Enagas Awarded Increased $302 Million Compensation in ICSID Arbitration Against Peru

Spanish gas network operator Enagas $ENG.MC announced a significant development in its ongoing arbitration case involving the Peruvian government. The International Centre for Settlement of Investment Disputes (ICSID), part of the World Bank Group, has increased the compensation awarded to Enagas from $194 million to $302 million. This arbitration concerns a gas pipeline project developed by Enagas in Peru, and the recent ruling marks a substantial escalation in the financial remuneration the company is entitled to receive.

Implications of ICSID’s Increased Arbitration Award for Enagas and Peru

The ICSID’s decision to raise the compensation by more than 50% underscores the complexity and gravity of the investment dispute between Enagas and Peru. The initial $194 million award, granted in December, was revisited after further review of the claims and damages sustained by Enagas due to alleged breaches related to the gas pipeline project.

Such arbitration proceedings under ICSID aim to protect foreign investors by ensuring fair treatment and legal recourse against host states when investment agreements are violated. The increased award not only improves Enagas’s financial outlook but also sets a precedent for arbitration enforcement in Latin America, where regulatory and political risks remain prevalent.

For Peru, the ruling poses a considerable fiscal challenge, requiring the country to allocate substantial funds potentially impacting its budgetary priorities. Additionally, the decision could influence future foreign direct investment (FDI) perceptions, emphasizing the risks tied to infrastructure projects amid evolving regulatory frameworks.

Key Facts

ICSID increased Enagas’s arbitration award from $194 million to $302 million.

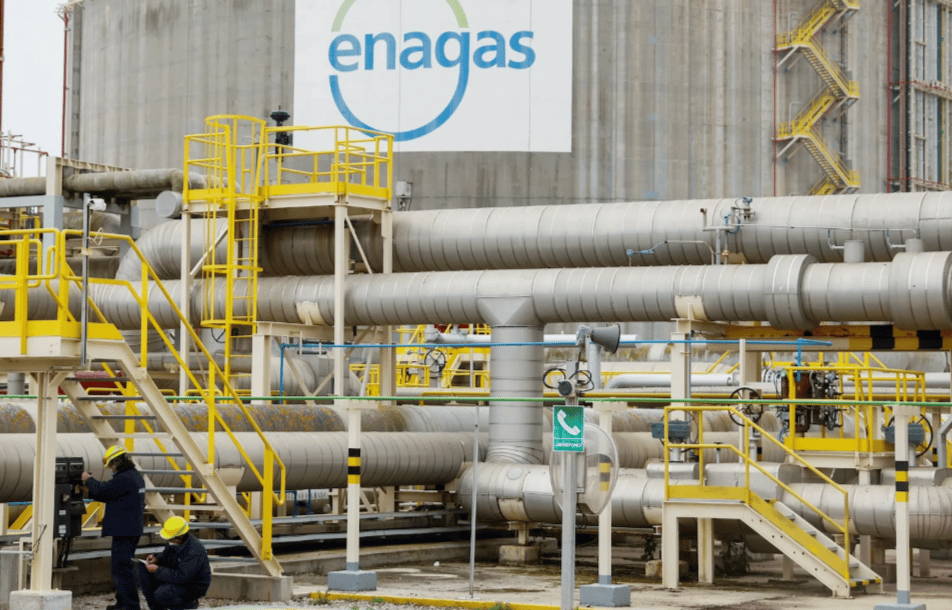

The arbitration relates to a gas pipeline project operated by Enagas in Peru.

The ruling was announced in a statement filed with the Spanish stock market regulator.

ICSID operates under the World Bank Group to resolve investment disputes.

The increase reflects a reassessment of damages due to alleged contractual breaches.

Market Reaction and Broader Impact on Investment Climate

Following the announcement, Enagas’s stock showed moderate positive movement, reflecting investor confidence in the company's strengthened financial position. The arbitration award enhances Enagas’s balance sheet by securing significant compensation, which may also affect its future capital allocation and investment strategy.

Market analysts note that arbitration awards of this magnitude signal the importance of legal protections for international investors and highlight potential geopolitical and regulatory risks in emerging markets like Peru. The decision may prompt other multinational corporations to carefully evaluate their exposure to similar risks in Latin America.

From a broader perspective, Peru faces increased scrutiny regarding its investment climate, as disputes of this nature can deter future FDI inflows unless reforms or clearer regulatory frameworks are introduced to mitigate such conflicts.

Key Points

ICSID’s increased award substantially benefits Enagas financially.

Peru is required to pay a significantly higher compensation, impacting its fiscal resources.

The arbitration emphasizes the role of international legal bodies in investor protection.

Enagas’s stock market response reflects investor approval of the ruling.

The case highlights the regulatory and political risks in Latin America’s infrastructure sector.

Significance of ICSID Ruling for Enagas, Peru, and International Investment Arbitration

The ICSID’s decision to raise Enagas’s compensation from $194 million to $302 million demonstrates the critical role of international arbitration in safeguarding foreign investments. For Enagas, the award provides crucial financial redress and strengthens its position amid complex international operations.

For Peru, the ruling underscores the challenges emerging markets face in balancing investment attraction with regulatory oversight. It also serves as a reminder of the necessity for transparent and stable legal frameworks to foster investor confidence.

Overall, this case exemplifies how arbitration tribunals influence cross-border infrastructure investments and shape the dialogue around sovereign risk and investor-state relations in the global economic landscape.

Comments

It demonstrates how strategic decisions are shaping the future of intelligent technologies