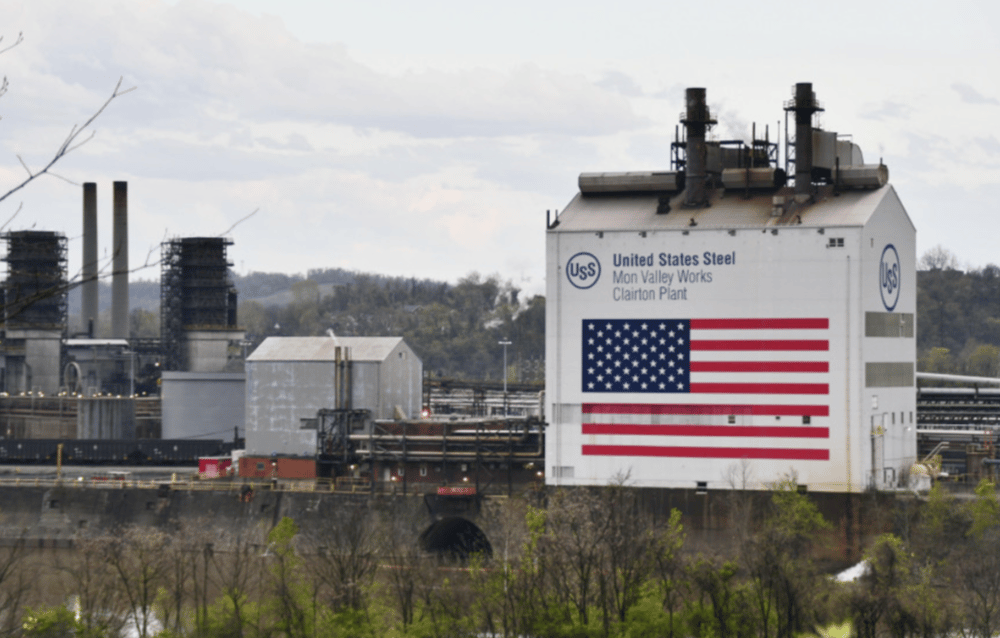

Nippon Steel–U.S. Steel Deal Gains Trump’s Endorsement Amid $14.9B Acquisition Plans

The $14.9 billion acquisition of U.S. Steel Corp $X by Japan’s Nippon Steel Corp $5401.T received unexpected support from former U.S. President Donald Trump, who praised the deal in a post on Truth Social. Trump described the transaction as a "planned partnership" that could create over 70,000 U.S. jobs and inject $14 billion into the American economy.

This public endorsement has drawn attention not only to the cross-border nature of the merger but also to its potential political ramifications ahead of the 2024 U.S. election cycle. While shares of Nippon Steel saw a slight uptick on Monday, analysts remain cautious about the valuation, operational synergies, and potential regulatory hurdles involved in the transaction.

Strategic Alignment or Overpriced Bet?

The proposed acquisition represents one of the largest foreign takeovers of a major American industrial firm. Nippon Steel aims to strengthen its global production footprint and secure a stronger position in the U.S. market, one of the world's most politically sensitive regions for industrial jobs and domestic manufacturing.

From a valuation standpoint, some market observers have questioned whether the $14.9 billion price tag accurately reflects the value of U.S. Steel’s assets and future growth trajectory. Moreover, the deal arrives in a protectionist climate where domestic steelmakers and unions have historically opposed foreign ownership, especially from countries perceived as economic competitors.

Trump's vocal support could signal a shift in political sentiment toward the deal — or alternatively, may deepen scrutiny from stakeholders concerned with national security, economic sovereignty, and job quality promises.

Key Facts

Transaction Size: $14.9 billion acquisition of U.S. Steel by Nippon Steel.

Political Endorsement: Donald Trump claims the deal will add $14 billion to the U.S. economy and generate 70,000 jobs.

Market Reaction: Shares of Nippon Steel rose modestly on the news.

Timing: Trump’s statement followed the official deal announcement on Friday.

Sectoral Context: The deal involves core sectors like steel, manufacturing, and infrastructure — all central to economic nationalism debates.

Market Reaction and Expert Commentary — Navigating Geopolitics and Economics

While the equity market response has been limited, stakeholders across government, labor, and industry are evaluating the transaction through the lenses of both economics and national interest. Industry unions have historically resisted foreign control of critical manufacturing assets. Congressional oversight may follow, especially with the Committee on Foreign Investment in the United States (CFIUS) likely to review the deal.

Some analysts speculate that Trump’s support might help sway political sentiment in favor of the merger, particularly among manufacturing-heavy constituencies in key electoral states. However, it remains uncertain whether such endorsements will influence regulatory reviews or address concerns around technology transfers, supply chain dependency, or labor standards.

Strategic Highlights

Deal Scale: One of the largest foreign takeovers in U.S. industrial history.

Valuation Debates: Questions arise over whether the $14.9B price reflects U.S. Steel’s intrinsic value.

Trump’s Position: Endorsement emphasizes job creation and economic stimulation.

Regulatory Landscape: Potential review by CFIUS and opposition from labor groups.

Geoeconomic Signals: The transaction reflects broader trends of industrial consolidation amid strategic competition.

A High-Stakes Bet in the Global Steel Arena

Nippon Steel’s proposed acquisition of U.S. Steel marks a significant inflection point in global industrial M&A activity. While the transaction promises operational scale and market access for both entities, its success hinges on regulatory approvals, stakeholder buy-in, and economic feasibility.

Donald Trump’s endorsement has placed the deal in the political spotlight, adding layers of complexity that extend beyond boardrooms and balance sheets. As global supply chains realign and industrial policies tighten, this cross-border partnership could become a litmus test for the future of transnational manufacturing cooperation in an era of economic nationalism.

Comments

This sale could have a lasting impact on how automation is leveraged across the tech industry

We're witnessing how forward-thinking capital is powering the future of intelligent technology