Related Articles

US-Vietnam Trade Talks to Resume Amid 46% Export Tariff Deadline and Strategic Economic Stakes

The United States and Vietnam are set to hold a new round of trade negotiations by the end of next week, as announced by Vietnam’s Ministry of Industry and Trade on Thursday. This development follows Hanoi’s submission of a formal response document addressing trade inquiries from the US. The upcoming third round of talks aims to reach a compromise before the impending expiration of the current 46% “reciprocal” tariffs imposed on Vietnamese exports to the US, scheduled for early July. The urgency underscores the increasing economic and geopolitical significance of US-Vietnam trade relations amid global market volatility.

Suzuki Motor Halts Swift Production Amid China Rare Earth Export Restrictions

Suzuki Motor Corporation $7269.T, one of Japan’s major automotive manufacturers, has announced a temporary suspension of production for its popular compact model Swift — excluding the Swift Sport variant — from May 26 to June 6. This pause is attributed to supply shortages caused by China's tightened restrictions on rare earth metal exports, according to two sources familiar with the matter. Suzuki thus becomes the first Japanese automaker directly affected by these new export limitations imposed by China.

Global Clean Energy Investment Set to Hit $3.3 Trillion in 2025 Amid Economic Uncertainty

The International Energy Agency (IEA) announced on Thursday a forecast of unprecedented global investments in clean energy technologies for 2025. Despite prevailing economic uncertainty and escalating geopolitical tensions, total spending on global energy is expected to reach a record $3.3 trillion (approximately €2.89 trillion). This marks a significant shift in the energy sector, emphasizing the accelerating transition from fossil fuels to sustainable alternatives.

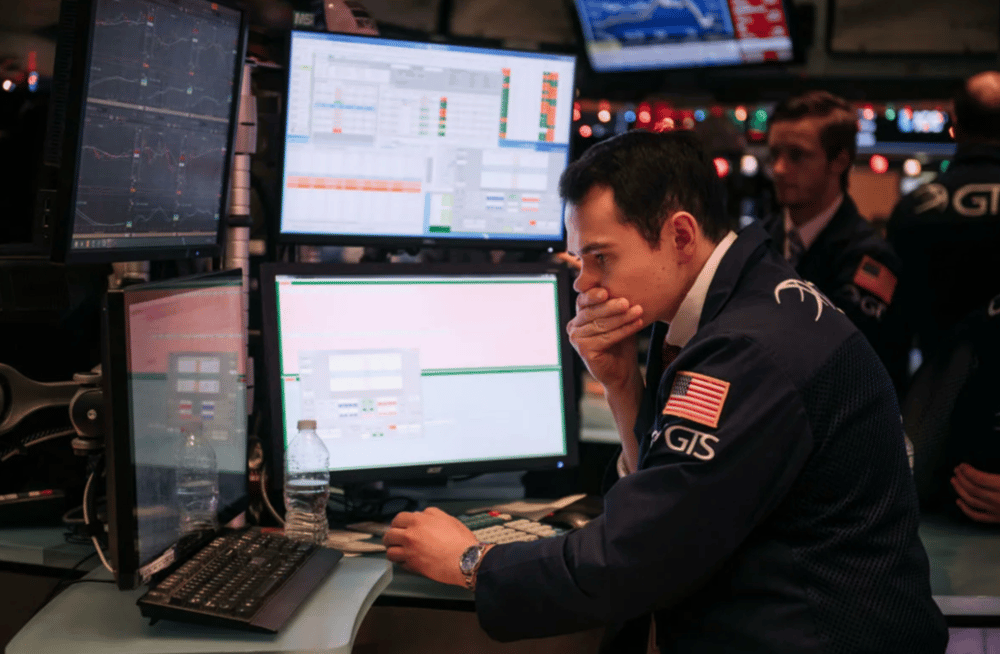

This downturn highlights just how interconnected our global economy truly is and how events in one region can ripple across the world.

It's disheartening to see Latin America's markets reflecting the ripple effects of U.S. economic fears.