SiCarrier Targets $2.8 Billion Capital Raise as China’s Chip Race Intensifies

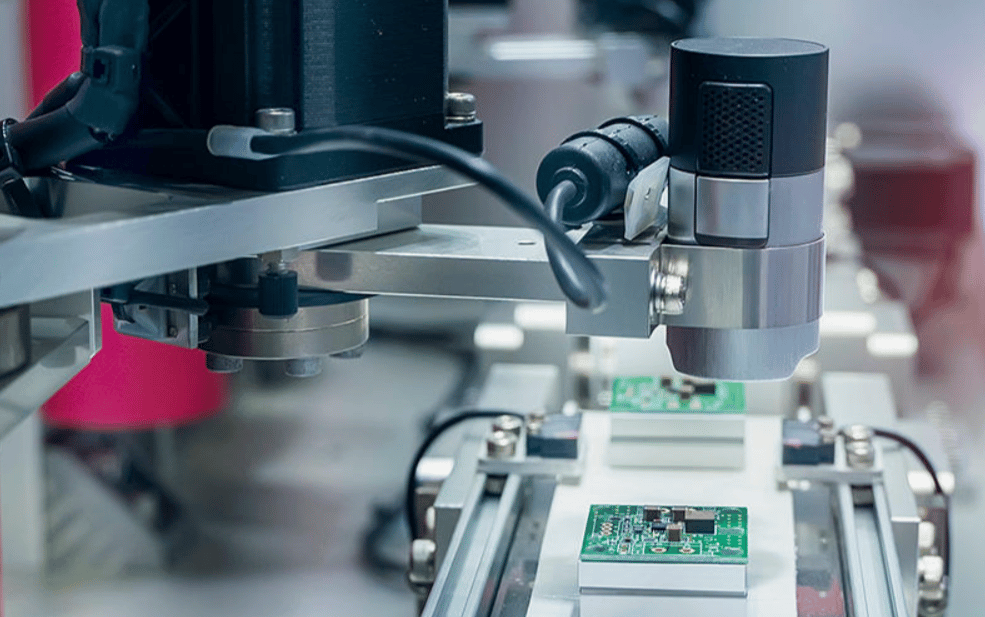

China's semiconductor industry is witnessing the emergence of a powerful new player. SiCarrier, a chip equipment manufacturer closely aligned with Huawei Technologies, is seeking to raise $2.8 billion in its first funding round. The move marks a significant shift in the country’s efforts to build a self-sufficient semiconductor ecosystem amid intensifying global tech competition and export controls.

Founded in 2021 and backed by the Shenzhen municipal government, SiCarrier has swiftly risen from relative obscurity to become one of the most closely watched startups in China’s chip manufacturing landscape. With a growing product portfolio and expanding customer base, the company now sets its sights on rivaling—and eventually surpassing—established domestic players like Naura Technology Group $002371.SZ and Advanced Micro-Fabrication Equipment Inc. China (AMEC) $688012.SS.

Strategic Positioning Amid a Shifting Global Tech Landscape

SiCarrier’s funding ambitions come at a time when China is under increasing pressure to achieve technological independence. U.S. sanctions on advanced semiconductor exports have severely restricted access to cutting-edge tools, making local solutions more critical than ever. SiCarrier is positioning itself as a national champion in chipmaking equipment—a sector traditionally dominated by global players such as ASML, Applied Materials, and Lam Research.

Despite being a relatively young firm, the company is rapidly gaining recognition for its breadth of offerings, ranging from etching systems to lithography alternatives. Industry insiders suggest that its close ties to Huawei not only provide a strategic customer pipeline but also bolster SiCarrier’s credibility as a serious competitor in a tightly contested domestic market.

Competitive Forces Shaping the Local Semiconductor Industry

Naura: Currently the dominant domestic player in etching and cleaning equipment; seen as SiCarrier’s most immediate rival.

AMEC: Specializes in advanced etching tools and has already made inroads into both domestic and international markets.

Huawei’s Involvement: As a major consumer of high-end chips, Huawei’s support is expected to give SiCarrier a strong commercial advantage.

Policy Backing: The Chinese government’s push for semiconductor self-reliance serves as a tailwind for companies like SiCarrier.

Supply Chain Localization: Increased funding is aimed at helping SiCarrier develop tools that reduce dependency on foreign technologies.

Capital Objectives and Market Differentiators

SiCarrier’s $2.8 billion fundraising plan is not just a signal of ambition—it is a crucial step toward R&D scaling, customer acquisition, and supply chain autonomy. Sources familiar with the company’s strategy note that it intends to use the proceeds to expand production capacity, accelerate technology innovation, and boost talent recruitment in a sector facing both technical and geopolitical challenges.

Key Areas of Strategic Investment

Tool Development and Customization SiCarrier aims to widen its product range, particularly in the fields of dry etching and deposition, which are vital for advanced chipmaking.

Manufacturing Infrastructure Expansion Proceeds from the fundraising round will support the build-out of fabs and cleanrooms to meet domestic demand.

Advanced R&D Initiatives The firm plans to channel capital into next-generation lithography research—seen as one of the final frontiers in domestic semiconductor sovereignty.

Client Base Diversification While Huawei remains its key client, the company seeks to onboard other Chinese fab operators and foundries.

International Talent Acquisition To stay competitive, SiCarrier is reportedly recruiting engineers from Taiwan, South Korea, and the U.S., targeting those with expertise in chip production tools.

Conclusion: SiCarrier as a Bellwether for China’s Tech Self-Reliance Drive

SiCarrier’s meteoric rise and capital raising plans reflect broader national priorities within China’s industrial strategy. As the semiconductor arms race escalates globally, the company’s success will serve as a key indicator of how well China can insulate its supply chain from geopolitical disruption.

While challenges remain—not least in matching the precision and reliability of Western semiconductor equipment—SiCarrier’s emergence adds critical momentum to Beijing’s goal of achieving full-stack independence in chip manufacturing. In this climate, state backing, strategic partnerships, and rapid capital deployment are proving to be powerful levers for scaling innovation.

Comments