Related Articles

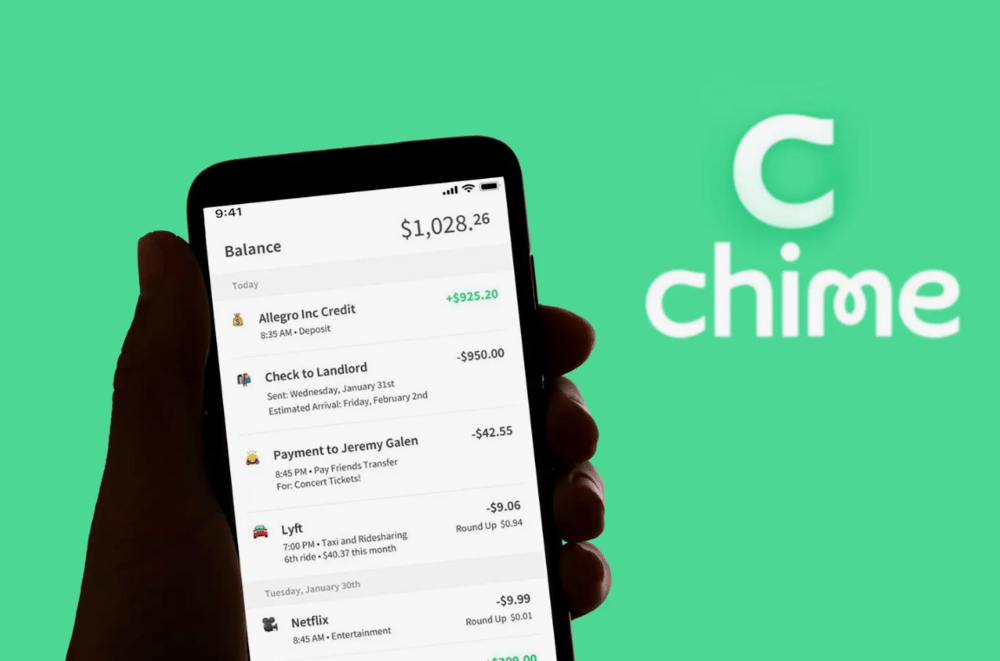

Chime IPO Prices at $25 on Nasdaq Debut, Valuing Digital Bank at $11 Billion

The much-anticipated public offering of Chime, one of the leading U.S. digital banking platforms, has officially priced ahead of its trading debut on Nasdaq under the ticker CHYM. The final pricing, set at $25 per share, falls within the marketed range of $24 to $26, giving the company an approximate valuation of $11 billion.

Reliance Group Stocks Rebound Sharply as Legal Relief Triggers Investor Optimism

Two of the flagship entities under Anil Ambani’s Reliance Group, Reliance Infrastructure Ltd. $RELINFRA.NS and Reliance Power Ltd. $RPOWER.NS, have recorded dramatic rallies in June, rising over 22% each. The gains extend a broader upward trend: Reliance Power surged 173%, while Reliance Infrastructure appreciated 141% over the past year. The sharp recovery marks a critical inflection point in the market’s reassessment of Anil Ambani’s once-distressed corporate empire.

Alexander Dennis to Relocate Bus Production to Scarborough Amid Chinese EV Competition

Alexander Dennis Ltd, a UK-based subsidiary of NFI Group Inc. $NFI.TO, plans to consolidate its bus manufacturing operations in response to mounting pressure from low-cost Chinese electric vehicle (EV) competitors. The company has confirmed it is considering transferring production to its existing site in Scarborough, England, which would result in the closure of the Larbert facility and cessation of manufacturing in Falkirk, Scotland. According to the statement, production in Falkirk would be discontinued, while operations at Larbert—currently used for finishing work and back-office functions—would shut down once current contracts are fulfilled. The company acknowledged that the changes could place approximately 400 positions at risk.

Lynas Rare Earths is proving that strategic backing can lead to exceptional market resilience, even in tough times.