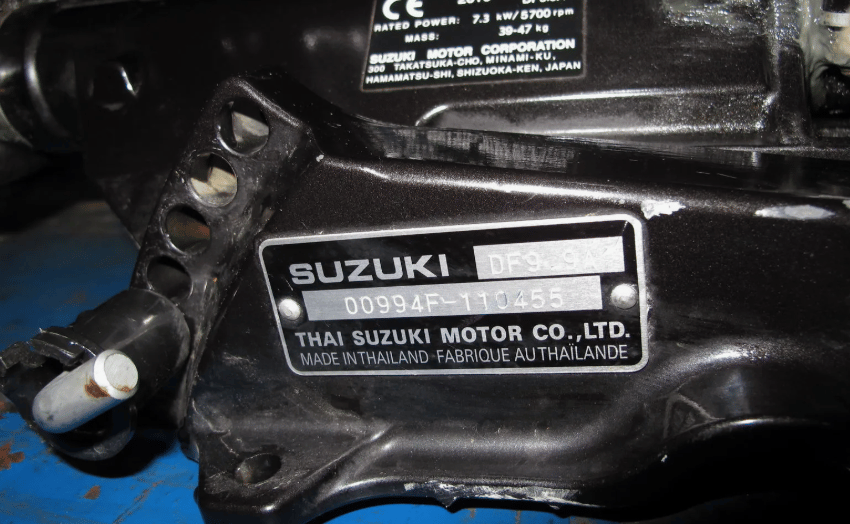

Suzuki Motor Corporation $7269.T, one of Japan’s major automotive manufacturers, has announced a temporary suspension of production for its popular compact model Swift — excluding the Swift Sport variant — from May 26 to June 6. This pause is attributed to supply shortages caused by China's tightened restrictions on rare earth metal exports, according to two sources familiar with the matter. Suzuki thus becomes the first Japanese automaker directly affected by these new export limitations imposed by China.

Impact of China’s Rare Earth Export Restrictions on Suzuki Swift Manufacturing

Rare earth metals, including neodymium and dysprosium, are critical components in manufacturing high-performance automotive parts such as electric motors and advanced electronics. China, controlling roughly 80% of the global rare earth supply, has recently implemented export restrictions amid rising geopolitical tensions and resource security concerns. This move has sent ripples across global supply chains, affecting automotive manufacturers worldwide.

Suzuki’s decision to halt Swift production reflects a significant vulnerability within the global auto industry’s supply chain—reliance on China’s rare earth metals. The shortage of these essential components has created a bottleneck, forcing manufacturers to either slow down or suspend production temporarily.

While the Swift Sport model remains unaffected, the halt impacts Suzuki’s capacity to meet market demand for the regular Swift, which has been a consistent performer in compact car sales. This interruption could lead to delayed deliveries and potentially impact quarterly revenues.

The incident also highlights broader risks faced by automakers dependent on geographically concentrated raw materials, emphasizing the need for diversified sourcing strategies and alternative material innovations.

Suzuki Swift Production Suspension Overview

Suzuki Motor to halt Swift production from May 26 to June 6, 2025

Suspension excludes Swift Sport model

Cause: shortage of rare earth metals due to China export restrictions

China controls approximately 80% of global rare earth supply

First Japanese automaker impacted by new export constraints

Market Reactions and Industry Commentary on Rare Earth Export Controls

Following the announcement, Suzuki’s stock showed minor fluctuations amid broader concerns over supply chain stability in the automotive sector. Industry analysts note that China’s export restrictions on rare earths may intensify pressures on other manufacturers reliant on these materials, potentially exacerbating component shortages and production delays globally.

Automotive companies are increasingly exploring recycling technologies, alternative materials, and strategic stockpiling to mitigate risks associated with rare earth dependency. Meanwhile, governments and industry bodies are accelerating initiatives to develop domestic rare earth production capabilities.

The Suzuki case serves as a bellwether for potential disruptions across the automotive industry, where electrification and advanced vehicle technologies further increase reliance on scarce minerals.

Key Takeaways

Suzuki Motor’s Swift production suspension is directly linked to China’s rare earth export limits.

Rare earth metals are indispensable for modern automotive components, including electric motors.

The disruption exposes vulnerabilities in global supply chains centered around China.

Automotive industry faces growing pressure to diversify sourcing and innovate materials.

The incident may signal further production impacts for global car manufacturers amid geopolitical tensions.

Strategic Implications of Suzuki’s Production Halt Amid Rare Earth Constraints

Suzuki Motor’s temporary halt in Swift production underscores the critical role rare earth metals play in contemporary automotive manufacturing and the significant risks posed by supply chain concentration. As China tightens export controls, automakers worldwide are compelled to reassess sourcing strategies, invest in alternative materials, and seek new supply routes to ensure production continuity.

This development is a stark reminder of how geopolitical factors and resource dependencies intersect to shape industrial operations and market dynamics. For Suzuki and the wider industry, adapting to these challenges will be pivotal in maintaining resilience and competitive advantage in an increasingly complex global environment.

Automation is becoming a foundational pillar in long-term investment narratives