Quantum Computing Inc. Surges Amid IonQ’s $1B Acquisition of Oxford Ionics

On Tuesday, shares of Quantum Computing Inc. $QUBT climbed by 4.2%, having previously spiked as much as 22.7% intraday, driven by renewed investor enthusiasm in the quantum technology space. The surge came as broader indices — notably the S&P 500 $^SPX and Nasdaq Composite $^IXIC — posted modest gains, providing a favorable backdrop for tech-centric and speculative assets.

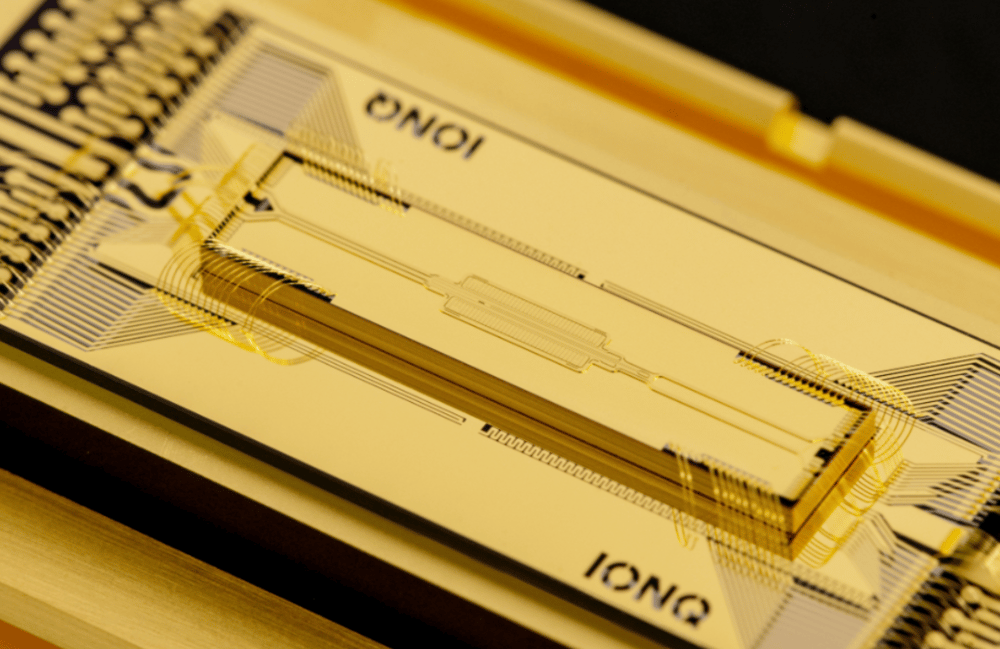

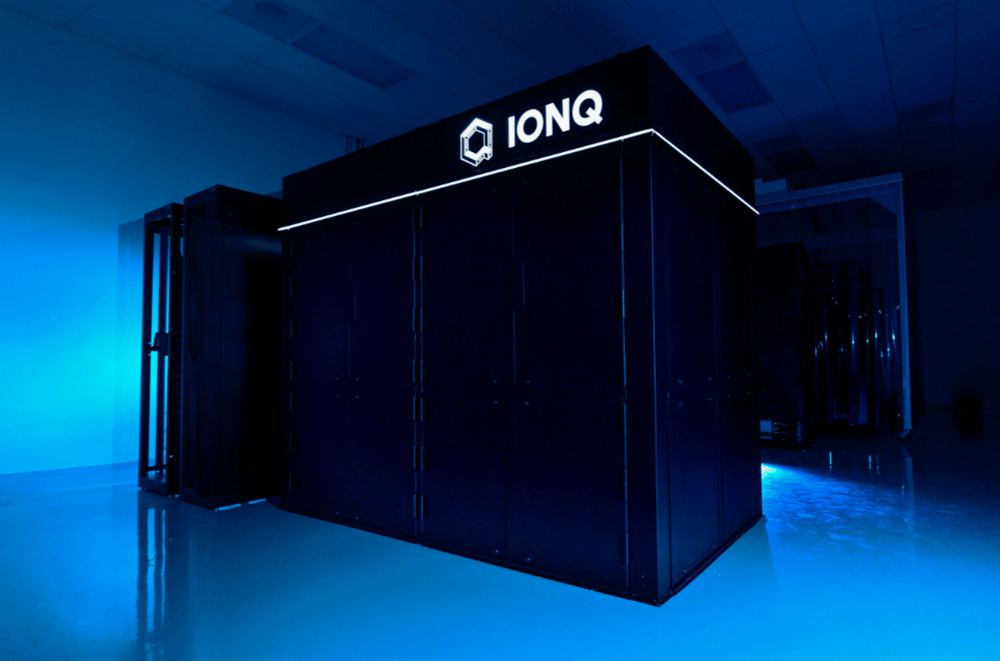

While QUBT itself did not release any material news, the broader quantum computing sector received a significant catalyst: IonQ Inc. $IONQ announced a $1 billion acquisition of UK-based Oxford Ionics, a strategic move designed to integrate Oxford's quantum semiconductor hardware with IonQ’s established quantum software platform. The transaction underscored intensifying competition and capital commitment in a field often viewed as years away from commercial maturity — yet rich in long-term potential.

Industry Ripple Effects: Strategic Implications of the IonQ-Oxford Ionics Deal

IonQ’s acquisition represents one of the largest private sector investments in quantum hardware to date and signals a shift toward hardware-software integration as a pathway to scalable commercial quantum solutions. Although QUBT is not directly involved in the transaction, the market interpreted the development as validation of the entire quantum computing sector, lifting shares of smaller players like QUBT in anticipation of increased attention, funding, and M&A activity.

Quantum Computing Inc., while still pre-revenue, has been focused on hybrid quantum-classical algorithms and optimization platforms, particularly through its Qatalyst™ software. Investors appear to be positioning QUBT as a speculative beneficiary of the technological momentum, despite stark differences in scale and commercialization between it and IonQ.

📌 Quick Facts:

📈 QUBT Daily High: +22.7% intraday gain; closed +4.2%

🧠 Catalyst: IonQ acquires Oxford Ionics for $1 billion

🔗 Sector Impact: Boost in investor sentiment across quantum names

🧪 QUBT Product Focus: Quantum algorithms and software integration

📉 Nasdaq & SPX Performance: Minor gains supporting tech uptick

Investor Sentiment and Market Response: Sector-Wide Repricing in Play?

The quantum computing sector, long considered speculative due to technical and regulatory uncertainties, is witnessing a gradual sentiment shift, driven by larger-scale investments and strategic consolidation. The IonQ-Oxford Ionics transaction may act as a bellwether for future capital flows, especially if it results in demonstrable hardware advancements or partnerships with hyperscale cloud providers.

QUBT, as a small-cap participant in the quantum arena, benefits from this shift through increased visibility and capital market interest, albeit with continued scrutiny over its financial fundamentals and long-term commercialization path. Notably, institutional coverage remains limited, and the stock remains volatile — subject to abrupt sentiment swings based on competitor activity.

🔑 Key Developments:

IonQ’s $1B acquisition of Oxford Ionics reinforces bullish narratives around scalable quantum systems.

QUBT shares surged intraday by over 22%, reflecting speculative positioning on sector spillover effects.

No direct announcement from QUBT, suggesting the rally was sentiment-driven rather than fundamental.

Market backdrop was favorable, with Nasdaq and S&P 500 providing broad-based support.

Quantum computing remains pre-commercial, and investor behavior is driven largely by perceived potential, not earnings.

Momentum Grows, But Fundamentals Remain Fragile

The recent rally in Quantum Computing Inc. highlights the sensitivity of the sector to broader narrative shifts and competitive moves. While the IonQ acquisition of Oxford Ionics brings renewed optimism to the quantum race, the surge in QUBT’s valuation must be tempered with the reality of its current business stage — limited revenue, early-stage technology, and competitive uncertainty.

For the quantum computing market, this week marks a pivotal inflection point: a transition from theoretical value to tangible investment, as industry giants commit significant capital. Yet for smaller firms like QUBT, the path forward still demands credible milestones, execution discipline, and sustained innovation beyond speculative price action.

Comments

This sale signals a pivotal shift in how automation will integrate with next-generation technologies

Investors appear to be riding the quantum wave, betting big on breakthrough tech even as the broader market eases into modest gains.