Nigeria’s $800M Lithium Processing Plants Signal Strategic Shift in Mineral Export Policy and Attract Chinese Investment

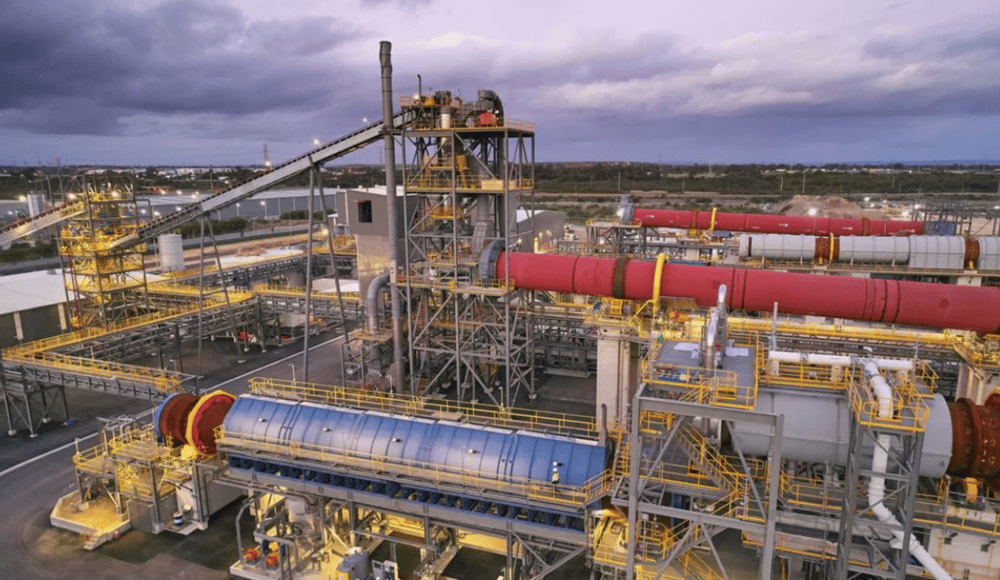

Nigeria has announced a transformative industrial initiative aimed at transitioning from the export of raw lithium to local processing and value-added production. In 2025, the country is set to commission two large-scale lithium processing plants with a combined value of $800 million, primarily funded by Chinese investors, including Jiuling Lithium Mining Company and Canmax Technologies $300390.SZ.

This strategic pivot reflects Nigeria's broader ambition to position itself within the global electric vehicle (EV) battery supply chain, leveraging its vast untapped lithium reserves to create domestic jobs, technology hubs, and downstream manufacturing opportunities.

From Mineral Extraction to Industrialization

The Nigerian Ministry of Solid Minerals, under Minister Dele Alake, has confirmed that a $600 million plant near the Kaduna-Niger border will become operational within the current quarter, while a $200 million facility on the outskirts of Abuja is nearing completion. Additionally, two more lithium refineries are scheduled for construction in Nasarawa State by Q3 2025.

The strategic focus on lithium beneficiation rather than raw mineral exports reflects Nigeria’s effort to build economic resilience by capturing greater margins along the value chain. Until now, lithium extracted in Nigeria has been predominantly shipped overseas for refining, missing critical opportunities in job creation and industrial capacity-building.

The entry of Chinese capital also underscores Beijing’s growing stake in African battery mineral supply lines, particularly as global demand for lithium-ion batteries rises in response to green transition policies across Europe, Asia, and North America.

Quick Facts

Total Investment: $800 million across four plants

Lead Investors: Jiuling Lithium Mining Company, Canmax Technologies

Plant Locations: Kaduna-Niger border, Abuja outskirts, Nasarawa State

First Plant Launch: Expected Q2 2025

Strategic Objective: Reduce raw exports, stimulate domestic value chains

Ownership Structure: Over 80% Chinese-funded

Extended Analysis: Market Impacts, Policy Significance, and Regional Implications

Nigeria’s lithium initiative could redefine the West African mining landscape, traditionally focused on primary resource extraction with minimal domestic processing. By incentivizing in-country beneficiation, the government aims to reverse the “extract-export” paradigm and align mineral policy with industrial diversification goals outlined in Nigeria’s midterm economic framework.

From a market perspective, these facilities are poised to serve both local battery manufacturing initiatives and export markets, particularly in Asia. If successful, Nigeria could become a regional hub for lithium processing, reducing reliance on external supply chains and reinforcing commodity security for global EV manufacturers.

International observers note that this move also serves a geo-economic function: attracting foreign direct investment (FDI) from China amid intensifying competition over critical minerals. The participation of Canmax Technologies, a Shenzhen-listed battery materials company, links Nigeria directly to the supply chains of Chinese electric vehicle giants.

Key Points

Structural shift in mineral policy toward domestic processing marks a break from historic export patterns.

Chinese FDI is central to project financing, reinforcing China's influence in Africa’s resource sector.

Four lithium refineries scheduled by Q3 2025 may boost Nigeria’s GDP and tech sector.

Industrial spillovers expected in logistics, power supply, skilled labor development, and local manufacturing.

Global EV markets could see Nigeria emerge as a new strategic player in raw material processing.

Nigeria’s Lithium Policy Sets the Stage for Industrial Transformation

The commissioning of four lithium processing facilities represents a watershed moment for Nigeria’s mining sector. This transition from extraction to processing aligns with broader global efforts to localize supply chains, increase value retention, and reduce dependency on volatile raw commodity markets.

By harnessing Chinese investment and targeting technology-driven industrial growth, Nigeria is strategically positioning itself in the global lithium economy, while also catalyzing domestic job creation and technological development. The success of this initiative could serve as a blueprint for other resource-rich African nations seeking sustainable economic transformation through mineral value addition.

Comments

Nigeria's bold pivot from exporting raw lithium to local processing marks a promising step towards sustainable industrial growth!

This sale could mark a critical inflection point for automation in the tech industry