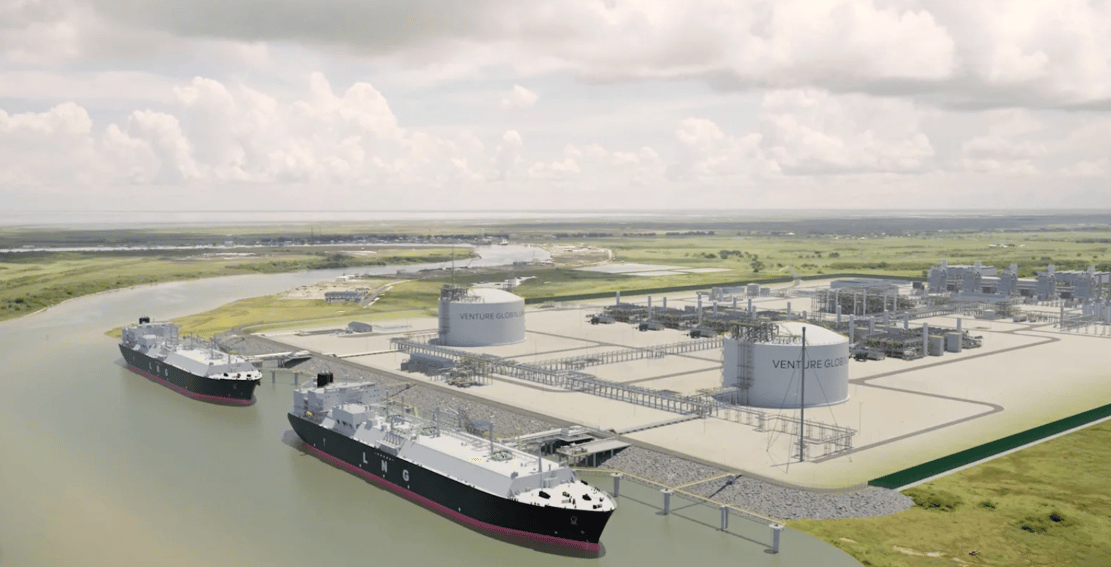

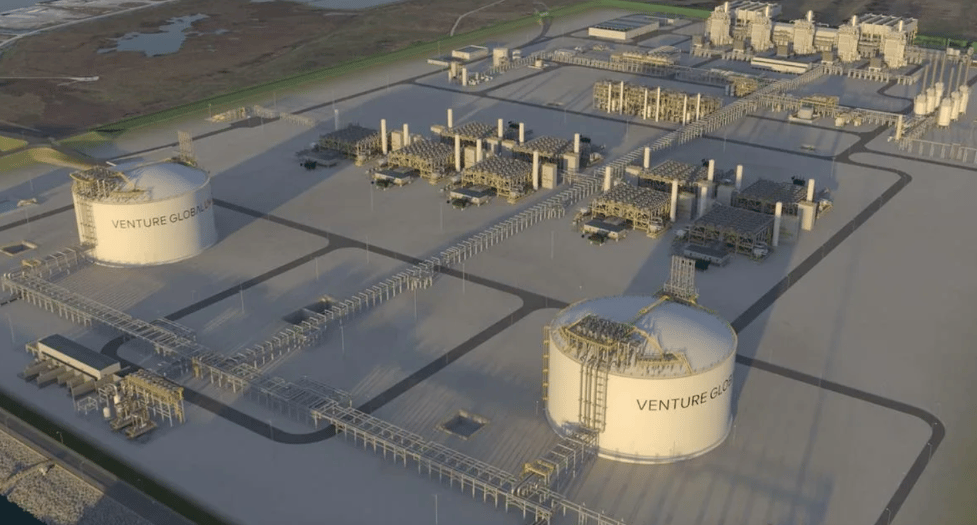

Venture Global $VG, a prominent American LNG producer, has taken a pivotal step by proposing the construction of the CP2 export facility in Louisiana. This development holds significant implications for the global LNG market and the strategic positioning of the United States in energy exports.

In 2023, the United States emerged as the world’s largest LNG supplier, surpassing previous leaders Australia and Qatar. This shift was fueled by several factors:

1. Increased Global Prices: The rise in LNG prices has spurred greater demand for exports.

2. New Projects: Initiatives by Venture Global and other companies contributed to the growth of LNG export capacity.

3. Geopolitical Factors: Supply disruptions and sanctions linked to Russia's invasion of Ukraine in 2022 intensified global LNG demand.

On Friday, the Federal Energy Regulatory Commission (FERC) released a draft environmental report on the CP2 project. In response, Venture Global's shares, after hitting an all-time low of $16.00 earlier in the session, dropped approximately 4.0% and traded around $16.78. The release of the FERC news offered some recovery to the stocks.

- TotalEnergies' Decision: TotalEnergies $OTTEF, a major French energy company, recently decided against becoming a long-term client of Venture Global's terminals in the US.

- Trust Issues: This decision stems from ongoing disputes Venture Global has with some of its clients, prompting concerns over the reliability of the partnership.

The strategic moves by Venture Global and the response from global players like TotalEnergies highlight key trends:

- Trust and Stability: Maintaining reliable relationships is crucial for securing long-term commitments in the LNG market.

- Competitive Edge: The US’s growing capacity to export LNG positions it as a significant competitor on the global stage.

- Environmental Considerations: Projects like CP2 need to navigate regulatory landscapes and environmental concerns to move forward.

Venture Global's CP2 project underscores the dynamic changes in the global LNG sector, driven by market forces and geopolitical events. The evolution of the US as a leading exporter is reshaping the energy landscape and opening new pathways for future endeavors.

Successfully penetrating new markets can drive up the company’s share price

These updates have the potential to become pivotal in enhancing the corporation's market value

Embracing cutting-edge technologies is likely to secure stakeholder approval and trust

The CP2 facility proposal underscores the U.S.'s growing influence in the global LNG arena.

Experimenting with new business approaches could fortify the company’s presence in the financial sector