Saudi Arabia Increases Refining Capacity to Offset Oil Price and Export Revenue Declines

Saudi Arabia, the world’s largest oil exporter, is intensifying its refining capacity to bolster profits amid declining crude oil prices and reduced export revenues. This strategic pivot reflects the kingdom’s response to evolving global energy demand patterns and price volatility in the oil markets. By investing heavily in refining and petrochemical infrastructure domestically and internationally, Saudi Arabia aims to capitalize on higher value-added products such as refined fuels and plastics.

Impact of Saudi Arabia’s Expansion in Oil Refining on Revenue Diversification and Global Energy Markets

The decline in crude oil prices over recent years has pressured the revenue streams of Saudi Arabia’s oil-dependent economy, prompting the kingdom to pursue downstream expansion aggressively. Refining oil into gasoline, diesel, jet fuel, and petrochemical feedstocks generates greater margins compared to exporting crude oil alone, enabling Saudi Arabia to partially mitigate the impact of lower oil prices.

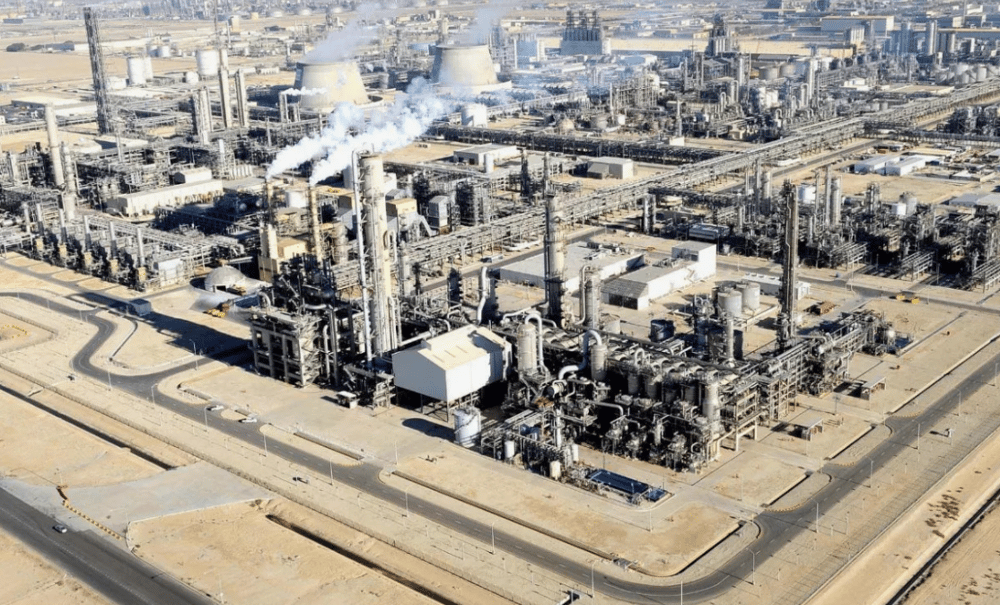

Significant capital investments have been directed toward upgrading existing refineries and constructing new facilities both within Saudi Arabia and abroad. These projects not only increase refining throughput but also enhance the quality and complexity of refined products to meet stricter environmental regulations and growing global demand.

Additionally, expanding petrochemical production allows Saudi Arabia to diversify its product portfolio, catering to the rising consumption of plastics and chemicals worldwide. This downstream integration strengthens the kingdom’s long-term economic resilience by reducing reliance on crude oil exports and generating more stable cash flows.

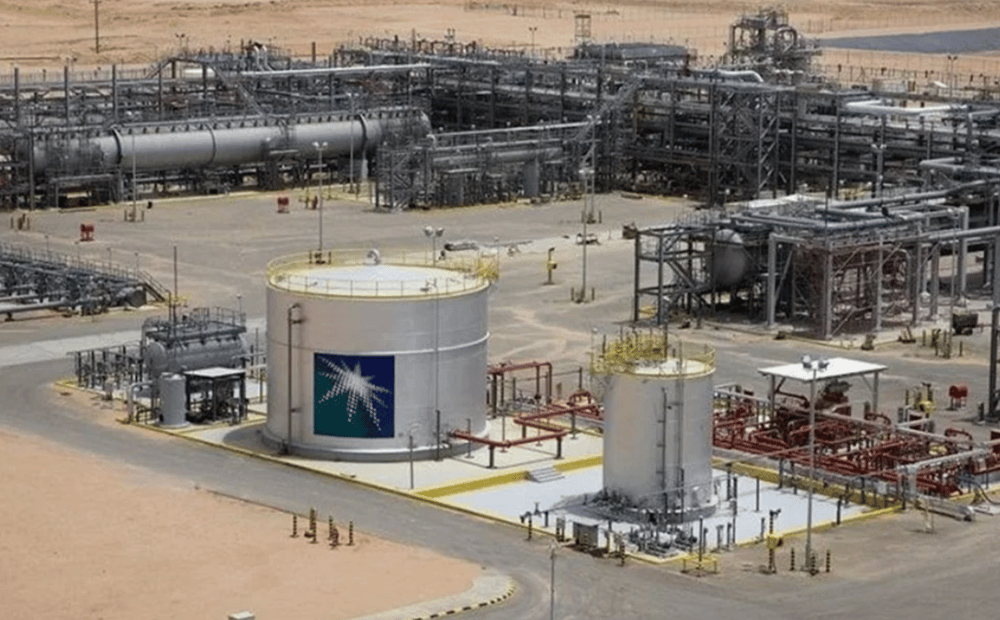

Saudi Aramco, the state oil company, plays a central role in this transformation, partnering with international firms and leveraging technological advancements to optimize refinery operations. The shift also aligns with Saudi Vision 2030, which emphasizes economic diversification away from fossil fuel dependency.

Key Facts

Saudi Arabia is the world’s largest crude oil exporter (OPEC leader).

The kingdom is expanding refining and petrochemical capacity domestically and internationally.

Declining crude oil prices have pressured export revenues.

Refining yields higher profit margins compared to crude oil sales.

Investments focus on modernizing refineries and producing high-value refined fuels and plastics.

The strategy aligns with Saudi Vision 2030 for economic diversification.

Further Analysis: Market Reactions and Industry Commentary on Saudi Refining Expansion

The expansion of Saudi Arabia’s refining sector has been well-received by energy markets and industry experts, who view it as a prudent move to stabilize the kingdom’s economy amid global oil market volatility. Increasing refining throughput helps Saudi Arabia secure long-term demand for its crude by converting it into products essential for transportation and manufacturing.

Energy analysts note that this downstream focus positions Saudi Arabia competitively as global fuel consumption rebounds post-pandemic and environmental regulations drive demand for cleaner fuels. The growing petrochemical sector also offers exposure to faster-growing markets like plastics, which underpin numerous industrial applications.

However, some market observers caution that capital-intensive refining projects carry risks, including fluctuating demand due to shifts toward renewable energy and electric vehicles. Nonetheless, Saudi Arabia’s financial strength and strategic partnerships mitigate these challenges.

Key Points

Saudi Arabia is strategically boosting oil refining to increase profit margins amid lower crude prices.

Upgrades and new refineries improve product quality and environmental compliance.

Petrochemical expansion supports diversification and access to growing plastics markets.

Saudi Aramco leads initiatives aligned with Vision 2030 economic goals.

Market analysts see the move as a stabilizing factor for Saudi Arabia’s oil revenue streams.

Saudi Arabia’s Refining Expansion as a Strategic Response to Market Dynamics and Revenue Volatility

Saudi Arabia’s substantial investments in refining and petrochemical capacity represent a strategic adaptation to the challenges posed by lower crude oil prices and fluctuating export revenues. By focusing on downstream integration, the kingdom enhances its ability to generate higher-value products, diversify its economy, and secure sustainable income streams.

This approach not only supports Saudi Arabia’s long-term economic stability but also strengthens its position in the global energy market amid accelerating structural changes, including the energy transition and evolving fuel demand.

Comments

We're witnessing a fundamental shift where automation becomes a core driver of value creation

Such a move points to automation as a key factor in navigating future industry challenges