What is PAMM Account

PAMM Account Explained

PAMM account is a special type of brokerage account used to facilitate percentage-based investment allocation among multiple investors and a professional trader. It allows pooled funds to be managed from a single master account, while each investor retains proportional ownership and risk. The broker’s system ensures that trades, profits, and losses are automatically distributed based on each participant’s share of the investment.

PAMM (Percentage Allocation Management Module) is a form of managed forex investment where investors allocate their capital to professional traders, known as PAMM managers. These managers trade on behalf of multiple participants in a single account. Profits and losses are distributed proportionally to each investor's contribution.To understand the core idea, read our dedicated guide: What is PAMM in trading

How PAMM Investment Works

PAMM investment account functions by pooling investor funds into one managed forex trading strategy. The key participants include the PAMM manager, who is a skilled trader executing trades; the investors, who contribute their funds; and the broker platform, which facilitates the process, including allocations and reporting. You can read more about how PAMM investment works in our in-depth breakdown of the process.

The manager earns a performance fee based on results. Investors can view all trading activities and profit distribution transparently on the broker's PAMM interface.

Profit Potential of a PAMM Account

PAMM accounts offer the opportunity for attractive returns, which vary depending on market conditions and the manager’s performance. For instance, some successful PAMM strategies have historically shown monthly gains ranging from 5% to 15%. However, these figures are not guaranteed. You can learn more about PAMM account profitability in our dedicated analysis.

Several factors influence profitability, such as market volatility, the manager's trading strategy, and the fee structure.

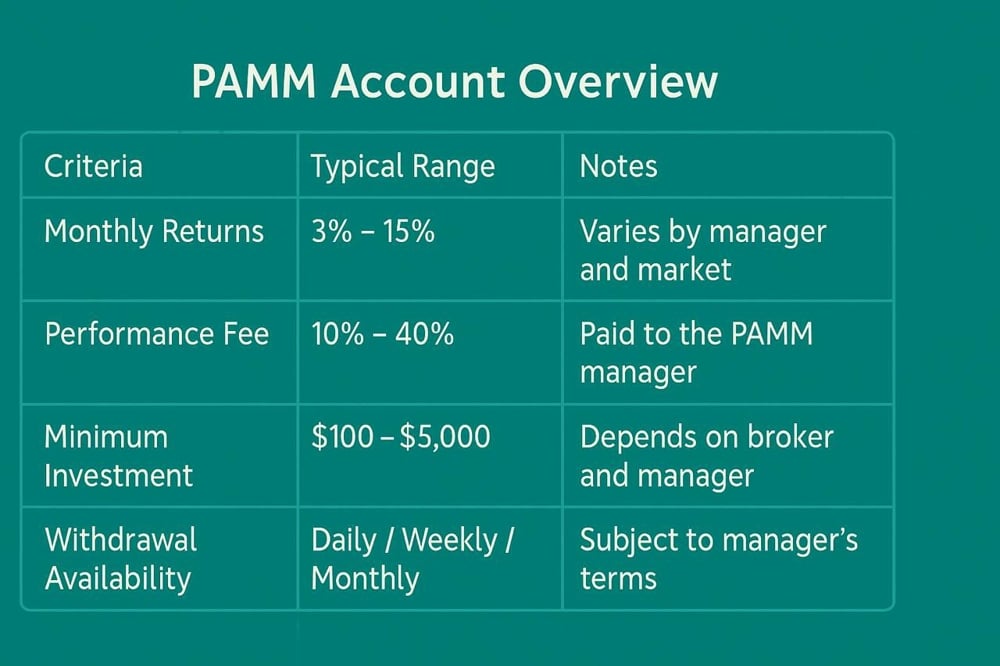

Sample Performance Overview:

Safety of PAMM Accounts for Investors

PAMM accounts offer several safety features, especially when operated through reputable brokers. Investor funds are held in segregated accounts, reducing the risk of misuse. Licensed brokers are typically regulated by financial authorities, which enforces transparency and reporting standards. To understand the risks and protections better, explore the safety aspects of PAMM accounts in our full article.

Still, it's important to remember that all trading involves risk, and there is no guaranteed protection of capital.

Main Risks of a PAMM Account Investment

Investing in PAMM accounts involves various risk categories. Market fluctuations can lead to losses, particularly during high-volatility periods. There’s also the possibility of poor decision-making on the part of the PAMM manager, which can directly affect your returns. Technical failures, such as broker-side execution delays or data feed discrepancies, are additional considerations. A detailed overview of PAMM-related risks can help you assess your exposure.

Legal Status of PAMM Accounts by Jurisdiction

The regulatory status of PAMM accounts varies by region. In the U.S., they are generally subject to oversight by organizations like the CFTC and NFA. In the European Union, PAMM operations must comply with MiFID II and country-specific financial rules. Meanwhile, jurisdictions in Asia and offshore regions offer different levels of regulation. For full context, read our legal guide to PAMM accounts by jurisdiction.

Investors should always confirm whether the platform is properly licensed and compliant with local laws.

FAQ

What is a PAMM?

A PAMM (Percentage Allocation Management Module) is a type of forex investment where traders manage pooled funds from multiple investors.To understand the PAMM model in depth, check our guide: What is PAMM in trading

How to choose a PAMM manager?

Evaluate the manager’s performance history, trading strategy, transparency, and risk profile. Choose someone whose approach aligns with your financial goals.

Is a PAMM account profitable in 2025?

Potentially, yes. Profitability depends on the manager’s skills and market conditions. Some accounts have shown consistent monthly profits, though risks remain.

Are PAMM accounts legal?

Generally, yes. The legality hinges on the broker’s regulatory status and the laws in your region.

Comments

Such momentum showcases how dynamic ecosystems reward proactive investment strategies