The Rise and Fall of the TRUMP Memecoin

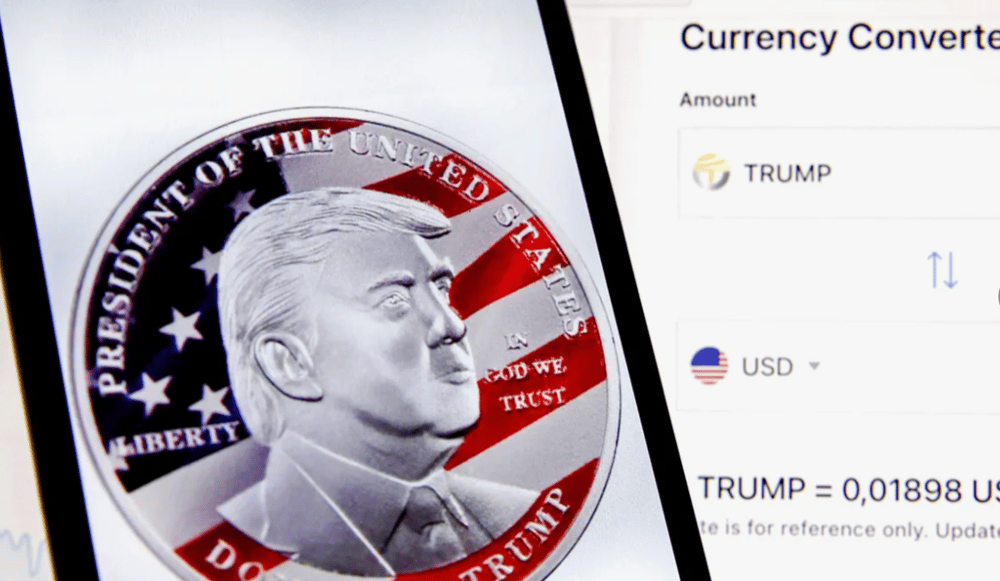

The recent launch of the memecoin OFFICIAL TRUMP $OTRUMPUSD, backed by Donald Trump’s team, has become a notable event in the cryptocurrency market. While the token experienced a meteoric rise in its initial days, its dramatic decline shortly after offers valuable insights for crypto analysts and market participants.

Upon its launch, TRUMP saw rapid growth, with its market capitalization reaching an impressive $14 billion within just two days. However, this momentum quickly dissipated, as the token lost approximately 75% of its peak value, tumbling to $17. This marked a drop below its initial trading price on major cryptocurrency exchanges, which was approximately $40.

Profits and Financial Impact

According to research conducted by Coinbase analyst Conor Grogan, the TRUMP project’s team may have grossed more than $800 million. Of this amount, $482 million—denominated in USDC, TRUMP, and SOL $SOLUSD —was transferred to exchanges, while an additional $29.3 million was reportedly earned through transaction fees.

It’s important to note that transferring tokens to exchanges doesn’t necessarily imply immediate liquidation. Some of these assets may have been used for liquidity provision or operational purposes. This ambiguity highlights the need for a deeper understanding of the team’s financial strategy.

Insights from Solana Wallet Analysis

Grogan’s analysis was largely limited to Solana wallet data, leaving questions about activity on centralized exchanges. While decentralized platforms provide transparency through blockchain data, transaction activities on centralized exchanges often remain opaque, making it challenging to paint a comprehensive picture of market behavior. This underscores the importance of multi-dimensional research when analyzing cryptocurrency projects.

Comments

The emergence of new financial sectors is drawing international investors

Another classic reminder that hype alone can’t sustain long-term value in the crypto world.