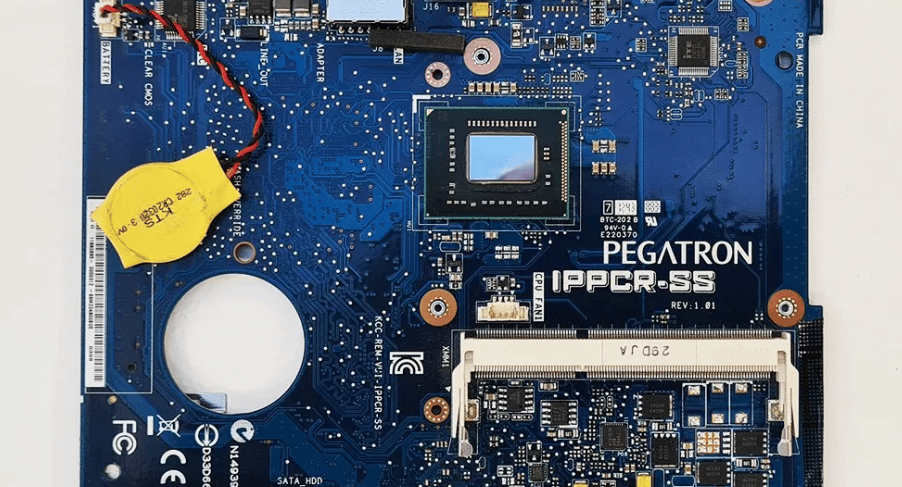

Pegatron Considers U.S. Expansion Amid Rising AI Server Demand and Supply Chain Shift

Taiwanese electronics manufacturing giant Pegatron Corp. $4938.TW, a key supplier to Apple Inc. $AAPL and Dell Technologies Inc. $DELL, is nearing a final decision on a strategic expansion into the United States. At its annual shareholder meeting on Friday, CEO Kuan-Chi Cheng confirmed that the company is in the final evaluation phase of building a manufacturing facility in the U.S., with a formal announcement expected within weeks.

The move reflects broader industry dynamics as global tech manufacturers seek to diversify production footprints amid geopolitical pressures, rising demand for AI infrastructure, and the growing imperative for localized manufacturing in North America.

Strategic Factors Behind Pegatron’s U.S. Facility Consideration

Pegatron's decision is driven by a combination of economic and operational factors, primarily the surging demand for servers used in artificial intelligence (AI) applications. As AI deployments grow exponentially, U.S.-based data centers require faster, more localized supply chains for high-performance computing infrastructure — an area where Pegatron specializes.

The company’s clients, including Apple and Dell, have publicly endorsed the trend of supply chain diversification, particularly following years of disruptions caused by tariffs, pandemics, and rising geopolitical tensions between the U.S. and China. By establishing a presence in the U.S., Pegatron can reduce logistics complexity, mitigate regulatory risks, and potentially benefit from government incentives aimed at strengthening domestic tech manufacturing.

Electricity costs emerged as a pivotal element in the company’s evaluation. Producing AI server hardware is energy-intensive, and U.S. states with competitive industrial electricity rates and renewable energy infrastructure could provide Pegatron a cost advantage. Labor and land costs, while important, were secondary considerations, according to Cheng’s comments.

Quick Facts

Company: Pegatron Corp.

Key Clients: Apple Inc., Dell Technologies

Project: Evaluating U.S. plant for AI server production

Timeline: Final decision expected this or next month

Location Drivers: Electricity cost, labor rates, land availability

Strategic Goal: Enhance U.S. manufacturing footprint, support AI infrastructure

CEO Comment: “Electricity is the most important factor for AI server production”

Market Reaction and Industry Commentary — Supply Chain Realignment and Regional Policy Incentives

Pegatron’s announcement follows a broader wave of reshoring and nearshoring initiatives in the global electronics sector. The Biden administration's CHIPS and Science Act and other incentives have catalyzed interest from international technology manufacturers seeking to establish production facilities within U.S. borders. Pegatron’s potential entry would align it with recent moves by Taiwan Semiconductor Manufacturing Company $TSM, Foxconn $2354.TW , and Samsung Electronics $028260.KS.

While the company did not name potential U.S. locations, analysts speculate that regions with established semiconductor or electronics manufacturing hubs — such as Texas, Arizona, or Ohio — may be under consideration, particularly those offering subsidies or tax breaks.

From a market standpoint, the news had a modest but positive effect on Pegatron's Taipei-listed shares, which edged higher following the announcement. Apple and Dell shares were stable, reflecting investor understanding that increased local capacity supports longer-term resilience rather than near-term financial changes.

Key Points

Pegatron Nears Decision on U.S. Facility — Final announcement expected within weeks.

AI Infrastructure as a Core Driver — Server demand from cloud and AI sectors motivates production expansion.

Electricity Costs Dominate Site Selection Criteria — Energy pricing trumps land and labor as strategic concerns.

Apple and Dell Supported by Manufacturing Diversification — Key clients stand to benefit from localized production.

Policy Tailwinds Encourage Entry — U.S. incentives for tech reshoring support Pegatron’s potential move.

Pegatron’s U.S. Expansion Reflects Next Phase in Global Tech Manufacturing Realignment

Pegatron’s exploration of a U.S.-based manufacturing site signals a critical inflection point in the ongoing reconfiguration of global electronics supply chains. With strategic partners like Apple and Dell increasingly emphasizing resilience, compliance, and proximity to end-markets, Pegatron’s potential move could further reinforce the U.S. as a competitive destination for advanced tech manufacturing — particularly in the AI hardware segment.

As stable electricity supply, policy incentives, and geopolitical shifts continue to reshape the manufacturing calculus, Pegatron's U.S. plans may serve as a model for other Asian OEMs seeking to future-proof operations while supporting the evolving needs of cloud and AI infrastructure players.

Comments

Strategic shifts like this reflect how automation is becoming central to competitive advantage