SoftBank's Investment in Chip Technology: The Acquisition of Ampere Computing

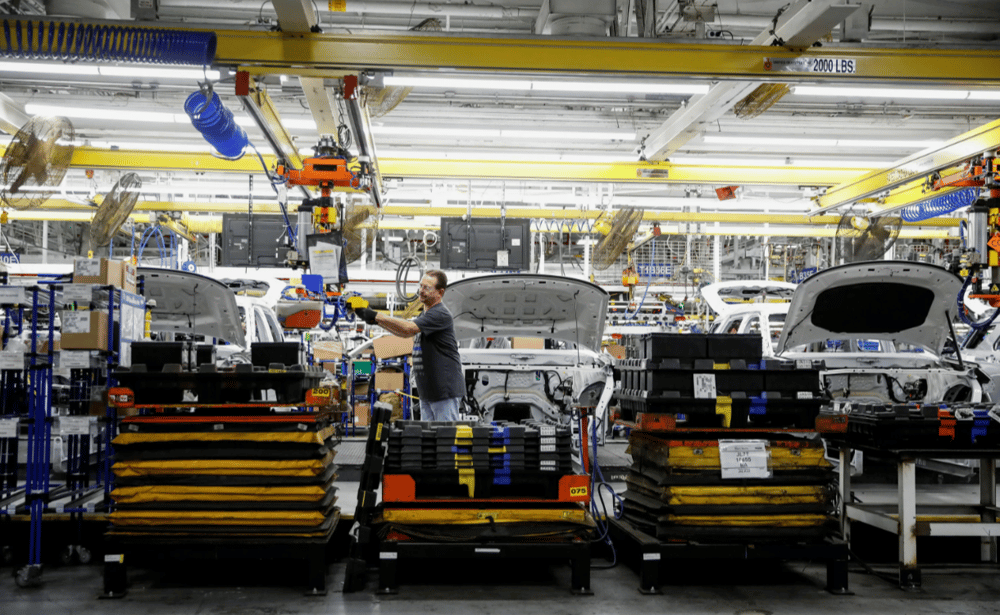

In the high-tech sector, Japanese company SoftBank Group continues its aggressive expansion strategy with the strategic acquisition of American startup Ampere Computing. The deal is valued at $6.5 billion and highlights SoftBank's intent to strengthen its position in the semiconductor sector, especially in light of the growing interest in artificial intelligence (AI).

Details of the Deal

The announcement of the acquisition of Ampere Computing was made on Wednesday, marking a significant move in SoftBank's broader strategy to increase investments in technologies that support AI development. Ampere's founder, a former president of Intel, adds considerable value to the company and its innovative solutions.

Key Facts About the Deal

1. Deal Value: $6.5 billion.

2. Announcement Date: Wednesday of last week.

3. Founder of Ampere: Former president of Intel.

SoftBank's Strategy in the AI Market

SoftBank has ramped up its efforts in AI-related investments, reflecting a global trend of increasing focus on this area. The company's founder, Masayoshi Son, emphasized that AI has become a key focus for the company and represents their latest major bet on transformative technologies.

Recent AI Investments by SoftBank

- OpenAI: Investments in the operator of ChatGPT.

- Stargate: A project aimed at developing data center infrastructure in the U.S.

- Cristal: A joint venture with OpenAI to develop AI services for corporate clients in Japan.

Future Prospects for Semiconductor Technologies

The acquisition of Ampere Computing broadens SoftBank's portfolio in the necessary technologies for building modern AI solutions. Given the increasing demand for computational power and data processing solutions, such transactions could strengthen the company's competitive standing within the industry.

Important Factors Influencing the Semiconductor Market

1. Rising Data Consumption: The need for efficient processors grows each year.

2. AI Development: AI demands powerful computing solutions, further increasing the demand for semiconductor technologies.

3. Competition Among Market Players: New technologies and startups like Ampere have the potential to significantly reshape the landscape.

In conclusion, SoftBank's acquisition of Ampere Computing underscores the company's strategic focus on developing artificial intelligence and semiconductor technologies. This event could have a substantial impact on the technology market and the company’s future investments and competitiveness.

Comments