Voyager Technologies Soars 125% at IPO, Signaling Renewed Confidence in Defense and Space Stocks

Voyager Technologies $VYGR, the aerospace company behind the Starlab space station initiative, made a striking entrance into public markets on Wednesday, closing up 125% on debut. The rally brought the firm’s valuation to $3.8 billion, underscoring growing investor confidence in space infrastructure and defense-related innovation—particularly amid expectations of expanded aerospace funding under a second Donald Trump administration.

The successful launch comes at a pivotal time for U.S. capital markets. The IPO pipeline, long stagnant due to macro uncertainty and shifting tariff dynamics under Trump’s economic agenda, now shows signs of resurgence. Voyager’s performance suggests renewed investor appetite for frontier technologies with long-term government contract exposure.

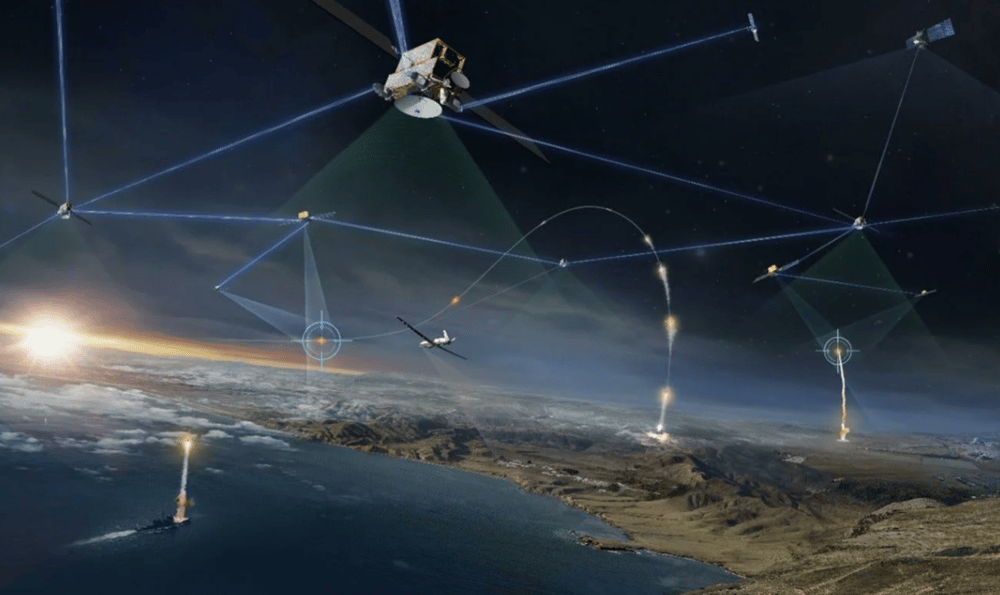

Rising Interest in Space and Defense Stocks Amid Geopolitical Realignment

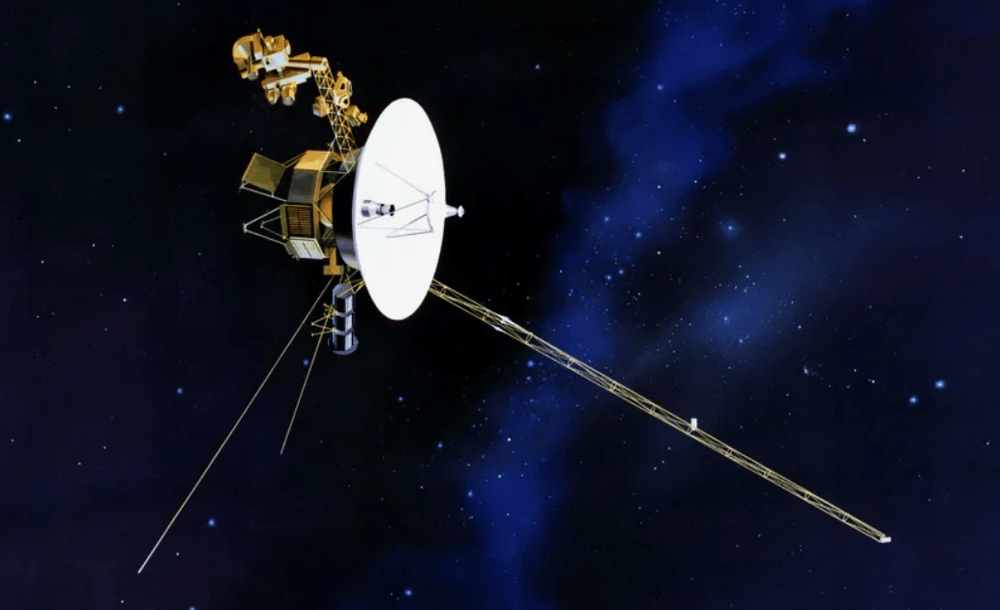

Voyager Technologies’ market debut is more than a single-day story—it represents a broader shift in capital allocation toward strategic industries such as defense, aerospace, and space commercialization. The Starlab project, expected to become a cornerstone in post-ISS orbital operations, has attracted attention from institutional investors anticipating an acceleration of space-related budgets in Washington.

With global tensions rising and the U.S. seeking technological supremacy in both low-Earth orbit and satellite communications, companies like Voyager are positioned at the intersection of national security and commercial innovation. Analysts point to potential synergies with defense contractors and government agencies as a key factor behind the valuation surge.

📌 Key Facts:

💹 Voyager Technologies stock closed up 125% on IPO day

🚀 Valuation reached $3.8 billion post-debut

🛰️ Developer of Starlab, a commercial low-Earth orbit space station

🏛️ Anticipated support from Trump-era pro-defense policies

📈 Boost to overall U.S. IPO market after tariff-driven volatility

Market Reaction and Strategic Commentary

Investor enthusiasm for Voyager's IPO is reflective of broader sentiment shifts in public markets. The defense and aerospace sectors are now viewed as hedges against geopolitical instability, with capital flowing into companies perceived as national strategic assets. Analysts note that Voyager’s timing—amid renewed Trump administration influence—was instrumental in maximizing IPO demand.

Additionally, the IPO’s success reinforces the perception that space equities are maturing into a viable asset class. ETFs like ARKX and defense-heavy indices are likely to incorporate newly public space firms, expanding their investor base and increasing institutional coverage.

🔑 Key Market Insights:

Voyager IPO surge signals investor confidence in defense-oriented innovation.

Pro-Trump policy outlook fuels bullish sentiment on aerospace firms.

Starlab’s strategic relevance aligns with post-ISS commercial priorities.

IPO market rebound suggests stabilization after trade-policy-related headwinds.

Capital rotation into space, AI, and defense sectors gaining momentum.

Conclusion: Voyager's IPO Reflects Strategic Market Pivot Toward Space Innovation

Voyager Technologies’ blockbuster IPO is emblematic of two critical market trends: the revitalization of public offerings and the elevation of space and defense as dominant themes in U.S. industrial policy. The strong debut reinforces investor belief that companies aligned with national objectives—particularly those benefitting from military or civil space contracts—are well-positioned for sustained growth.

As the geopolitical environment continues to evolve and a potential Trump return to office reshapes federal funding priorities, space infrastructure firms like Voyager are likely to play a central role in both economic and strategic planning. The IPO sets a benchmark for upcoming listings in adjacent sectors and signals that risk capital is once again flowing into mission-critical technologies.

Comments