Sterlite Tech Shares Jump as Company Reinforces AI Data Center Capabilities

Shares of Sterlite Technologies Ltd. $STLTECH.NS climbed over 11% on Monday, closing at ₹92.95. The surge followed the company’s announcement of expanded data center connectivity offerings, specifically adapted for AI-focused infrastructure. Despite the recent rally, the stock trades well below its 52-week peak of ₹155, leaving a notable performance gap. The update reflects Sterlite’s strategy shift toward solutions addressing surging demand from AI applications, cloud services, and edge computing environments in India. The company aims to support the ongoing transformation in digital infrastructure driven by data-intensive workloads.

Product Portfolio Aligns with AI Infrastructure Demand

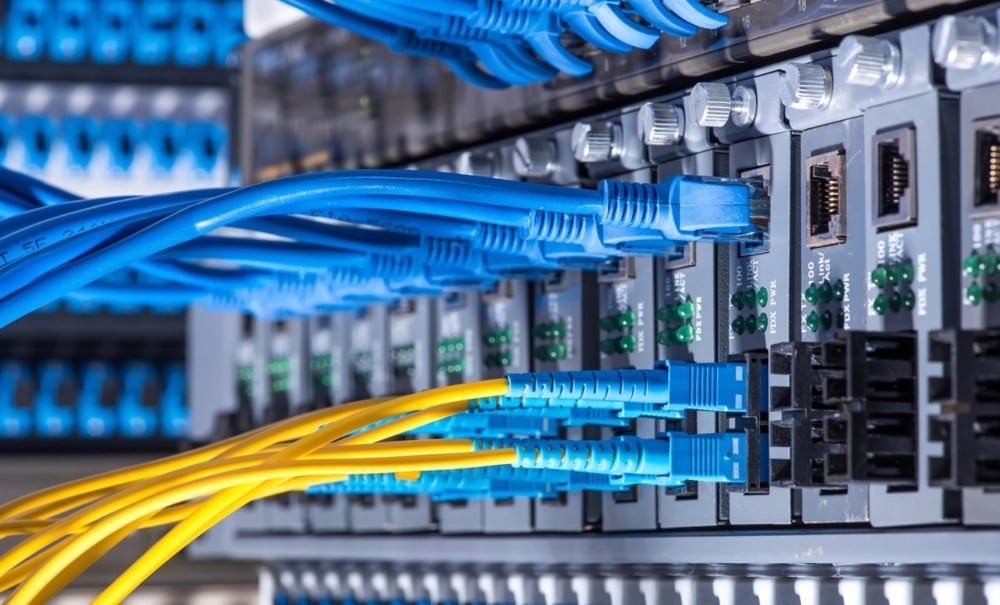

Sterlite’s new line of data center products targets hyperscale operators, telecom carriers, colocation centers, and enterprise clients. The solutions cover core connectivity components required for scalable, secure, and high-throughput environments.

High-capacity fiber and copper cables engineered for low-latency transmission;

Pre-configured AV and surveillance links for integrated data security;

Modular network systems suitable for edge, core, and hybrid configurations;

Dense cabling solutions tailored for high-volume data flows;

Design architectures supporting large-scale AI model hosting.

These developments position Sterlite to address the infrastructure bottlenecks created by AI adoption and the digitization of industries.

Partnership with Tech Data India Enhances Local Reach

To scale deployment, Sterlite has teamed up with Tech Data India, a subsidiary of TD SYNNEX $SNX. The alliance is expected to streamline product distribution across major metropolitan areas and enterprise zones. This collaboration enables faster time-to-market for new deployments, while offering integrators and service providers access to localized supply chains. With India investing heavily in data localization and AI readiness, regional availability of robust connectivity systems is becoming a critical differentiator.

Trading Performance and Market Position

The stock’s performance on Monday placed Sterlite among the day’s strongest mid-cap movers. The rally reflects a reassessment of the company’s positioning as a hardware enabler of AI growth, particularly amid global shifts in demand for low-latency digital infrastructure. Despite positive sentiment, long-term investor focus will likely remain on delivery metrics, including revenue impact, operating margins, and execution within competitive and cost-sensitive markets.

Conclusion: Infrastructure Innovation Meets AI Momentum

Sterlite Technologies’ expanded data center suite signals a focused pivot toward high-performance digital infrastructure. The company’s integration of AI-oriented connectivity solutions, paired with a distribution pact through Tech Data India, outlines a strategy built on technical relevance and scalability. While challenges remain in execution and market penetration, the recent stock movement underscores growing investor confidence in Sterlite’s repositioning within the evolving data infrastructure space.

Comments