders seek clarity on the terms imposed on the expansion of Australia’s oldest and most strategically significant liquefied natural gas (LNG) facility.

Eighth West Texas Intermediate Crude Oil $80 Call Options Surge Amid Middle East Tensions

On Friday, traders significantly increased their activity in West Texas Intermediate (WTI) crude oil call options priced at $80, anticipating further price gains following heightened geopolitical tensions in the Middle East. The escalation began with Israeli airstrikes targeting Iranian positions, intensifying fears of a broader conflict in the region—a key factor influencing global oil markets due to the Middle East's critical role in energy supply.

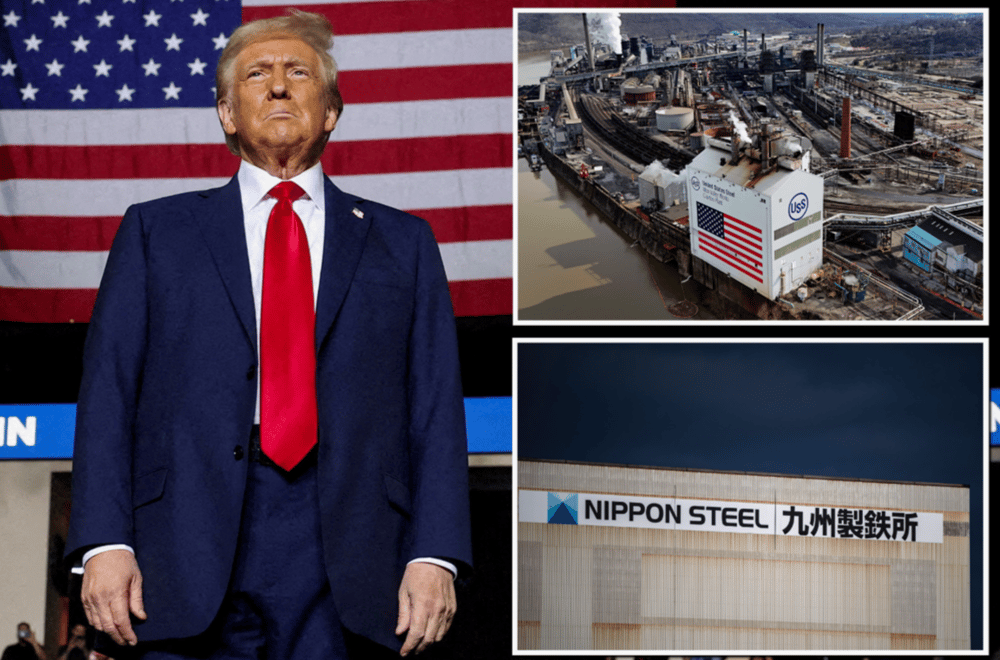

Trump Greenlights $14.9 Billion Nippon Steel–U.S. Steel (X.N) Merger After Security Reviews

In a landmark decision reshaping the global steel industry, former U.S. President Donald Trump has approved Nippon Steel’s $5401.T $14.9 billion acquisition of U.S. Steel $X. The move concludes nearly 18 months of regulatory scrutiny, labor union pushback, and national security evaluations.

Investors can expect that such strategic moves will strengthen market positions

Analysts note that recent moves have set the stage for renewed confidence, especially in sectors sensitive to global events

Corporate transformations could create a wave of new investor opportunities