Trump Greenlights $14.9 Billion Nippon Steel–U.S. Steel (X.N) Merger After Security Reviews

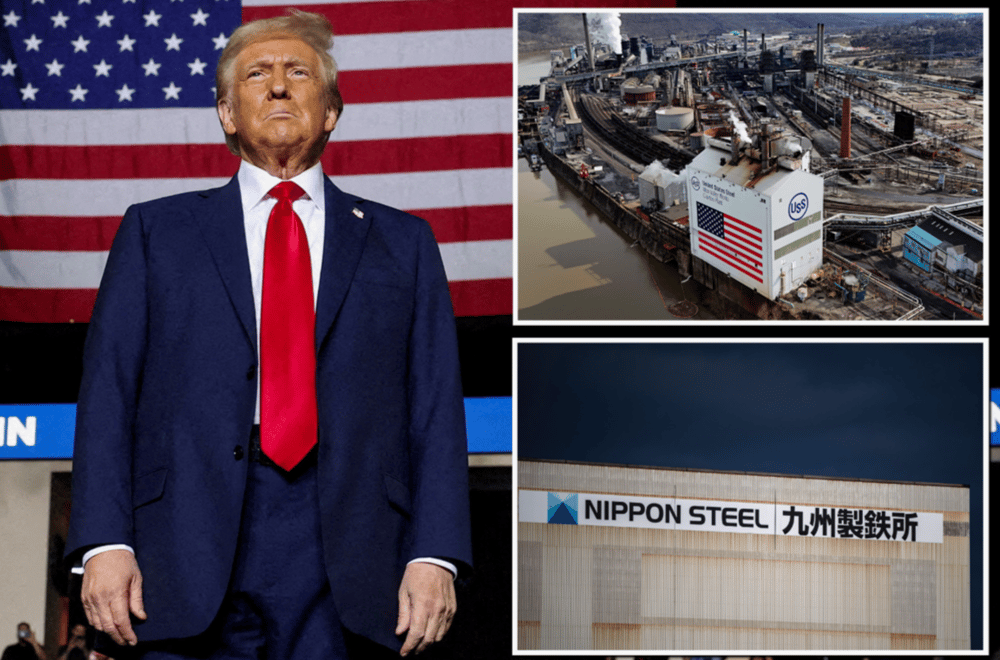

In a landmark decision reshaping the global steel industry, former U.S. President Donald Trump has approved Nippon Steel’s $5401.T $14.9 billion acquisition of U.S. Steel $X. The move concludes nearly 18 months of regulatory scrutiny, labor union pushback, and national security evaluations.

The green light came via an executive order signed on Friday, in which Trump outlined conditions under which the Japan-based steelmaker could finalize the acquisition. Central to the approval was the requirement for both companies to enter into an agreement with the U.S. Treasury addressing national security concerns. This agreement has since been executed, effectively paving the way for one of the largest foreign takeovers in the U.S. industrial sector in recent years.

Strategic Implications of the Nippon Steel–U.S. Steel Merger

The merger between Nippon Steel and U.S. Steel is more than a business transaction—it’s a politically charged event that touches on industrial policy, foreign investment, and strategic materials. The steel industry remains a cornerstone of U.S. national security due to its role in defense manufacturing, infrastructure, and energy production.

Nippon Steel’s acquisition follows a series of foreign investments scrutinized by the Committee on Foreign Investment in the United States (CFIUS), a federal body that evaluates deals for potential security risks. The U.S. government’s conditional approval signals cautious openness to foreign capital in strategic sectors—provided safeguards are in place.

Union resistance had been a persistent challenge throughout the negotiation process. The United Steelworkers (USW) union expressed concerns about job losses, domestic production capacity, and the influence of foreign owners on American labor practices. However, those objections were ultimately overruled following the national security reviews and the Treasury agreement.

Key Facts: Timeline and Deal Components

📌 Deal Size: $14.9 billion acquisition of U.S. Steel by Nippon Steel

📌 Duration: 18-month negotiation and regulatory process

📌 Executive Order: Trump authorized the merger under national security conditions

📌 Security Review: Passed scrutiny from CFIUS and Treasury Department

📌 Labor Opposition: Concerns from United Steelworkers (USW) addressed but not obstructive

Market Response and Political Repercussions

Financial markets reacted cautiously. Shares of U.S. Steel saw modest gains following the announcement, reflecting investor confidence in deal closure. Conversely, Nippon Steel's Tokyo-listed shares remained relatively flat, indicating mixed sentiment around the cost and geopolitical risks of the deal.

The broader implications extend to trade and industrial diplomacy. The transaction may serve as a template for future cross-border M&A involving strategic sectors. It also reveals the complexities of navigating U.S. national security laws amid heightened geopolitical tension, particularly with Asia-Pacific economies.

For Trump, the decision aligns with his “America First” narrative by showing that foreign investment can proceed under strict regulatory oversight. It also comes at a politically advantageous time, reinforcing his administration’s leverage over economic policy as campaign season intensifies.

Strategic Takeaways

National Security Precedent: Sets a template for how foreign entities can enter sensitive U.S. sectors.

Union Resistance Managed: Labor concerns addressed but outweighed by strategic priorities.

CFIUS Role Strengthened: Reaffirms the importance of CFIUS in evaluating FDI in core industries.

Bipartisan Industrial Policy Trend: Continues the trend of treating manufacturing as a national security issue.

Market Signal: Investor sentiment suggests confidence in cross-border consolidation under regulatory compliance.

A Pivotal Moment in U.S. Industrial Consolidation

The approval of the Nippon Steel–U.S. Steel merger marks a pivotal moment for both U.S. industrial policy and global M&A activity. By balancing economic openness with national security safeguards, the deal demonstrates how foreign investment in strategic sectors can proceed under clearly defined conditions.

As global supply chains shift and industrial assets become geopolitically sensitive, the steel deal highlights the evolving role of regulatory oversight in shaping the future of cross-border consolidation. For both companies and governments, the message is clear: strategic acquisitions must now align with political, economic, and security imperatives.

Comments

This decision could serve as a catalyst for broader technological transformation across sectors

Deals of this magnitude often mark inflection points in automation’s trajectory