Escalation in the Middle East Raises Alarms Over Oil Supply and Market Stability

Heightened tensions in the Middle East have intensified investor concerns after the United States reportedly launched a direct strike on Iranian nuclear facilities. This marks a serious escalation in the ongoing regional conflict and raises the specter of broader geopolitical instability. The market response, particularly in oil futures and safe-haven assets like gold and the U.S. dollar (USD), reflects fears of supply disruptions and risk contagion.

Although Middle Eastern stock exchanges, which operate on Sundays, showed muted immediate reactions, investor sentiment remains fragile. Iranian missile attacks on Israel have intensified, and the sudden U.S. military involvement may deepen uncertainty in an already volatile region.

Oil Markets React Swiftly: Brent and WTI Futures Surge on Supply Shock Fears

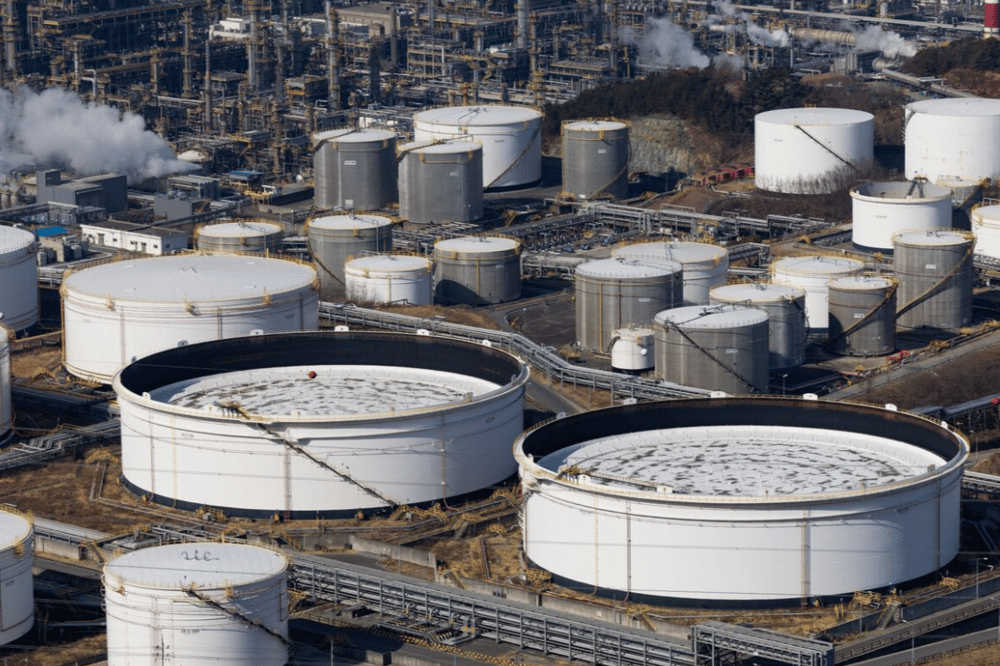

The geopolitical shock has already sent oil benchmarks — Brent and West Texas Intermediate (WTI) — climbing sharply. Investors are pricing in the potential for a supply shock, given Iran’s strategic importance to global oil flows and its proximity to the Strait of Hormuz, a critical transit chokepoint through which nearly 20% of global oil passes daily.

The rise in crude oil prices (USD-denominated) reflects the market’s expectation of reduced supply or retaliatory action targeting shipping lanes, which would increase transportation risks and insurance costs for energy cargo.

Further complicating the outlook is the investor rush into safe-haven assets, including gold, U.S. Treasuries, and the Japanese yen (JPY). This rotation away from risk assets — particularly in emerging markets and cyclical sectors — highlights the fragility of sentiment.

Key Developments:

U.S. launches military strike on Iranian nuclear sites

Iran responds with intensified missile attacks on Israel

Brent crude rises above $90 USD per barrel, WTI climbs in tandem

Middle East equity markets show measured reaction despite escalations

Flight to safety drives demand for USD, gold, and U.S. Treasuries

Investor Reactions and Strategic Assessments of the Crisis

Market participants are actively reassessing geopolitical risk premiums. Analysts warn that while the initial financial market response has been measured, especially in Middle Eastern stock markets, the risk of prolonged escalation remains elevated.

Energy analysts also point to the fragility of global supply chains. Any sustained disruption in Iranian production or transportation infrastructure — or threats to the Strait of Hormuz — could raise the global oil risk premium significantly. This would affect not only energy prices but also inflation expectations and central bank policy trajectories globally.

Key Market Impact Areas:

Energy prices: Short-term spike in Brent and WTI due to supply concerns.

Currency markets: Strengthening of safe-haven currencies like JPY and USD.

Equities: Emerging market outflows and volatility in cyclical sectors.

Bond markets: Increased demand for U.S. Treasuries amid risk-off sentiment.

Commodity-linked economies: Potential upside for exporters like Saudi Arabia, Canada, and Norway.

Briefing Points:

U.S. military action targeted Iranian nuclear infrastructure.

Iran responded with missile strikes on Israeli territory.

Oil prices surged due to supply disruption fears.

Gold, USD, and JPY rose as investors sought safety.

Middle East stock markets remained stable but fragile.

Strategic Considerations: Market and Policy Commentary

Despite the lack of immediate panic in equities, the strategic implications of U.S. intervention are significant. Analysts from major banks and energy consultancies are warning of long-term structural changes to oil flows, insurance premiums in maritime shipping, and central bank inflation strategies if tensions escalate further.

Key Strategic Takeaways:

Oil supply risk remains concentrated in the Gulf region, with Iran playing a pivotal logistical and geopolitical role.

The U.S. strike introduces a new risk premium, increasing the likelihood of retaliatory actions beyond the regional context.

Inflationary risks may rise globally, potentially derailing easing cycles in Western economies.

Defense and energy stocks may outperform in the short term due to heightened geopolitical exposure.

Risk sentiment remains volatile, with investor attention sharply focused on diplomatic developments and potential further escalations.

U.S.–Iran Tensions Mark a Turning Point for Global Risk Pricing

The U.S. military action against Iran has added a critical layer of complexity to an already uncertain macroeconomic landscape. The rise in oil prices and safe-haven flows underscores market sensitivity to any developments in the Gulf, particularly those that may impact supply routes or broader geopolitical stability.

While Sunday’s muted reaction in Middle Eastern equities may reflect local investor resilience or limited initial disruption, the global financial system is now recalibrating its risk models to account for a deeper U.S. engagement in the region. The situation will remain fluid, with every diplomatic or military signal likely to generate pronounced market reactions.

Comments

This escalation makes it crucial for investors to reassess their strategies amid rising uncertainty.