T-Mobile Expands Starlink-Powered Satellite Data Service as Subscriber Base Tops 1.8 Million

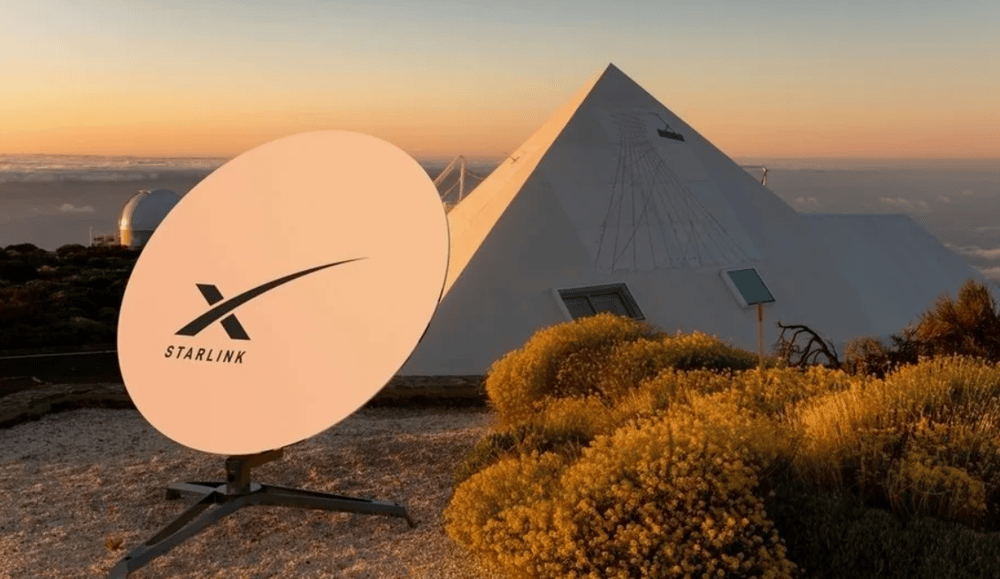

T-Mobile US Inc. $TMUS has confirmed the commercial rollout of its satellite-based data service, developed in partnership with Starlink, a division of SpaceX, beginning in October 2025. This development marks a pivotal step in the U.S. telecom landscape, as traditional wireless infrastructure meets next-generation low Earth orbit (LEO) satellite capabilities.

Since the launch of its beta program in late 2024, the offering has attracted more than 1.8 million early users, including a substantial number of switchers from AT&T $T and Verizon Communications $VZ, highlighting both the demand for broader coverage and the growing convergence of satellite and terrestrial networks.

Market Implications and Technological Shift

The integration of Starlink’s satellite infrastructure into T-Mobile’s network strategy represents more than a coverage enhancement; it is a strategic redefinition of how mobile connectivity is delivered in remote or underserved regions. The service will allow users to access mobile data in areas without cellular towers, effectively eliminating dead zones—a persistent problem in rural and off-grid locations.

T-Mobile’s move also signals a competitive escalation in the U.S. telecom sector. By leveraging SpaceX’s satellite constellation, T-Mobile has acquired an asset none of its rivals can currently match in scope or latency. This partnership enables the company to offer true nationwide coverage and lays the groundwork for expanding into global roaming via satellite in the future.

Industry analysts suggest that the hybrid network model—terrestrial + satellite—may soon become standard, particularly as 5G demand for seamless, high-availability coverage continues to rise. T-Mobile’s early leadership in this space positions it to capture users frustrated with service gaps from legacy networks.

Key Facts at a Glance

Company: T-Mobile US Inc.

Partner: Starlink (SpaceX)

Service Type: Satellite-based mobile data (via LEO satellite constellation)

Launch Date: Full commercial launch scheduled for October 2025

Beta Adoption: Over 1.8 million users since late 2024

Competitive Impact: "Hundreds of thousands" of subscribers migrated from AT&T and Verizon

Coverage Benefit: Enables connectivity in areas without cellular infrastructure

Broader Market Impact and Industry Reactions

The telecom and satellite sectors are closely watching this development, as it reflects a disruption vector that could redraw market boundaries. The positive early adoption metrics suggest that consumer willingness to adopt satellite-based solutions is high when latency is low and integration with existing devices is seamless.

Verizon and AT&T have not yet unveiled comparable partnerships or rollouts, which places them at a tactical disadvantage in the near term. T-Mobile’s hybrid service strategy aligns well with both consumer preferences for coverage continuity and government initiatives aimed at bridging the digital divide.

Furthermore, T-Mobile’s strategic use of Starlink’s LEO constellation circumvents many limitations of older geostationary satellite services, offering lower latency and higher throughput, essential for real-time applications and enterprise solutions in logistics, emergency response, and remote operations.

Strategic Highlights

First-Mover Advantage: T-Mobile becomes the first major U.S. carrier to commercialize satellite data via Starlink.

Market Share Expansion: Notable customer migration from AT&T and Verizon to T-Mobile’s satellite-enabled network.

Infrastructure Leap: Direct-to-device connectivity from satellite networks without need for specialized terminals.

Regulatory Favorability: FCC and federal interest in rural coverage support T-Mobile’s expansion narrative.

Technological Milestone: Integration of 5G with LEO satellites redefines mobile broadband standards.

A Defining Moment in Telecom Evolution

T-Mobile’s satellite service launch with Starlink is more than a technical milestone—it represents a paradigm shift in mobile infrastructure design. As the number of satellite-connected users grows, traditional barriers to connectivity—geographic or economic—begin to erode.

For T-Mobile, this innovation strengthens its competitive edge and reinforces its "uncarrier" positioning in a mature market. For the industry, it sets the tone for a new era where hybrid terrestrial-satellite models may become not only viable but essential to maintaining coverage leadership and subscriber loyalty.

Comments

Exciting to see T-Mobile embracing satellite technology for better connectivity!