Aflac Hit by Major Cyberattack Amid Wave of Insurance Industry Breaches

Aflac Inc. $AFL has confirmed a significant cybersecurity breach, potentially compromising Social Security numbers, insurance claims, and sensitive medical data of its clients. The incident marks a serious escalation in a wave of targeted cyberattacks against U.S. insurance providers and underscores rising systemic vulnerabilities in the sector. The breach, disclosed on Friday, positions Aflac, the second-largest provider of supplemental insurance in the United States with billions in annual revenue and millions of policyholders, as the most high-profile victim in this recent string of attacks.

Circle Stock Extends Rally as GENIUS Act Gains Senate Approval

Circle $CRCL, the issuer of the USDC $USDCUSD stablecoin, continued its market rally on Friday after the U.S. Senate passed the GENIUS Act, a bill focused on regulating stablecoins. Shares jumped nearly 17% in premarket trading, adding to significant gains earlier in the week. The legislation, designed to set compliance standards for fiat-backed digital currencies, now moves to the House of Representatives. Its Senate passage has amplified investor interest in Circle, which is seen as well-positioned under the proposed regulatory framework.

QXO’s Bold Play for GMS Signals Aggressive Push to Consolidate Building Supply Sector

QXO Inc., led by industry veteran Brad Jacobs, has submitted a $5 billion all-cash acquisition proposal for GMS Inc. $GMS, aiming to expand its footprint in the fragmented building materials distribution sector. With a deadline of June 24, Jacobs has indicated that if GMS’s board rejects the offer, a hostile bid remains a strong possibility. The move follows Jacobs’ strategic pattern of building scale through acquisitions, reinforcing his plan to turn QXO into a $50 billion revenue enterprise within the next decade.

Accenture Surpasses Q3 Revenue Expectations Despite Order Slowdown

Accenture plc $ACN posted stronger-than-anticipated third-quarter revenue, reaching $17.7 billion, outperforming the average analyst forecast of $17.3 billion. This growth was largely fueled by sustained corporate demand for the firm’s AI-driven consulting services. However, investor sentiment remained cautious after the firm reported a notable decline in new business orders.

U.S. Clean Energy Projects at Risk: 794 Renewable Sites Threatened by Proposed GOP-Led Legislation

The United States' ambitious clean energy transition faces a significant legislative threat. A sweeping bill introduced in the House of Representatives—dubbed the “Megabill”—aims to overhaul federal spending, including revisions to renewable energy subsidies. An analysis by POLITICO reveals that up to 794 planned clean electricity facilities, primarily in Republican-held districts, are now at risk of losing critical financial support if the bill passes without amendment.

Berkshire Hathaway Stock Declines Amid Buffett Premium Concerns and Leadership Transition

The recent announcement by Warren Buffett, Chairman and CEO of Berkshire Hathaway Inc. $BRK-B, that he plans to step down at the end of this year, just months after turning 95, has sent ripples through global equity markets. Shares of the conglomerate have fallen approximately 10% since the May declaration, a decline largely attributed to what investors refer to as the "Buffett premium"—the market valuation surplus reflecting investor confidence in Buffett’s stewardship.

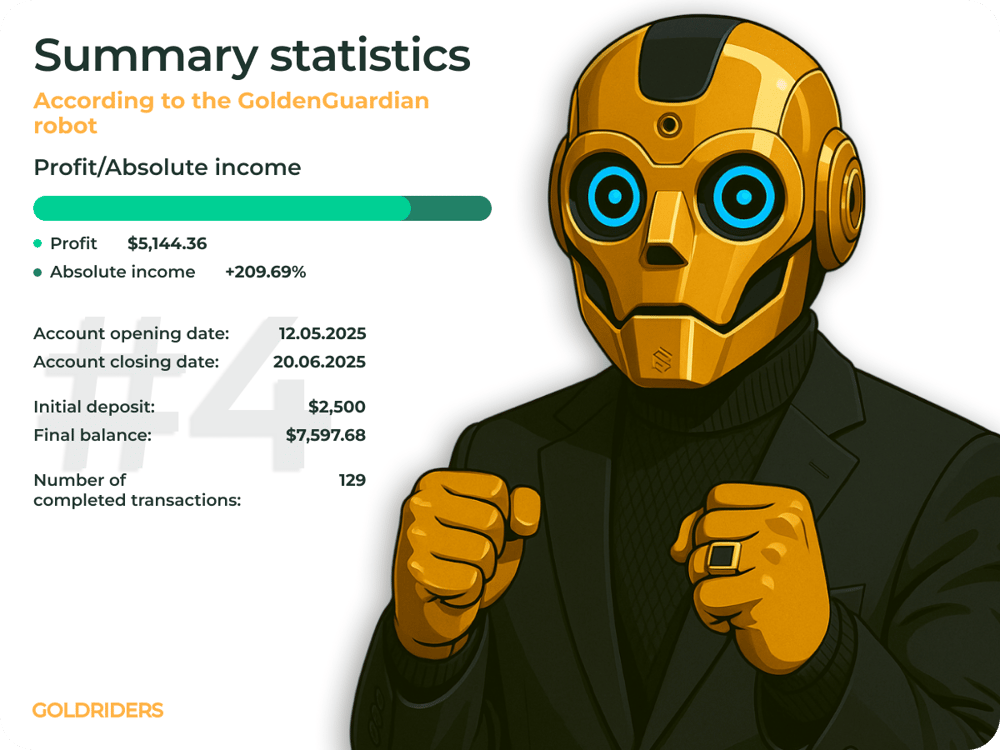

How to Buy a Trading Robot for Forex, Stocks, and Crypto

According to reports from Deloitte and Bloomberg, retail investors have increased their use of trading robots—also known as algorithmic trading systems or automated strategies—by over 45% since 2020. At the same time, institutional players across equities (SPX), forex (USD, EUR, JPY), and cryptocurrencies (BTC, ETH) now rely on automation for over 70% of executed trades. In this context, purchasing a trading robot is becoming a strategic investment decision rather than just a technical one.

Where to Buy a Trading Robot for Forex, Stocks, and Crypto

Algorithmic trading is rapidly transforming the financial landscape. According to McKinsey and Statista, over 75% of trades on the forex market—particularly in major currency pairs like USD, EUR, and JPY—are now executed through automated systems. On equity markets such as the S&P 500 (SPX) and NASDAQ (IXIC), automation accounts for more than 80% of all trading activity.

Apple Eyes Generative AI to Accelerate Custom Chip Development

Apple Inc. $AAPL, known for its vertically integrated approach to hardware and software, is exploring generative artificial intelligence (AI) to enhance the design process of its proprietary semiconductors. In a private speech delivered in Belgium last month, Johny Srouji, Apple’s Senior Vice President of Hardware Technologies, revealed that the company aims to integrate generative AI into its chip design workflow — a move that could redefine its position in the global semiconductor race.

Tesla Launches First Utility-Scale Energy Storage Project in China

Tesla Inc. $TSLA is expanding its energy operations in Asia with a new grid-connected battery storage facility in Shanghai. The project, announced by local outlet Yicai, is part of a strategic collaboration with China Kangfu International Leasing Co. and the municipal government. This development marks the company's first direct foray into grid-scale energy infrastructure on the Chinese mainland, positioning Tesla to play a larger role in stabilizing regional electricity networks.

Ethereum Price Consolidates Below $2,800: Accumulation or Market Fatigue?

Ethereum $ETHUSD, the second-largest cryptocurrency by market capitalization after Bitcoin $BTCUSD, has entered a critical technical zone. After recent rallies driven by renewed institutional interest and macroeconomic tailwinds, Ethereum now appears to be in a sideways consolidation pattern, trading in a narrow range between $2,500 and $2,540. This development comes amid declining trading volumes, prompting analysts to assess whether the move reflects accumulation ahead of a breakout — or signals bull exhaustion.