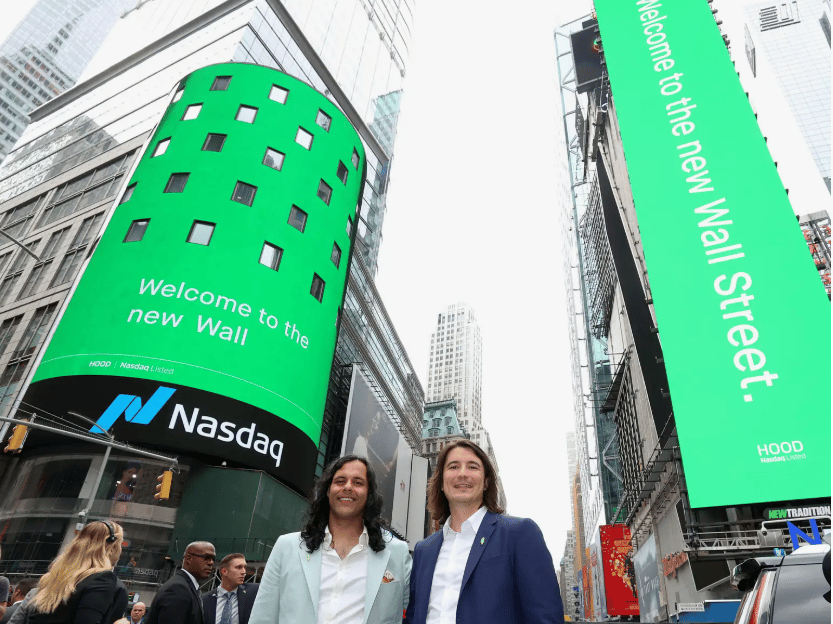

Chime IPO Prices at $25 on Nasdaq Debut, Valuing Digital Bank at $11 Billion

The much-anticipated public offering of Chime, one of the leading U.S. digital banking platforms, has officially priced ahead of its trading debut on Nasdaq under the ticker CHYM. The final pricing, set at $25 per share, falls within the marketed range of $24 to $26, giving the company an approximate valuation of $11 billion.

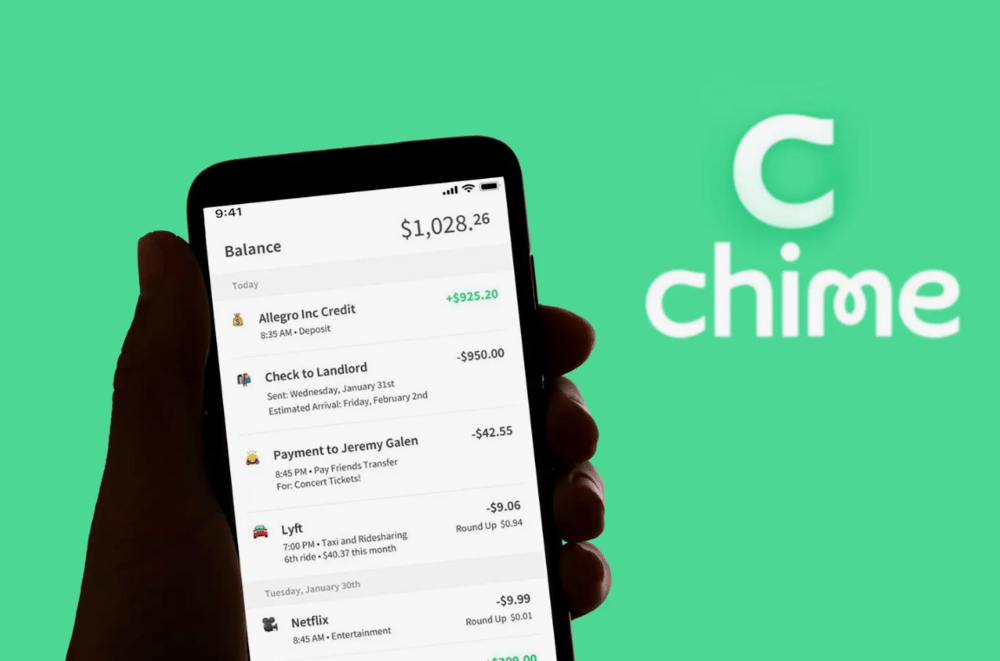

Chime’s offering comes amid cautious optimism in the fintech space, where investor enthusiasm has been selective. The IPO serves as a barometer for broader market sentiment toward digital finance platforms that aim to disrupt traditional banking models.

Strategic Positioning and Market Implications of Chime’s Nasdaq Listing

The offering includes 32 million shares, with 25.9 million newly issued by Chime and the remainder offered by existing shareholders, a split reflecting both growth financing and partial investor exit strategies. The capital raised is expected to fund technology infrastructure, product development, and potential strategic acquisitions in the competitive neobank landscape.

By listing under Chime, Chime enters a volatile IPO market that is showing signs of revival after a subdued 2023. Analysts suggest Chime’s strong customer base, mobile-first business model, and banking-as-a-service infrastructure position it favorably against both incumbent banks and newer fintech rivals.

Quick Facts on the Chime IPO

Ticker Symbol: CHYM

Exchange: Nasdaq

IPO Price Range: $24–$26 per share

Final Price: $25

Shares Offered: 32 million (25.9 million primary, 6.1 million secondary)

Valuation at IPO: Approx. $11 billion

Sector: Fintech / Digital Banking

Market Reaction and Investor Outlook on Chime’s Debut

Chime’s IPO is being closely watched as a proxy for investor sentiment toward consumer-facing fintech. The fact that the pricing landed in the upper-middle of the range may indicate healthy demand, though sustained performance will depend on post-listing market dynamics and Chime's ability to maintain user growth in a crowded space.

Private equity and venture capital firms backing Chime, including Sequoia Capital $SEQUX and SoftBank $9434.T , are also observing this listing as a potential inflection point for monetizing fintech bets amid tightening liquidity and higher interest rates.

Market participants are paying attention to Chime’s revenue model — which primarily depends on interchange fees rather than lending — as a differentiator from traditional banks and some fintech peers.

Key Considerations Going Forward

Post-IPO Stock Performance: Chime’s trading trajectory will test investor conviction in the neobank thesis.

Use of IPO Proceeds: Focus areas include product innovation and infrastructure scaling.

Competitive Landscape: Chime must continue differentiating from both incumbent banks and fintech startups.

Regulatory Environment: Digital banking faces growing scrutiny, particularly around fee structures and compliance.

Valuation Sustainability: Maintaining the $11 billion valuation will require strong operational performance.

Chime’s IPO as a Litmus Test for Fintech Market Revival

Chime’s successful IPO pricing illustrates a cautiously improving appetite for fintech offerings after a challenging stretch for tech stocks. The company's mobile-first model, significant market share among underbanked consumers, and capital-light strategy through banking partnerships contribute to its appeal.

As Chime begins trading on Nasdaq, market observers will evaluate whether Chime can deliver sustainable growth and profitability in a segment where scale, trust, and compliance are crucial. The IPO outcome also provides insight into the evolving valuation framework for digital finance firms in the post-zero interest rate era.

Comments

Market dynamics are clearly favoring innovative approaches that integrate automation at scale