Coca-Cola Delivers Strong Earnings but Flags Tariff Risks Amid Global Uncertainty

Coca-Cola Co. $KO reported better-than-expected earnings and revenue for the quarter, bolstered by robust demand for its beverage portfolio and strategic price increases. However, despite outperforming Wall Street projections, the beverage giant issued a cautionary note on potential headwinds linked to U.S. trade policy, particularly tariffs that could disrupt input costs and consumer sentiment.

As the global economy wrestles with mounting geopolitical and fiscal uncertainties, Coca-Cola’s performance—and its outlook—offers a window into how major consumer goods companies are navigating cost pressures and shifting demand dynamics.

Performance Highlights Reflecting Market Strength

Coca-Cola's quarterly results reflect a combination of brand resilience and strategic pricing, helping offset inflationary pressures and currency volatility. While many peers have struggled to maintain guidance, Coca-Cola reaffirmed its full-year outlook on organic revenue and comparable earnings, reinforcing its positioning in a challenging macro environment.

Key Takeaways from Coca-Cola’s Quarterly Report

Revenue Beat: The company posted revenue above analyst estimates, supported by higher pricing and strong global demand for sparkling beverages.

Earnings Strength: Earnings per share also exceeded projections, reflecting solid cost management despite macroeconomic volatility.

Steady Guidance: Coca-Cola maintained its full-year forecasts, standing in contrast to recent downward revisions from competitors.

Tariff Warning: Management flagged U.S. tariff risks as a possible drag on future margins and consumer behavior.

Global Diversification: Performance across emerging markets helped cushion against softness in certain developed economies.

Broader Industry Ripples

Coca-Cola’s report comes at a time when major consumer staples companies are adjusting their strategies amid rising operational costs. Notably:

PepsiCo $PEP has trimmed its forward guidance, citing pressure from input cost inflation and uncertain trade dynamics.

Procter & Gamble $PG has echoed similar concerns, reflecting a broader recalibration across the consumer goods sector.

These cautionary tones underscore the shared exposure to escalating tariffs, particularly under policies introduced by the Trump administration that are reshaping global trade frameworks.

Market Forces Shaping the Beverage Sector

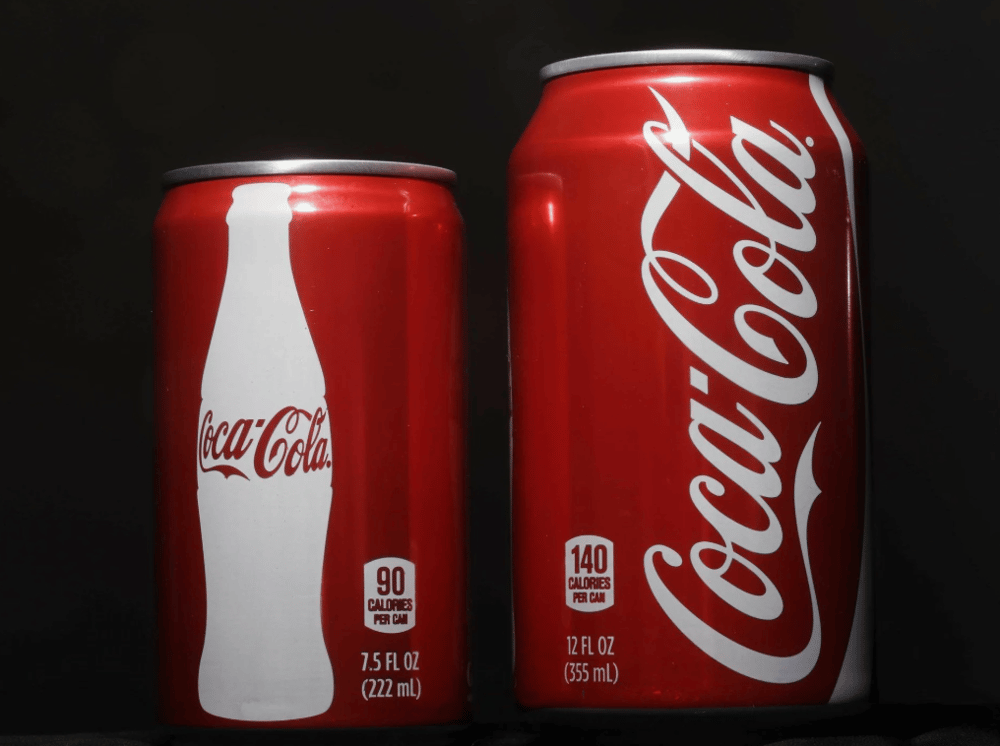

Rising input costs: Packaging, sweeteners, and aluminum prices continue to climb, squeezing margins.

Currency fluctuations: A strong U.S. dollar has created headwinds for international revenue conversion.

Consumer elasticity: While demand remains strong, there are limits to how much cost increases can be passed on.

Trade policy shifts: Global supply chains are under review as companies brace for potential new tariffs.

Competitive pressures: Innovation and brand loyalty are critical as new entrants and health trends challenge incumbents.

Conclusion: Resilience Meets Caution

Coca-Cola’s strong earnings report signals that brand power and pricing strategies remain effective in volatile markets. However, the company’s warning on trade-related risks highlights the fragile balance between operational execution and policy-driven disruption. As global trade tensions evolve, the beverage sector may face new complexities in protecting margins while sustaining volume growth.

Comments

Decisive actions in the market are fueling forward-thinking shifts that stand to permanently change the face of automation in tech

A transaction like this might signal a revolutionary shift in tech automation