Zhejiang Sanhua Intelligent Controls Targets $1.03 Billion via Hong Kong Listing

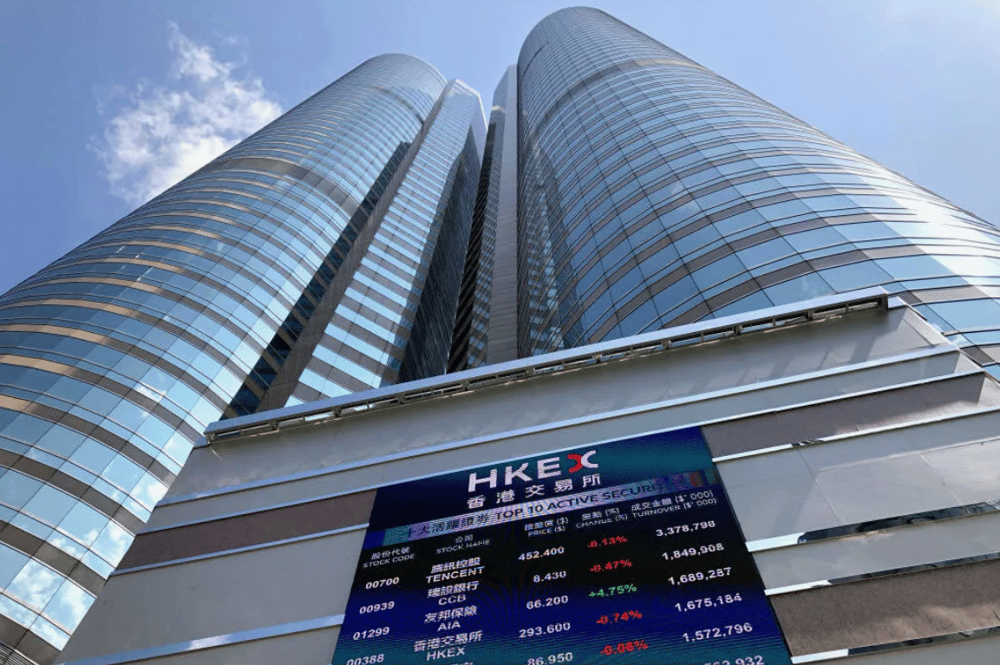

Zhejiang Sanhua Intelligent Controls Co. Ltd. $002050.SZ, a leading mainland Chinese supplier of energy-efficient heating and cooling systems, has announced its intention to raise up to HK$8.12 billion ($1.03 billion) through a Hong Kong Stock Exchange (HKEX) listing. The move comes amid a broader rally in Asia-Pacific capital markets and increasing investor demand for sustainable industrial technologies.

This proposed H-share issuance reflects an accelerating trend among mainland Chinese firms to leverage offshore equity markets for capital expansion, particularly those developing green infrastructure and climate-aligned industrial technologies.

Strategic Capital Raising and Sectoral Significance

Zhejiang Sanhua, known for its advanced thermal management solutions in HVAC and electric vehicles, plans to issue 360.3 million H-shares at a maximum price of HK$22.53 each. This IPO aims to enhance the company’s R&D capacity, production expansion, and international market penetration.

The timing of the listing is notable. After several quarters of subdued investor activity, Hong Kong’s equity markets are experiencing a resurgence, supported by expectations of monetary easing and improving mainland-China macro data. Zhejiang Sanhua’s offering is one of the largest Hong Kong IPOs year-to-date in the industrial and green tech space, reinforcing the city’s role as a gateway for renminbi (CNY)–denominated assets and sustainable investment flows.

Zhejiang Sanhua’s HKEX Listing Plans

🏢 Company: Zhejiang Sanhua Intelligent Controls

📍 Sector: Energy-efficient HVAC systems and thermal controls

📈 IPO Size: Up to HK$8.12 billion (~$1.03 billion USD)

📊 Shares Offered: 360.3 million H-shares

💰 Max Offer Price: HK$22.53 per share

🌍 IPO Venue: Hong Kong Stock Exchange (HKEX)

💡 Purpose: R&D, capacity expansion, overseas market access

Market Sentiment and Capital Flow Trends

The Sanhua offering is emblematic of the green industrial pivot in Asia’s public markets. As the People’s Republic of China (PRC) pursues carbon neutrality targets, companies that align with decarbonization efforts — particularly those in building technologies and EV infrastructure — are expected to benefit from both policy tailwinds and capital market interest.

Investor sentiment toward Hong Kong IPOs has gradually improved since Q2 2025, as macro conditions stabilized and cross-border capital linkages strengthened. Sanhua’s dual exposure to the automotive and residential climate control markets gives it structural growth drivers, especially in the context of global energy transition mandates.

Moreover, the IPO may act as a litmus test for the current demand for environmental-themed equity in a recovering IPO pipeline — especially after a multi-year lull following pandemic-era volatility and regulatory crackdowns.

Key Developments to Track

IPO Valuation Dynamics — Market appetite for HK$22.53 per share pricing and final subscription levels.

Cross-Border Listings — Reinforced trend of Chinese companies listing in HKEX to access global liquidity.

Green Technology Premium — Investor willingness to price in ESG-aligned business models.

Regulatory Comfort — Continued easing of IPO approvals and capital account measures by Beijing.

Sector Benchmarking — Comparison with prior green industrial IPOs such as LONGi Green Energy $601012.SS or CATL $300750.SZ.

HKEX Pipeline Outlook — Influence of Sanhua’s listing on other pipeline deals in H2 2025.

Capital Access Meets Climate Strategy

Zhejiang Sanhua’s planned IPO in Hong Kong illustrates how green industrial players are re-engaging with capital markets as liquidity conditions improve and ESG priorities intensify. The offering not only enables Sanhua to fund innovation and international growth but also positions the company as a key corporate actor in China’s carbon transition strategy.

The move reinforces the HKEX’s status as a platform for cross-border listings and highlights sustained institutional interest in energy-efficient infrastructure and smart manufacturing technologies. In a climate where industrial policy and capital markets are increasingly interlinked, Sanhua’s IPO could set the tone for a new wave of sustainability-oriented listings across the region.

Comments

This could be a catalyst for redefining how automation integrates with next-gen digital systems