In recent trading sessions, the British stock market has experienced significant turbulence as key indices have shown notable declines. This development is closely linked to growing concerns over a potential recession on a global scale, intensified by recent tariff measures and escalating trade tensions between global powers.

Market Tremors and the Role of Tariff Policy

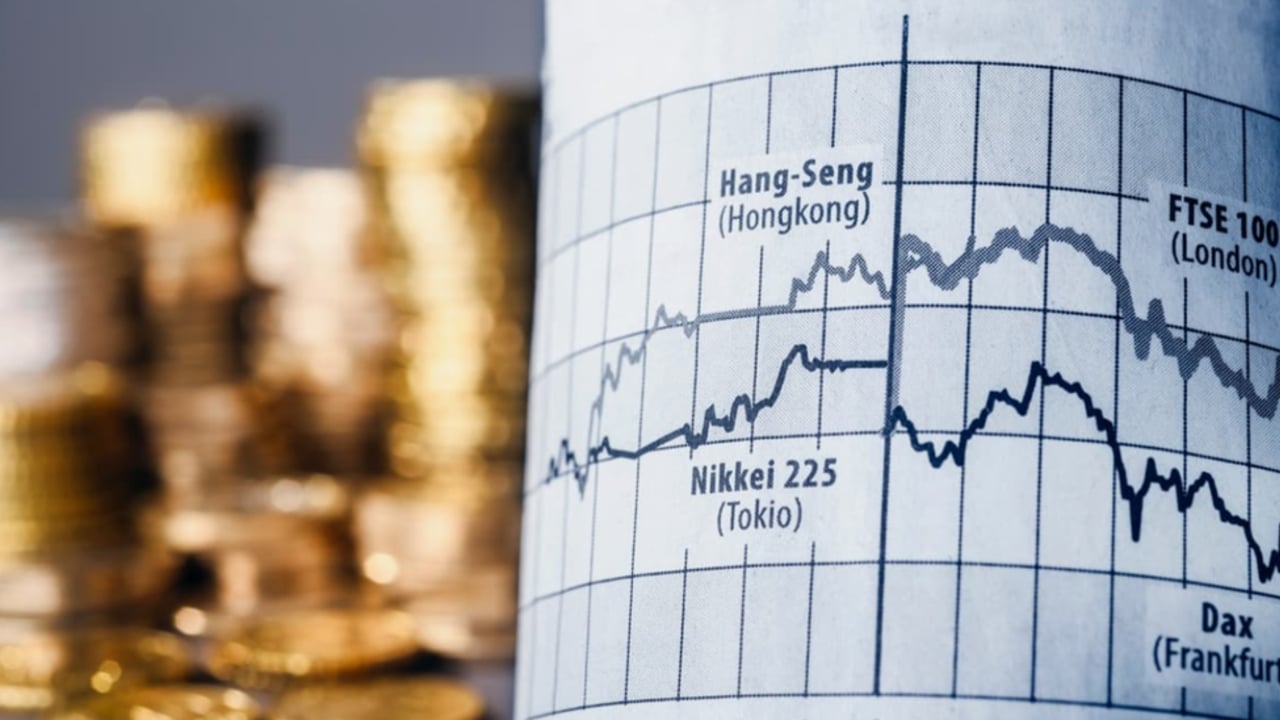

As of 11:10 GMT, the FTSE 100 index opened with a dramatic 3.8% drop, reaching its lowest point since December of last year. Financial analysts highlight that this is the steepest weekly decline seen since February 2022, reflecting deep market anxiety. Simultaneously, the FTMC index—which focuses on mid-cap companies within the domestic market—suffered a 4% decrease, positioning itself for the worst weekly performance since March 2020.

This steep decline in both the FTSE 100 and the FTMC underscores the market’s sensitivity not only to domestic economic pressures but also to the unfolding international trade disputes. The situation further deteriorated following President Donald Trump’s announcement of large-scale import tariffs. In response, China, which already imposes a 54% tariff on U.S. exports, declared that it would levy an additional 34% tariff on all U.S. imports as of April 10, according to the Chinese Ministry of Finance. Despite the United Kingdom maintaining a minimal import duty rate of 10%, officials have openly acknowledged the country’s vulnerability amid these escalating global economic challenges.

Critical Phases in the Market Downturn

1. The FTSE 100 plunged by 3.8%, touching its lowest level since December.

2. The FTMC index fell by 4%, heralding its worst weekly descent since March 2020.

3. Mounting recession fears intensified due to the shift in global trade policies amid U.S.-China tariff disputes.

4. China ramped up its tariff measures by announcing an extra 34% levy on all U.S. imports, compounding global economic risks.

5. President Trump’s tariff announcements further destabilized investor sentiment, eroding confidence in the global trading system.

Key Elements Shaping the Economic Landscape

- Rising influence of international economic policies: Changes in U.S. and Chinese tariff measures contribute to an atmosphere of global uncertainty.

- Ongoing volatility in the FTSE 100 suggests that British equities may continue to suffer losses as the week draws to a close.

- The noteworthy drop in the FTMC index reflects the heightened risk for domestic mid-cap companies in an increasingly unstable market.

- Growing concerns about a recession are supported by deteriorating conditions in international trade and supply chains.

- The current expansion of tariff barriers may have long-term repercussions for cross-border economic relations and global market stability.

Analyzing the Broader Implications

The current events unfolding in the British financial markets serve as a stark reminder of how international trade policies can send shockwaves through domestic equity markets. While the dramatic falls in the FTSE 100 and FTMC indices are indicative of short-term investor anxiety, they also point to deeper structural challenges within the global economy.

Market experts and economic strategists are closely monitoring these developments, aiming to understand how enduring the current turmoil might be and what systemic changes it could herald. The underlying market fragility has prompted discussions about the need for transparent financial flows, robust risk management, and timely policy adjustments. Many observers believe that while the current market dislocation is severe, comprehensive and well-planned reforms might be the catalyst for long-term growth, provided they are executed at the highest levels.

Concluding Insights

The saga of the British stock market in this context is far from an isolated incident. Rather, it is part of a broader narrative where market sentiments, international trade policies, and global economic conditions converge. Analyses of the current situation emphasize that while current downturns present significant challenges, they also create opportunities for systemic reforms and future stabilization. The interplay between domestic market performance and external economic policies remains a critical area for ongoing investigation and analysis.

Forward-thinking strategies in investment are propelling remarkable growth and innovation.

The volatility in the British stock market is just a reflection of the larger uncertainty gripping the global economy.