Oil Prices Surge as Middle East Tensions and U.S. Inflation Diverge

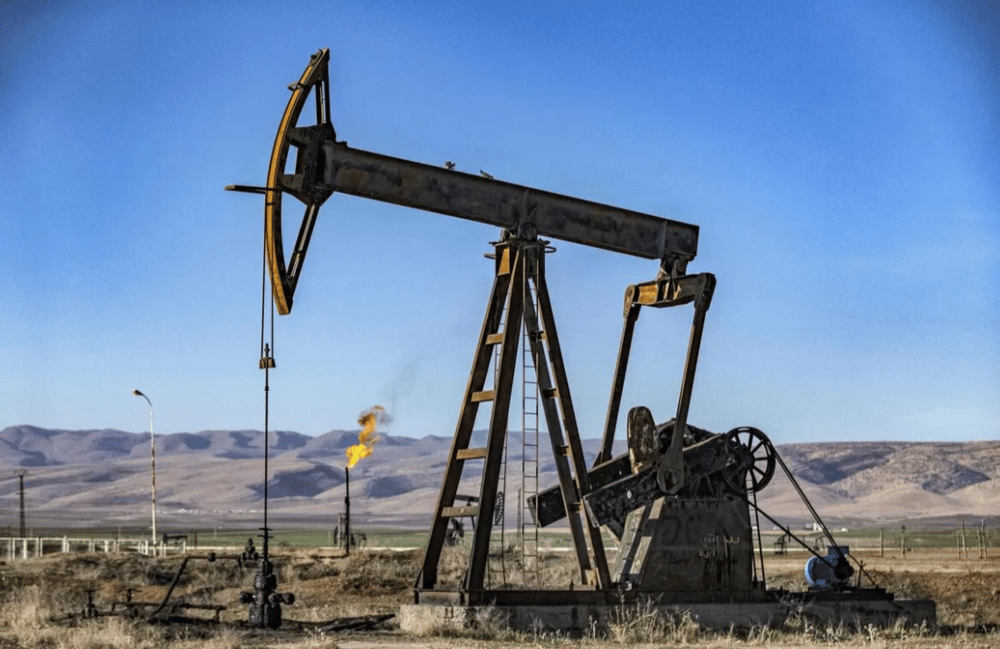

Global financial markets are once again navigating conflicting macroeconomic signals. A sharp rise in crude oil prices—triggered by escalating geopolitical tensions in the Middle East—has collided with unexpectedly soft U.S. inflation data, producing a highly uncertain trading environment. These opposing forces are creating friction across asset classes, including commodities, currencies, and equities.

This development follows a series of volatile sessions in 2025, with investors recalibrating positions amid mixed macro indicators. The divergence between energy price inflation and broader disinflation trends in the U.S. complicates Federal Reserve (Fed) policy expectations and challenges the recent rebound in the U.S. dollar index (DXY).

Oil Rally Clashes With Disinflation Narrative

Brent crude futures surged above $89 per barrel, while WTI (West Texas Intermediate) approached $85, supported by supply concerns following regional instability near key production zones. At the same time, U.S. Consumer Price Index (CPI) data showed weaker-than-expected core inflation, reinforcing speculation that the Fed may pivot to rate cuts sooner than anticipated.

This confluence of events has created contrasting macro pressures: rising energy costs typically signal inflationary momentum, yet the broader basket of prices in the U.S. economy continues to ease. For policymakers, the challenge lies in balancing inflation control against a backdrop of fragile growth and increasing geopolitical risk premiums.

Quick Facts

🛢 Brent crude climbed to a two-month high, trading near $89.10 per barrel.

💹 U.S. CPI core inflation rose just 0.2% in May, below market forecasts.

💱 USD (DXY) slipped 0.4% as investors priced in potential rate cuts.

📉 U.S. Treasury yields fell across the curve, reflecting a dovish shift in expectations.

🧯 Middle East tensions, particularly in the Strait of Hormuz, reignite supply disruption fears.

Continued Analysis: Market Reaction and Expert Commentary

Financial markets responded to the oil-inflation divergence with caution. The S&P 500 $^SPX retreated from recent highs as energy sector gains were offset by weakness in rate-sensitive sectors. The USD, already pressured by cooling inflation, faced additional headwinds from falling yields and increased demand for safe-haven currencies such as the JPY and CHF.

Strategists remain divided on the sustainability of the oil rally and its influence on inflation expectations. While some argue that energy-driven inflation could complicate the Fed’s roadmap, others contend that isolated commodity shocks are unlikely to derail the broader disinflation trend unless they persist.

Key Market Points

Energy Price Spike: Brent and WTI crude prices surged due to heightened geopolitical tensions.

Benign U.S. Inflation: Softer core CPI data supports the case for a Fed policy pivot.

Dollar Under Pressure: The DXY declined, with investors shifting into low-yielding safe havens.

Divergent Sector Impact: Energy stocks gained, but tech and financials lagged on rate cut bets.

Geopolitical Risk Premiums: Market volatility reflects elevated risk-adjusted valuations amid uncertainty.

Markets Face Macro Dissonance Amid Global Risks

The juxtaposition of rising oil prices and decelerating U.S. inflation encapsulates the macroeconomic complexity currently confronting global markets. While inflation fears have subsided in core indicators, commodity markets are reintroducing volatility through the supply channel. This duality is placing central banks, particularly the Fed, in a reactive position as they attempt to balance inflation containment with economic stability.

For investors, the key takeaway is the persistence of macro dissonance: while headline indicators suggest disinflation, exogenous shocks—such as geopolitical events—remain a significant tail risk, influencing both market sentiment and policy direction.

Comments

Global markets today feel like a high-stakes tightrope walk between surging oil and soft inflation.

Navigating today’s market feels like balancing on a tightrope between escalating oil prices and unexpectedly soft inflation.