G7 Finance Ministers Target Global Imbalances and Supply Chain Risks in New Economic Security Push

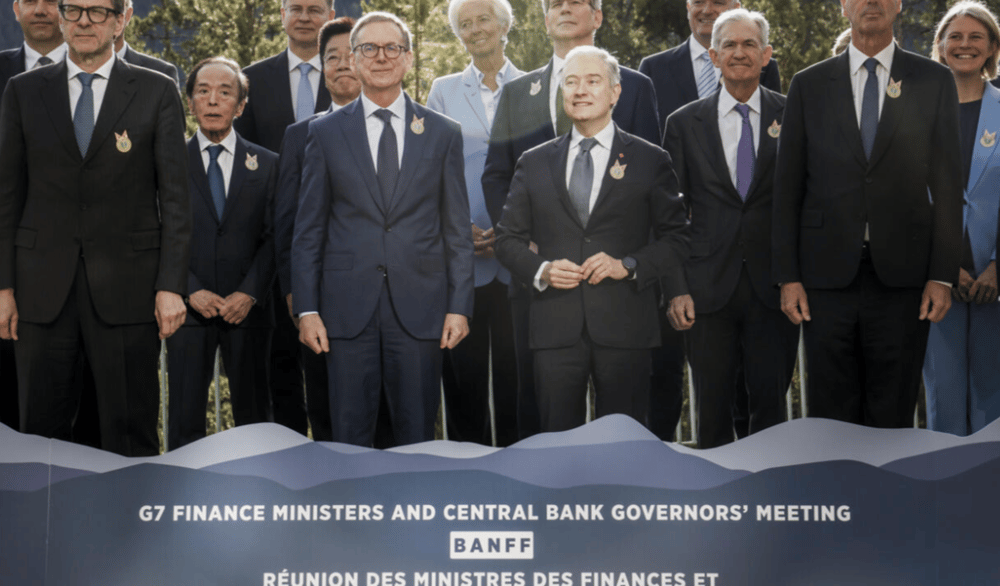

The Group of Seven (G7) has renewed its focus on addressing structural vulnerabilities in the global economy, signaling a policy shift toward greater alignment in trade, monetary frameworks, and supply chain resilience. According to a draft communiqué obtained, G7 finance ministers and central bank governors have pledged to counteract “excessive imbalances” and enhance international economic security through collective action.

This coordinated effort reflects rising concern among advanced economies about the long-term consequences of market concentration, state intervention in trade, and geopolitical fragmentation. The communiqué outlines intentions to confront non-market practices — an implicit reference to trade distortions often attributed to state-led models — and emphasizes the need for diversified and resilient global supply networks.

Global Imbalances and Strategic Coordination: Core Risks and Policy Direction

While global GDP has rebounded since the COVID-19 shock, uneven recoveries, persistent inflationary pressures, and monetary tightening cycles have created new asymmetries. The G7’s position underscores the growing risk that economic fragmentation, particularly between liberalized economies and more interventionist models, could destabilize both markets and multilateral frameworks.

The reference to “non-market practices” is widely interpreted as a signal to economies such as China, where state subsidies and trade restrictions have drawn criticism from Western officials. G7 members have increasingly cited the strategic importance of ensuring fair competition and safeguarding critical supply chains in sectors ranging from semiconductors to clean energy.

The communiqué further calls for a shared framework to assess risks related to the concentration of market power in key industries and urges further integration of supply chain resilience metrics into national and multilateral policy.

Key Facts

G7 members include the U.S., Canada, Germany, France, Italy, Japan, and the U.K.

The communiqué aims to tackle economic imbalances and non-market trade practices

Key focus: market concentration and supply chain vulnerabilities

Draft obtained by Bloomberg News ahead of official G7 release

Discussion reflects concern over economic fragmentation and global competition norms

Financial Market Implications and Institutional Reactions

Market reactions to the G7’s messaging have been mixed, with investors closely watching whether rhetoric will translate into actionable frameworks. In FX markets, the USD and JPY saw minor intraday volatility following the release of the draft communiqué, as currency traders evaluated potential impacts on monetary coordination and future trade alignments.

Policy analysts noted the communiqué’s alignment with recent discussions at the World Bank and IMF, which have emphasized the need to mitigate cross-border economic shocks and diversify import dependencies. Multilateral institutions have warned that fragmented regulatory standards and unbalanced capital flows could undermine financial stability and trigger protectionist cycles.

The G7's approach reflects a shift toward “economic security” as a policy lens — broadening the focus beyond traditional fiscal metrics to include resilience against trade weaponization, supply disruptions, and systemic monopolies.

Key Policy and Market Takeaways

Strategic Coordination: G7 signals a more unified stance against state-driven market distortions.

Monetary Policy Convergence: Central banks continue informal alignment on inflation control while recognizing divergence risks.

Supply Chain Governance: Emphasis on securing critical infrastructure across healthcare, tech, and energy sectors.

Risk of Retaliatory Measures: Potential for trade tensions to escalate if policy tools become more protectionist.

Geopolitical Undercurrents: Economic policy increasingly reflects strategic rivalry with non-G7 actors.

G7 Prioritizes Economic Security in a Fragmented Global Order

The G7’s emerging consensus on tackling structural imbalances and reinforcing supply chain resilience represents a notable evolution in the bloc’s economic strategy. The draft communiqué signals a move beyond macroeconomic stabilization toward a model that places systemic resilience and geopolitical alignment at its core.

While implementation challenges remain, the acknowledgment of market concentration risks and non-market practices underscores a strategic recalibration of international economic policy. As global institutions and national governments navigate this complex terrain, the G7’s direction will likely serve as both a benchmark and catalyst for broader realignments in global financial governance.

Comments

It highlights how adaptive strategies are becoming essential in a fast-changing ecosystem