RevenueCat Raises $50M Series C Led by Bain Capital Ventures Amid Growing Demand for Subscription Management Platforms

RevenueCat, a leading subscription management platform, secured $50 million in Series C funding on Thursday. The financing round was spearheaded by Bain Capital Ventures with participation from notable investors including Index Ventures, Y Combinator, and Volo Ventures. The growing complexity of app monetization and pricing strategies amid the surge of software development tools has amplified the need for platforms like RevenueCat that simplify subscription management for developers and businesses.

RevenueCat’s Funding and Market Position Amid Subscription Economy Growth

The recent $50 million injection in RevenueCat reflects increasing investor confidence in the platform’s ability to address a critical challenge in the app economy: efficient and scalable subscription management. As developers face growing demands to implement flexible pricing, manage recurring payments, and analyze subscription metrics, platforms that consolidate these functionalities become essential.

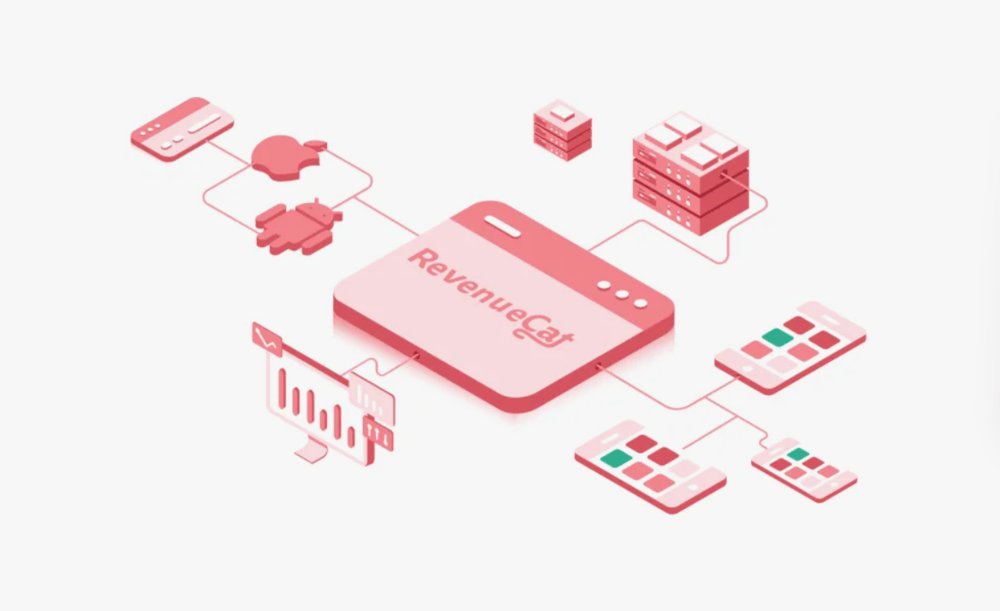

RevenueCat’s software streamlines the management of in-app subscriptions across multiple platforms, automating billing, pricing updates, and analytics. This reduces operational overhead and enhances user experience by ensuring seamless payment flows. The backing by Bain Capital Ventures, a prominent venture capital firm, signals a strong endorsement of RevenueCat’s business model and growth potential.

The company operates within a broader subscription economy that continues to expand rapidly, driven by consumer preference for flexible, recurring payment models and the proliferation of mobile applications and SaaS products. Platforms simplifying subscription monetization are becoming increasingly vital as app developers prioritize retention and lifetime value optimization.

Quick Facts:

RevenueCat raised $50 million in Series C funding.

Lead investor: Bain Capital Ventures.

Other investors: Index Ventures, Y Combinator, Volo Ventures.

The platform simplifies pricing and subscription management for apps.

Growing demand driven by rising app development and subscription economy trends.

Continued Analysis: Market Reaction and Industry Insights

The announcement was met with positive signals from both the venture capital community and app development industry. Investors see subscription management as a critical vertical within SaaS and mobile ecosystems, especially as recurring revenue models dominate market monetization strategies.

Industry experts highlight that platforms like RevenueCat play a crucial role in reducing technical barriers, enabling smaller developers to compete with large enterprises by offering sophisticated subscription features. Furthermore, as app marketplaces evolve and regulations around subscriptions tighten, having a robust management layer becomes indispensable.

Analysts predict increased consolidation in this space, with larger SaaS providers potentially acquiring specialized subscription platforms to broaden their service offerings. The partnership with major investors also provides RevenueCat with strategic resources to scale globally and enhance product capabilities.

Key Points:

RevenueCat’s $50M funding underscores the growing importance of subscription management in app monetization.

Bain Capital Ventures’ lead investment reflects confidence in RevenueCat’s market position.

Simplifying subscription pricing and billing is critical for developer success in a competitive market.

The subscription economy’s expansion fuels demand for scalable SaaS monetization tools.

Future industry consolidation and product innovation are anticipated as competition intensifies.

RevenueCat’s Strategic Position in the Expanding Subscription Management Market

RevenueCat’s successful $50 million Series C round led by Bain Capital Ventures highlights the increasing significance of subscription management platforms in the evolving app and SaaS markets. By addressing complex pricing and billing challenges, RevenueCat enables developers and companies to optimize recurring revenue streams and enhance customer retention. This funding milestone positions RevenueCat to accelerate growth, expand global reach, and innovate further in response to rising demand for effective in-app monetization solutions. The development underscores a broader trend of investment focus on subscription economy enablers, shaping the future of digital revenue management.

Comments