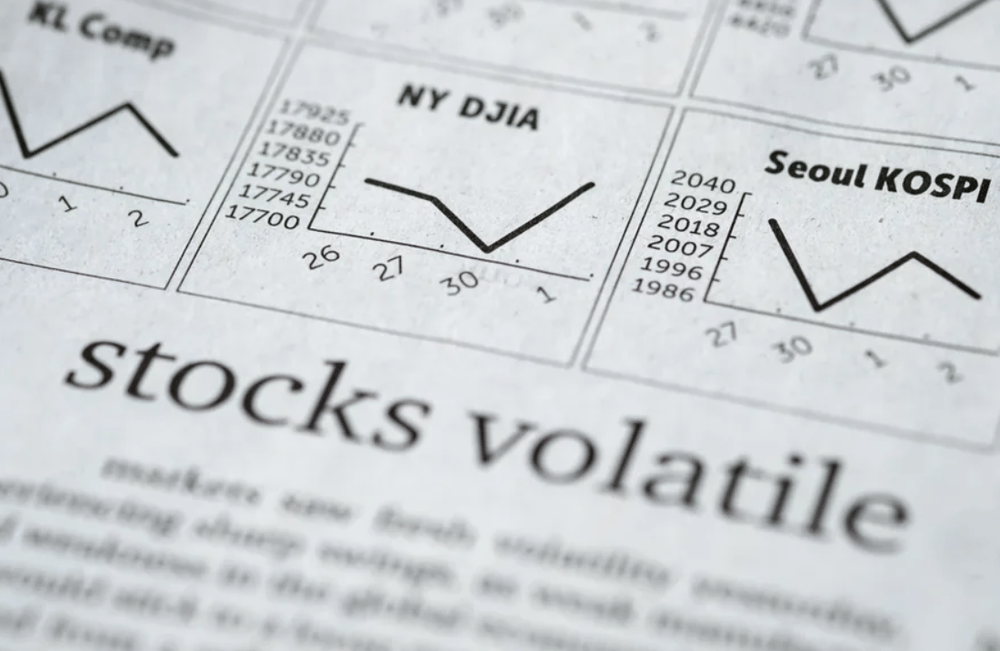

S-Oil Faces Q1 Loss Amid Refining Headwinds and Market Volatility Concerns

South Korean energy giant S-Oil Corp. $010950.KS, majority-owned by Saudi Aramco $2223.SR, reported an operating loss for the first quarter of 2025, underscoring the persistent challenges in the refining and petrochemical sectors. The company also cautioned that ongoing tariff negotiations in the United States and market volatility could weigh on its profitability moving into the second quarter.

A Tough Quarter: Unpacking the Numbers

In its latest earnings statement released on Monday, S-Oil disclosed an operating loss of 21.5 billion won ($14.93 million) for the January–March period. This marks a stark reversal from the operating profit of 454.1 billion won recorded during the same quarter a year earlier.

Revenue also suffered, slipping 3.4% year-on-year to 8.99 trillion won, reflecting both softer demand dynamics and pricing pressures across its business lines.

Key Drivers Behind S-Oil’s Weak Performance

Several major factors contributed to S-Oil's downturn in the first quarter:

Refining Margin Compression: Global refining margins tightened, reducing profitability in the company's core operations.

Petrochemical Market Weakness: Oversupply and subdued demand particularly impacted margins in the chemical segment.

Lower Crude Oil Prices: Fluctuating feedstock costs eroded earnings stability.

Currency Fluctuations: The won’s movements against the dollar added pressure on cost structures.

Seasonal Maintenance Activities: Planned shutdowns at key facilities also limited production capacity.

Emerging Pressures on the Horizon

Looking ahead, S-Oil warned of external risks that could continue to influence its financial results:

US Tariff Negotiations: Potential trade restrictions could impact export competitiveness and margins.

Global Market Volatility: Uncertainty in crude and refined product markets remains a persistent threat.

Geopolitical Tensions: Energy markets are increasingly sensitive to regional instability, adding unpredictability to price movements.

Fluctuations in Demand: Slower-than-expected economic growth in key markets could dampen demand for fuel and petrochemical products.

Ongoing Refinery Upgrades: Investments aimed at long-term gains may temporarily suppress near-term earnings.

Strategic Focus: Navigating Through Uncertainty

Despite current setbacks, S-Oil continues to leverage its ties with Saudi Aramco to secure steady crude supplies and explore downstream diversification strategies. The company's long-term outlook includes investments in cleaner energy solutions and higher-margin petrochemical products, positioning it to better weather cyclical industry downturns.

For now, S-Oil’s immediate future will likely be shaped by how effectively it manages external shocks and adapts to rapidly changing market dynamics.

Comments