Gas Turbine Market Faces Tight Supply Outlook Through 2040, Wood Mackenzie Warns

The global gas turbine market may be on the brink of prolonged supply strain over the next 15 years due to escalating demand, rising production costs, and increasing competition from renewables, according to a new report released by research and consultancy firm Wood Mackenzie. Between 2025 and 2040, approximately 890 gigawatts (GW) of new gas-fired power capacity is expected to come online worldwide, with the United States and China accounting for nearly half of the additions.

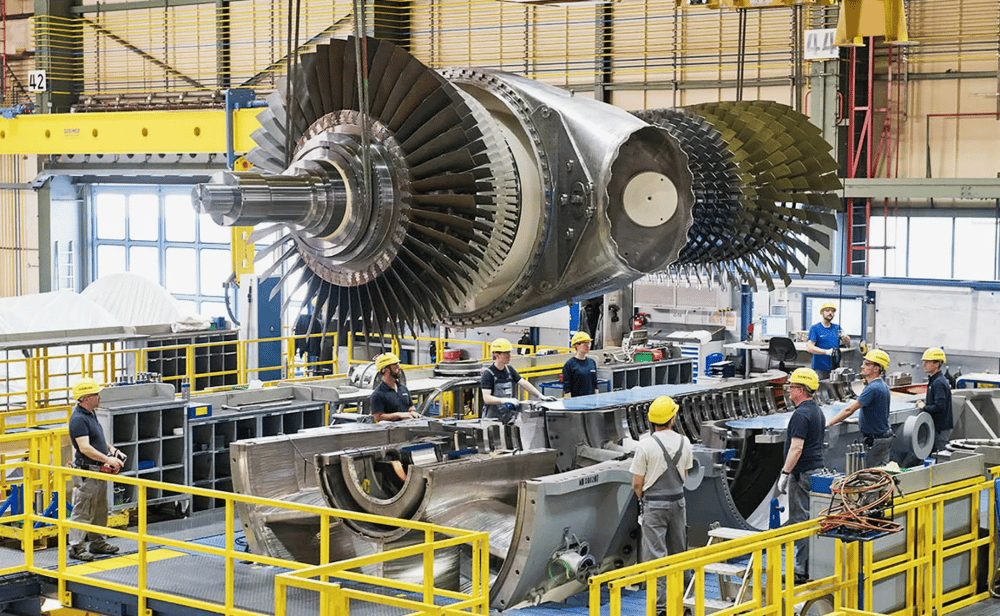

This demand surge comes at a critical inflection point in global energy systems. While gas remains a key transitional fuel—offering reliability and lower emissions compared to coal—its infrastructure and equipment supply chain is under growing pressure. Manufacturers are grappling with capacity constraints, longer lead times, and rising input costs, all while the industry navigates decarbonization efforts and mounting policy uncertainty.

Industrial Bottlenecks and Energy Security Challenges

The convergence of high gas demand with limited production flexibility could disrupt power system planning and grid reliability, especially in regions heavily dependent on dispatchable generation. While renewables are scaling rapidly, the intermittent nature of solar and wind means gas turbines still serve a critical role in balancing load and ensuring grid resilience.

Wood Mackenzie’s forecast suggests the market is moving toward a complex equilibrium, where natural gas continues to play a stabilizing role—particularly in emerging markets—despite structural and environmental headwinds.

Key Risks Reshaping the Gas Turbine Outlook

Manufacturing constraints limiting the ability to ramp up supply of large-scale turbines

Raw material cost inflation driving up capital expenditures for gas infrastructure

Labor and skills shortages within advanced manufacturing and engineering sectors

Decarbonization pressure accelerating investment diversion into renewables and battery storage

Policy and regulatory ambiguity slowing long-term investment decisions in thermal assets

Demand Centers and Capacity Growth by Region

In terms of global deployment, the United States and China are projected to lead the charge in new gas capacity additions, jointly contributing 47% of the annual buildout between 2025 and 2040. This reflects both countries' strategic efforts to balance decarbonization with energy security, particularly in light of heightened volatility in global commodity markets.

Regional Market Dynamics and Strategic Drivers

United States Aging coal retirements and regional peak demand growth are fueling interest in flexible gas assets. While renewable penetration is rising, firm capacity remains vital to meet reliability standards.

China Rapid industrialization and grid modernization continue to support gas turbine deployment, even as Beijing scales solar and wind. Gas is viewed as a strategic backup to variable renewable energy (VRE).

India and Southeast Asia These regions are emerging as secondary growth hubs, driven by urbanization and electrification. Grid stability remains a key concern, opening opportunities for gas generation.

Europe Policy frameworks are shifting toward net-zero compliance, yet gas still provides crucial backup during seasonal imbalances and in the context of recent geopolitical supply disruptions.

Middle East Domestic gas reserves and rising power demand support continued investment in gas-fired capacity, particularly in Gulf states prioritizing energy diversification.

Gas Generation’s Long-Term Viability at a Crossroads

Despite the evident momentum in gas turbine installations, long-term sustainability remains in question. The market must reconcile rising demand with decarbonization goals, infrastructure bottlenecks, and evolving financial dynamics. Investors and policymakers alike face a delicate balancing act: ensuring adequate capacity while accelerating the clean energy transition.

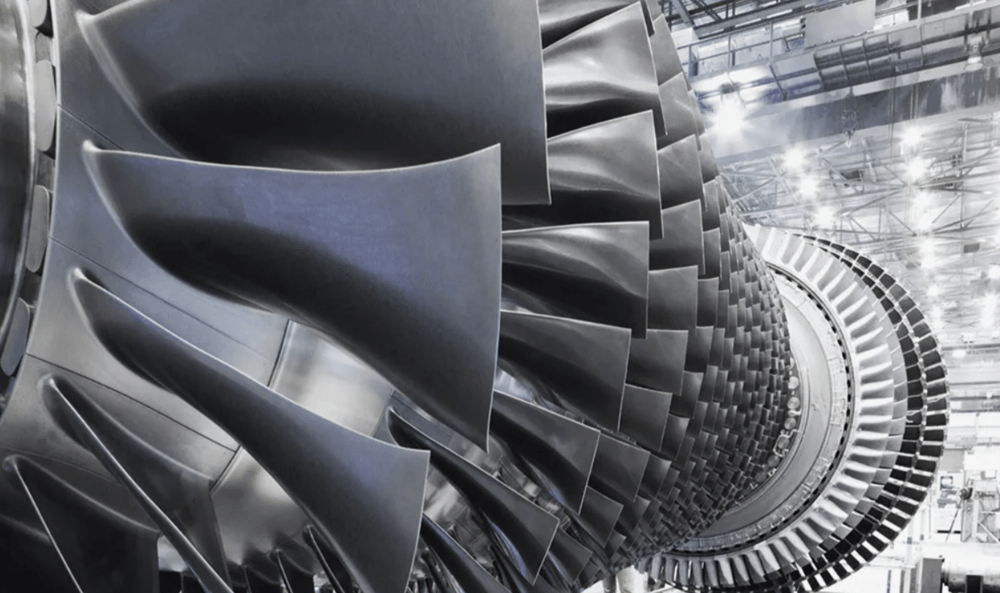

In this evolving context, technology innovation—such as hydrogen-compatible turbines, hybrid plants, and advanced materials—may define the next chapter for the gas power industry. However, the next 15 years will be critical in determining whether gas can retain its role as a cornerstone of global energy systems or become increasingly marginalized by zero-carbon alternatives.

Comments

The shift towards innovative investment strategies is setting the stage for remarkable growth in the automation sector.