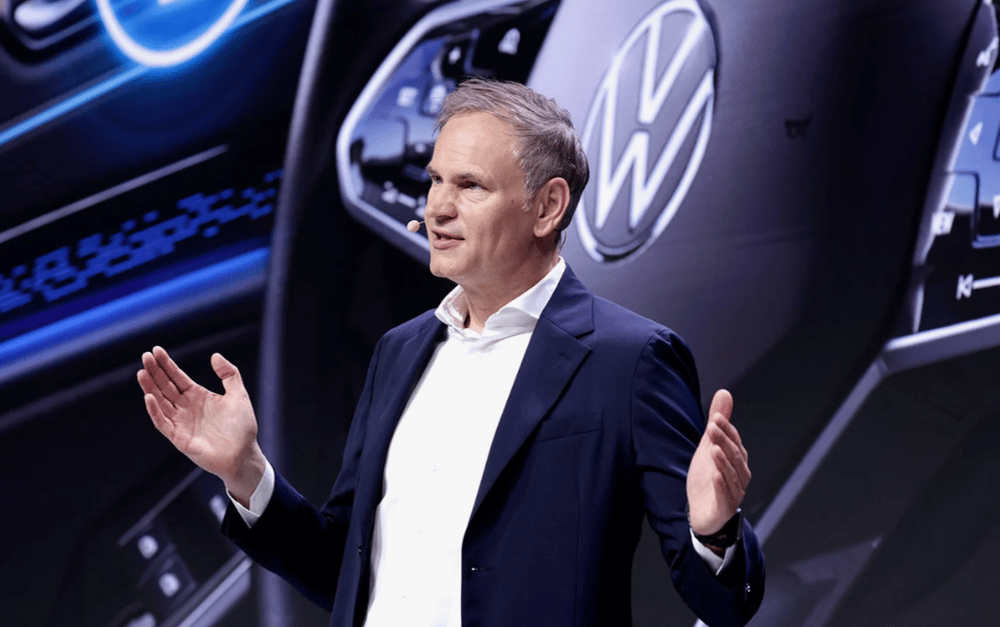

Porsche Lowers 2025 Profit Outlook Amid China Slowdown and U.S. Tariffs, Investors Call for CEO Oliver Blume to Resign One Role

On Wednesday, investors urged Porsche CEO Oliver Blume, who simultaneously heads parent company Volkswagen $VWAGY, to relinquish one of his executive positions. This demand follows Porsche’s downward revision of its profit outlook for 2025 amid a challenging macroeconomic environment. The luxury automaker’s performance has been significantly affected by a steep 42% decline in Chinese sales during the first quarter, complications from U.S. tariffs, and a slower-than-expected transition to electric vehicles (EVs).

Economic and Trade Factors Impacting Porsche’s Financial Forecast

Porsche $P911.DE revealed a sharp fall in profitability in Q1 2025, triggering concerns about its medium-term growth trajectory. The 42% slump in Chinese market sales represents a major blow, given China’s strategic importance as the world’s largest automobile market. This contraction is partly attributed to broader economic slowdown in China, diminishing consumer demand for premium vehicles.

In parallel, escalating U.S. tariffs on automotive imports have increased production and supply chain costs for Porsche, squeezing margins. These tariffs are part of ongoing trade tensions that complicate global automotive manufacturing and distribution networks.

Moreover, Porsche is grappling with the transition to electric vehicles, which demands significant capital expenditures and operational restructuring. The slower-than-anticipated pace of EV adoption has delayed expected profitability gains, impacting investor confidence.

The combination of these factors prompted Porsche to issue a more pessimistic full-year profit forecast, which has led investors to question the strategic effectiveness of CEO Oliver Blume’s leadership, especially as he holds concurrent roles at Volkswagen AG, raising concerns about potential divided attention during critical times.

Key Facts Summary

Porsche reported a 42% decline in Q1 2025 sales in China.

Profitability fell sharply in the first quarter of 2025.

U.S. tariffs on automotive imports increased costs and squeezed margins.

The transition to electric vehicles has slowed, affecting forecasted profits.

Investors requested CEO Oliver Blume to step down from one of his two leadership roles.

Porsche’s revised 2025 profit outlook is more pessimistic than prior guidance.

Continued Analysis: Market and Stakeholder Reactions

The market reacted negatively to Porsche’s revised forecast, with share prices experiencing volatility as investors digested the implications of weaker Chinese demand and tariff pressures. Analysts highlighted that the convergence of geopolitical risks and macroeconomic headwinds poses significant challenges for German luxury automakers heavily reliant on exports.

The call for Oliver Blume to relinquish one of his CEO positions reflects shareholder frustration over governance and strategic focus during a turbulent phase for both Porsche and Volkswagen. Leadership concentration can potentially limit agile decision-making required to navigate evolving trade environments and rapidly changing consumer preferences, particularly in electric mobility.

Industry experts emphasize that Porsche’s experience underscores the vulnerability of premium automakers to external shocks like trade disputes and regional economic slowdowns, while also spotlighting the critical importance of a clear strategic roadmap for electric vehicle integration.

Key Takeaways

A 42% Q1 sales drop in China critically impacts Porsche’s revenue and profit forecasts.

U.S. tariffs exacerbate cost pressures, undermining margins in a competitive market.

The delayed EV transition adds financial strain and uncertainty.

Investor demands for CEO Oliver Blume to focus on a single leadership role indicate governance concerns.

Porsche’s challenges highlight broader risks facing German automakers amid global trade tensions and shifting consumer demand.

Porsche’s Revised Outlook Reflects Broader Market and Strategic Challenges

Porsche’s downward revision of its 2025 profit expectations signals mounting pressures from macroeconomic slowdowns in China, trade policy uncertainties in the U.S., and the complexities of transitioning to electric vehicles. The calls for CEO Oliver Blume to resign one of his dual roles underscore the need for focused leadership as the company navigates this uncertain landscape.

This situation exemplifies the intertwined risks of geopolitical factors and industry transformation confronting premium automakers. Porsche’s strategic decisions and operational agility over the coming months will be pivotal in restoring investor confidence and ensuring sustainable growth amid global economic volatility.

Comments

This development might serve as a turning point for automation amid ongoing technological transformation