Trade Tensions Ground Momentum for Boeing and Chinese Airlines Amid Tariff Fallout

Fresh turbulence has hit the aviation sector as the Chinese Ministry of Commerce on Tuesday publicly acknowledged the significant impact of recent U.S. tariffs on both domestic airlines and U.S. aerospace giant Boeing Co. $BA. This rare official comment signals mounting pressure on the global aviation supply chain, which has long been a barometer of cross-border economic cooperation.

In an industry already recovering from pandemic-era disruptions, the re-escalation of trade friction between the world's two largest economies adds a fresh layer of uncertainty, particularly for manufacturers and carriers that depend on seamless international logistics and long-term procurement planning.

Signals from Beijing: A Strategic Shift?

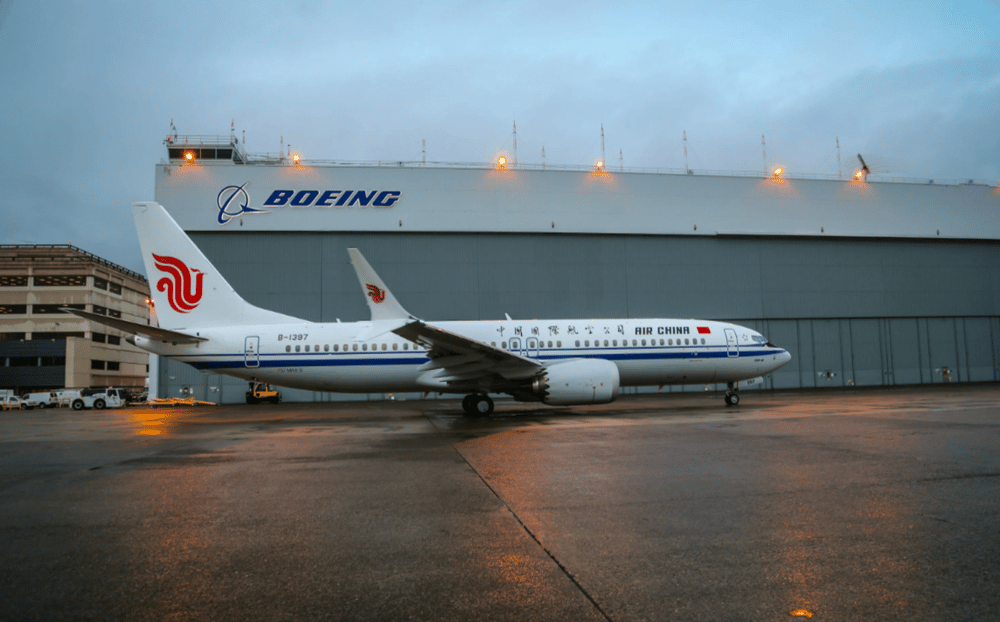

The Chinese government’s statement, which comes amid heightened bilateral tensions, follows Boeing’s recent decision to fly three 737 MAX aircraft back to the U.S. from China—planes originally meant for Chinese carriers but stalled due to regulatory and political bottlenecks.

This reversal not only highlights weakened commercial ties but also suggests deteriorating confidence in future deliveries. The Ministry’s remarks imply Beijing expects the U.S. to reconsider policies that risk destabilizing trade-sensitive sectors like aerospace.

Where the Impact Lands the Hardest

Boeing's Asia-Pacific Sales Outlook

Once a key growth market, China accounted for around one-fifth of Boeing’s global deliveries before tensions escalated. A prolonged standoff could significantly dampen revenue projections.

Chinese Airlines' Fleet Expansion Plans

Carriers such as China Southern Airlines and Air China are delaying or re-evaluating fleet modernization programs as geopolitical risks heighten acquisition costs and delivery timelines.

Global Aircraft Supply Chains

Many components for commercial aircraft cross borders multiple times. Tariffs and logistics disruptions increase lead times and reduce cost-efficiency.

Regulatory Fragmentation

Differing safety and trade rules between the U.S. and China challenge the standardization that aircraft makers rely on for scalable production.

A Push Toward Domestic Substitution

Trade friction is accelerating China’s push to develop and deploy homegrown aircraft such as the COMAC C919, potentially reshaping long-term market dynamics.

Broader Ripples in the Aviation Industry

Market Volatility: Shares of Boeing have shown sensitivity to trade-related headlines, with recent events triggering renewed investor caution.

Capacity Planning Disruptions: Airlines face growing complexity in route planning and fleet allocation amid supply delays.

Procurement Costs: Elevated tariffs increase the total cost of ownership for new aircraft, pressuring margins in an already capital-intensive industry.

Diplomatic Signaling: Aircraft deliveries—and delays—are increasingly being used as leverage in geopolitical negotiations.

Environmental Targets: Disruptions may also stall efforts by airlines to update to more fuel-efficient fleets, hindering decarbonization goals.

Aviation as a Barometer of Bilateral Stability

The unfolding developments reflect more than just commercial friction—they highlight aviation's role as a proxy in U.S.-China relations. Boeing’s reduced visibility in China, coupled with growing momentum behind indigenous alternatives, could lead to long-term structural changes in global aircraft demand patterns.

If trade tensions persist, the resulting fragmentation may force aerospace firms to regionalize production lines and recalibrate client strategies. For now, however, the market watches as both sides weigh the costs of continuing down a path of mutual economic disruption.

Comments

The convergence of groundbreaking technology and proactive investment signals a future where automation takes center stage

This landmark sale underscores the transformative potential of automation in today's tech scene