Vertical Aerospace and Bristow Group Expand eVTOL Partnership, Eyeing Air Taxi Market Growth

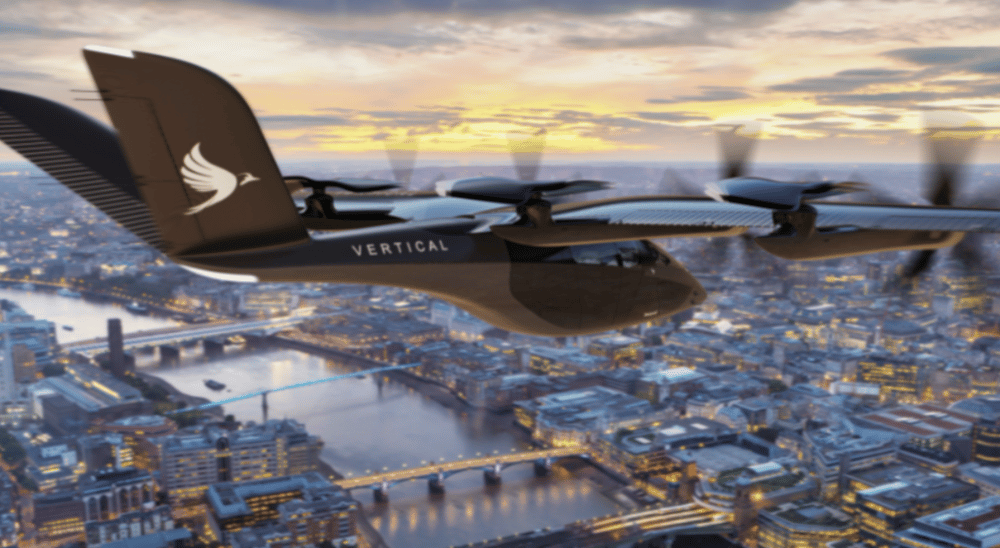

Vertical Aerospace, a British developer of electric vertical take-off and landing (eVTOL) aircraft, announced on Thursday the expansion of its collaboration with Bristow Group $VTOL —a move that underscores the accelerating momentum in the urban air mobility (UAM) sector.

As global aviation shifts toward decarbonization and innovation, the partnership reflects a strategic alignment aimed at making air taxi services commercially viable. With regulatory developments advancing and infrastructure investment growing, both companies are positioning themselves at the forefront of next-generation air transport.

Vertical and Bristow Double Down on eVTOL Ambitions

The updated agreement includes Bristow’s conditional pre-order of up to 100 VX4 eVTOL aircraft, with 50 firm and 50 optional. The VX4 is Vertical’s flagship electric aircraft, designed for low-emission urban and regional air mobility. It features zero operating emissions, low noise profiles, and short-hop range optimized for intra-city travel.

This enhanced commitment builds on a relationship first established in 2022 and reflects rising investor and industry confidence in eVTOL commercialization, particularly within existing helicopter markets such as offshore transport, medical evacuation, and regional commuting.

As legacy aviation players and new entrants race toward certification milestones, Vertical’s partnership with an experienced operator like Bristow enhances its credibility, especially in regulated aerospace markets such as the UK and U.S.

Quick Facts

✈️ Bristow to purchase up to 100 VX4 eVTOL aircraft from Vertical Aerospace.

🌍 Bristow currently operates helicopter services across the UK, U.S., Brazil, and Nigeria.

📈 Shares of Vertical Aerospace rose 2.6%; Bristow Group gained 3% in premarket trading.

♻️ VX4 is designed to offer zero-emission short-haul air mobility for up to four passengers.

🔄 Partnership deepens prior collaboration announced in 2022.

Market Response and Strategic Industry Implications

The expanded deal comes amid renewed interest in electric aviation, with both public and private capital increasingly flowing into eVTOL developers. The NASDAQ-listed Bristow Group has been particularly active in integrating next-gen aircraft into its fleet strategy as a hedge against rising fuel costs and regulatory carbon targets.

Market reaction was modest but positive, reflecting cautious optimism. The relatively small gains in share prices—2.6% for Vertical Aerospace and 3% for Bristow—suggest that investors view the agreement as strategically sound, though long-term execution risks remain.

Analysts point to the significance of Bristow’s operational expertise in navigating certification and deployment challenges. As more air taxi trials begin across global urban centers, partnerships with legacy aviation firms will be essential to achieving regulatory compliance, airspace integration, and customer trust.

Key Takeaways

The Vertical-Bristow alliance underscores growing confidence in the viability of eVTOL aircraft.

VX4’s zero-emission profile aligns with international sustainability targets in aviation.

Regulatory partnerships and operational experience are crucial differentiators in the UAM market.

Pre-orders and conditional agreements are key demand signals but require successful certification to convert into revenue.

Share price movements reflect early-stage optimism, tempered by the sector’s long-term capital intensity.

eVTOL Sector Gains Traction as Commercialization Approaches

The expanded agreement between Vertical Aerospace and Bristow Group marks another step toward bringing electric air taxis into real-world operation. As the VX4 moves closer to certification, Vertical aims to establish itself as a leader in the rapidly evolving UAM ecosystem.

With global aviation under pressure to innovate and decarbonize, strategic partnerships such as this one offer a blueprint for scaling electric aviation infrastructure and operations. While challenges remain—from certification delays to public airspace integration—this latest development reinforces the sector’s long-term viability and investor appeal.

Comments