Tiger Securities Plans to Double Its Hong Kong Workforce Amid Surge in Chinese Offshore Investment

Tiger Securities, a Singapore-headquartered online brokerage firm, has announced plans to double its workforce in Hong Kong over the next two to three years. The move reflects the company’s strategic positioning to capture a larger share of the rapidly expanding offshore Chinese investment market. The firm’s CEO, Tianhua Wu, revealed the initiative in an exclusive interview with Reuters this week, citing favorable market conditions and evolving investor behavior as key drivers.

Growing Presence of Online Brokerages in Asia’s Financial Hub

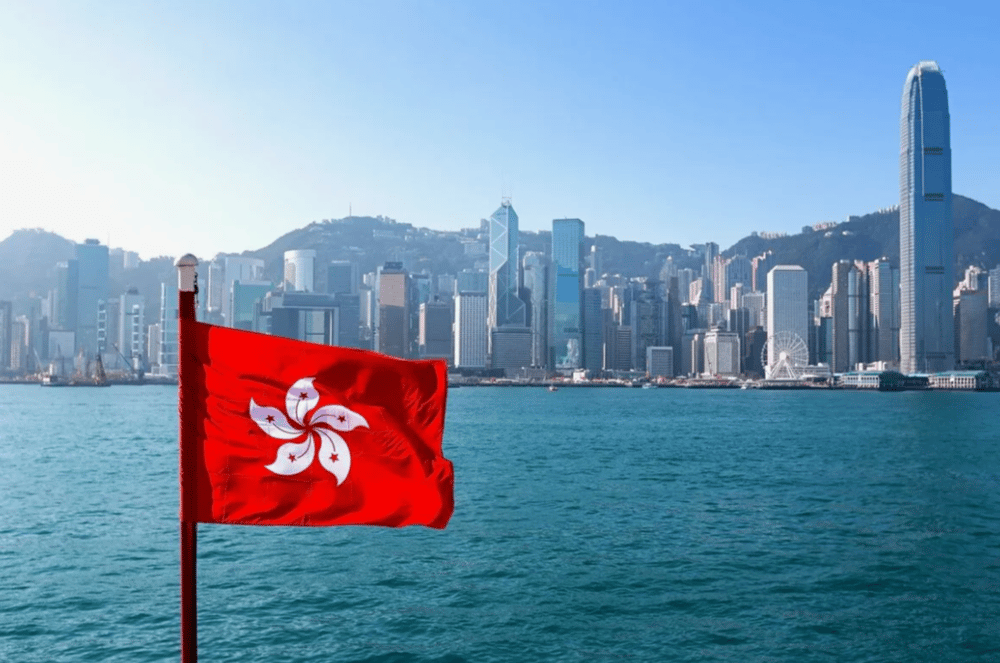

The expansion comes at a pivotal moment for Hong Kong’s financial sector. As one of Asia’s leading financial centers, Hong Kong continues to attract global and regional players amid increasing demand from mainland Chinese investors for offshore asset diversification. With regulatory pressures and economic headwinds in China, more high-net-worth individuals and retail investors are exploring international investment avenues.

Tiger Securities’ decision to ramp up its Hong Kong operations underscores the company’s confidence in the territory’s role as a gateway for Chinese capital. Since launching in Hong Kong in late 2022, Tiger has built a 60-person team and is now seeking to increase that number significantly to support growing client demand and expand its service offerings.

Key Facts About Tiger Securities' Expansion

Headquarters: Singapore; founded in Beijing in 2014

Current HK headcount: 60 employees

Planned workforce growth: +100% over 2–3 years

Market focus: Offshore Chinese investors

Core service: Digital brokerage platform

Launched in Hong Kong: Q4 2022

CEO: Tianhua Wu

Market Implications and Industry Reactions

The strategic hiring initiative is aligned with broader trends in digital brokerage and capital outflow from mainland China. Hong Kong’s regulatory environment, coupled with its international connectivity, makes it an optimal base for online brokerages seeking to scale operations.

Industry analysts point out that Tiger Securities is capitalizing on a confluence of favorable factors: regulatory tightening in China, the growing appetite for portfolio diversification, and the technological edge of online platforms over traditional financial institutions.

While the Hong Kong stock exchange $0388.HK continues to attract international listings and foreign capital, digital brokerages like Tiger are playing a pivotal role in democratizing market access. The firm's mobile-first approach and competitive fee structure appeal to a tech-savvy generation of investors increasingly looking beyond the mainland.

Key Market Takeaways

Hong Kong remains a prime offshore gateway for Chinese capital amid domestic market uncertainties.

Tiger Securities is scaling operations to meet rising demand from both retail and institutional clients.

Online brokerages are gaining ground on traditional players due to lower costs and faster onboarding.

Regulatory arbitrage continues to shape brokerage strategies across Asia.

Talent acquisition in Hong Kong's financial sector is intensifying, driven by fintech growth.

Tiger's Expansion Reflects Shifting Dynamics in Regional Finance

Tiger Securities' decision to double its headcount in Hong Kong marks a significant step in its regional growth strategy. It highlights the evolving nature of capital mobility in Asia and underscores Hong Kong’s critical role in facilitating offshore investment flows from China. As online brokerages gain momentum, firms like Tiger are redefining the competitive landscape in financial services by combining technological innovation with strategic geographic positioning.

The expansion also points to broader trends reshaping financial markets in Asia — from regulatory shifts and investor preferences to the digitization of trading platforms. In this context, Tiger Securities is not just scaling — it is positioning itself at the forefront of the next phase of Asian capital market integration.

Comments