Tesla Advances Urban Autonomy with Limited Robotaxi Launch in Austin

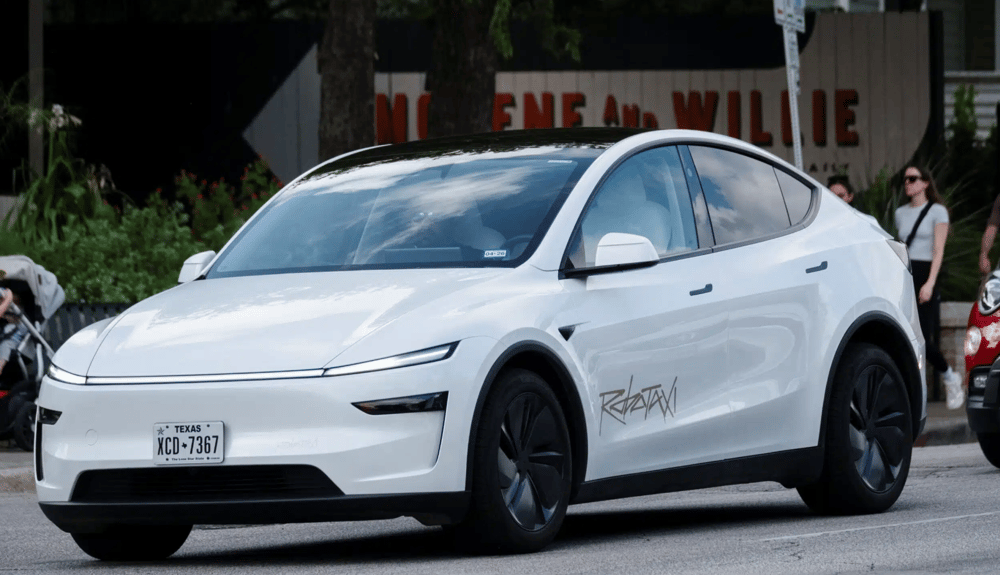

Tesla Inc. $TSLA recorded a 9% stock increase during early trading hours on Monday, reaching $351.35, following the debut of its first Robotaxi service in Austin, Texas. The rollout, featuring a small fleet of Model Y vehicles, represents a crucial milestone in the company’s self-driving roadmap.

Operational Structure: Geofenced Deployment and Safety Layers

Tesla’s Robotaxi initiative operates within a tightly defined geofenced perimeter inside the city of Austin. Trips to and from airports are currently outside the operational scope. The program begins with a fleet of approximately 10 to 20 vehicles, each monitored by a Tesla-employed observer stationed in the front passenger seat. These observers do not intervene during rides and are supplemented by a remote oversight system to ensure an additional layer of control. The service uses a flat fare of $4.20 per ride, introduced as part of a trial pricing model aimed at gathering early adoption data and operational feedback.

Program Structure and Technical Constraints

The pilot reflects a cautious yet strategic deployment model. Tesla has prioritized a limited-scale rollout to validate the system’s performance under controlled urban conditions. The following operational parameters define the current setup:

Fleet: Small-scale use of Model Y vehicles;

Territory: Restricted to city-based geofenced zones;

Trip exclusions: Airport routes not currently supported;

Oversight: In-vehicle safety monitors and remote supervision;

Pricing: Uniform ride cost during the test phase.

This structure enables Tesla to maintain tight quality control while laying the groundwork for future scalability, subject to regulatory feedback and system refinement.

Market Interpretation and Investor Reaction

Despite neutral sentiment among some institutional analysts, including RBC Capital Markets, which described the format as expected, investor optimism was reflected in TSLA’s early gains. The spike underscores how tangible progress in autonomy, particularly real-world launches, can influence market perception more than prototype demonstrations or roadmap presentations. The announcement comes at a time when most competitors in the autonomous mobility sector are still grappling with regulatory constraints, safety validations, or limited commercial viability. Tesla’s vertically integrated approach, combining vehicle manufacturing, software development, and fleet operation, offers a cohesive advantage over rivals dependent on third-party platforms or specialized hardware.

Broader Implications for the Self-Driving Ecosystem

The launch represents more than a local trial. By transforming conceptual autonomy into commercial activity, Tesla moves closer to reshaping the ride-hailing industry. While the scope remains narrow, success in Austin could accelerate the rollout of Robotaxi services in other cities, provided Tesla navigates regulatory landscapes effectively. The project also positions Tesla as a distinct player in the autonomous mobility race, contrasting with models used by Waymo $GOOG or Cruise $GM. Unlike those peers, Tesla’s approach integrates hardware and software across its production and deployment pipeline, minimizing reliance on third-party solutions.

Comments

As tech ecosystems evolve, investment agility is proving to be a key differentiator in long-term value creation