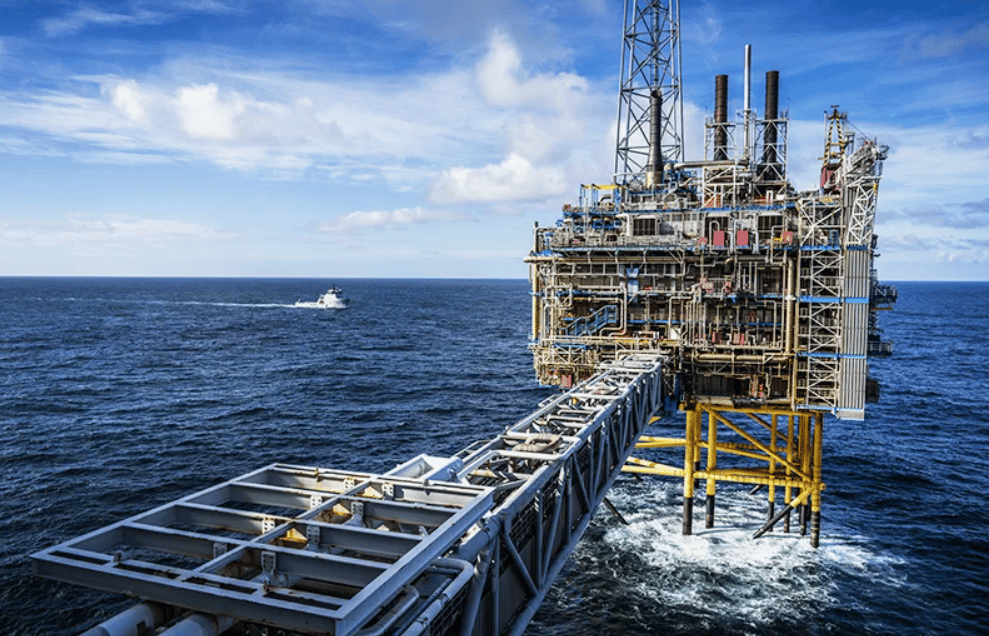

Norwegian Oil & Gas Investment to Hit Record NOK 269 Billion in 2025 Amid Global Energy Market Shifts

Norway's oil and gas sector is set to reach unprecedented levels of investment in 2025, according to a recent industry survey conducted by the Norwegian Statistics Office (Statistisk sentralbyrå). The largest business sector in the country plans to inject 269.1 billion Norwegian kroner (approximately USD 26.62 billion) into exploration, production, and infrastructure projects. This figure surpasses previous forecasts from February, which estimated investments at 253.8 billion NOK, and exceeds last year’s total of 251.2 billion NOK.

Implications of Record Investments for the Norwegian Oil & Gas Industry and Global Energy Markets

The substantial increase in Norwegian oil and gas investment highlights the strategic importance of the sector within both national and global contexts. Norway, as a major exporter of crude oil and natural gas, plays a critical role in European energy security, especially amid ongoing geopolitical tensions and global shifts towards energy transition.

The revised forecast for 2026 also indicates a rise, with preliminary estimates reaching 206.6 billion NOK, up from 197.1 billion NOK earlier in the year. This sustained capital expenditure suggests confidence among industry players despite volatility in oil prices and regulatory pressures related to climate change.

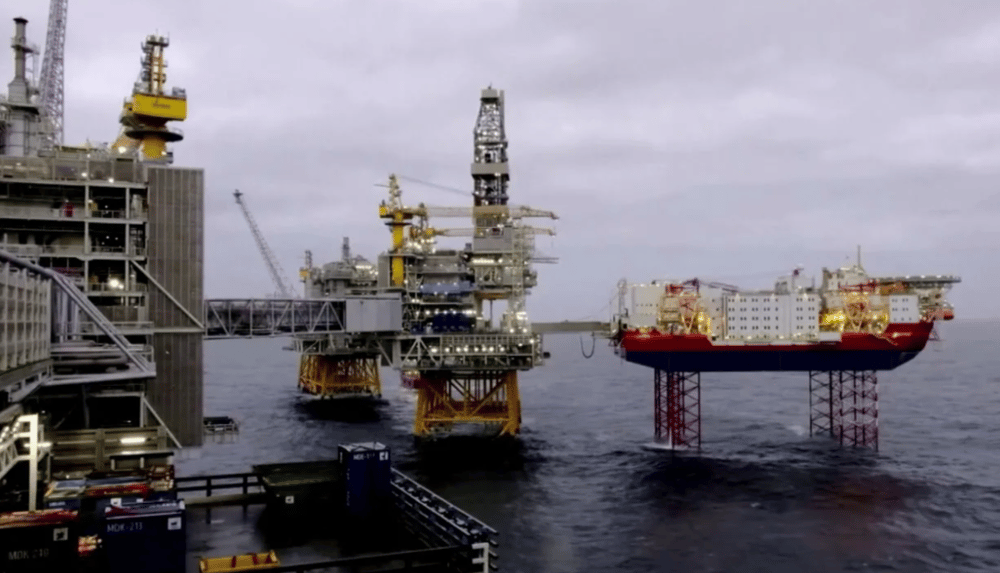

Investments are likely directed towards enhanced recovery projects on existing fields, new offshore developments, and upgrades in technology for more efficient production. The emphasis on capital-intensive projects reflects both a response to current energy demand and a strategic positioning for future market dynamics, including natural gas exports to Europe.

The Norwegian krone (NOK), closely tied to the country’s oil sector, may experience volatility aligned with investment trends and global oil prices. International investors and commodity markets are attentive to such capital flows, as they influence supply projections and energy price stability.

Key Facts

Planned oil and gas investment in Norway for 2025: 269.1 billion NOK (~USD 26.62 billion)

Increase from February forecast of 253.8 billion NOK and 2024 actual of 251.2 billion NOK

Preliminary 2026 investment forecast: 206.6 billion NOK, up from 197.1 billion NOK in February

Norway remains a key global oil and natural gas supplier, influencing European energy security

Investment focuses on enhanced recovery, offshore developments, and production efficiency technologies

Market and Economic Reactions to Norway’s Growing Oil & Gas Investment Outlook

The upward revision in Norway’s oil and gas capital expenditure has drawn positive attention from energy markets and financial analysts. The investment boost reinforces Norway’s position as a cornerstone in global energy supply, particularly for natural gas exports to the European Union (EU), which is seeking diversification following reductions in Russian gas flows.

Financial markets have responded with moderate strengthening of the Norwegian krone (NOK) against the US dollar (USD) and euro (EUR), reflecting expectations of improved trade balances driven by the energy sector. Energy equities listed on the Oslo Stock Exchange (OSE) also gained momentum, with companies like Equinor ASA $EQNR.OL poised to benefit from expanded upstream activities.

However, the investment surge occurs amid increasing scrutiny over environmental and regulatory frameworks aimed at decarbonization. Industry stakeholders balance the need for immediate energy security with long-term sustainability goals, impacting investment strategies and technological innovation.

Key Points

Norway’s oil and gas investment forecast for 2025 reaches record levels, reflecting sector confidence.

Capital expenditures target enhanced recovery, offshore projects, and efficiency improvements.

The Norwegian krone shows relative strength tied to energy sector performance.

European energy security considerations drive demand for Norwegian gas exports.

Environmental regulations continue to shape investment decisions and technological focus.

Strategic Significance of Record Norwegian Oil & Gas Investment for Global Energy Dynamics

Norway’s planned record investments in its oil and gas sector underscore the country's pivotal role in meeting current and future global energy demands. With 269.1 billion NOK allocated for 2025, the Norwegian oil industry reinforces its capacity to supply critical energy resources while navigating complex market and regulatory landscapes.

This investment trajectory not only supports economic growth domestically but also plays an essential role in stabilizing European energy markets amid geopolitical uncertainties. The balance between maximizing resource extraction and adhering to environmental standards will shape Norway’s energy strategy in the years ahead.

Comments

This sale could shape how automation becomes a core pillar of technological advancement

We're seeing automation evolve from a support function into a central driver of growth