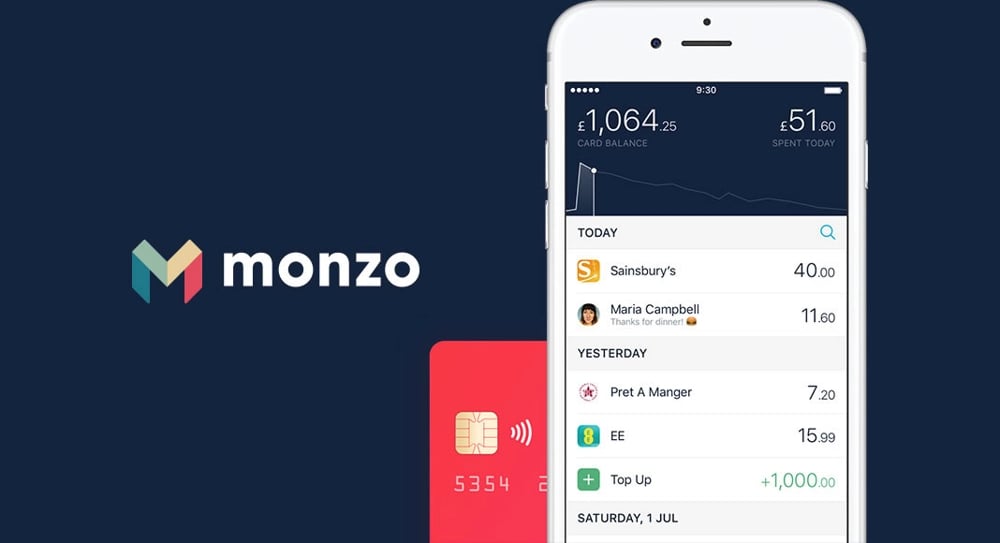

Monzo’s Record-Breaking Profit Signals New Era for UK Fintech

Monzo Bank Ltd., a UK-based digital banking pioneer, has reported a dramatic surge in pre-tax profit for the last fiscal year. Earnings before tax reached 60.4 million GBP (81.8 million USD) for the period ending March, quadrupling the previous figure of 15.4 million GBP from the earlier 13 months. Revenue also demonstrated resilient momentum, jumping to 1.2 billion GBP from 880 million GBP.

This rapid progression in financial performance demonstrates Monzo’s agile adaptation to evolving market dynamics. The digital lender’s robust income growth and profit expansion reflect a successful shift from a disruptive newcomer to an established industry contender.

Expanding Loan Book Underpins Revenue Leap

A substantial rise in Monzo’s lending activity served as a key growth engine. The bank’s outstanding loans to clients climbed 36% year-over-year, totaling 1.9 billion GBP. This expansion in credit operations diversified Monzo’s income streams and fortified its ability to generate sustainable returns in a highly competitive environment.

By harnessing advanced risk assessment models and digital-first credit products, Monzo reinforced its presence in the UK retail banking space. The institution’s capability to attract new customer segments while maximizing monetization of its growing base has become a core competitive advantage.

Transformation from Disruptor to Industry Mainstay

Over a decade, Monzo evolved from an ambitious challenger to one of the most recognized brands in British banking. Today, it stands as the seventh-largest bank in the UK by customer numbers, having transitioned from a high-growth startup to a profit-oriented financial enterprise. Chief Executive Officer TS Anil emphasized this evolution, citing Monzo’s brand leadership and nationwide influence.

This journey has been characterized by continued investment in technology, focus on product innovation, and prudent cost management. The combination of growth and sustained profitability positions Monzo at the forefront of digital finance transformation.

Key Drivers Behind Monzo’s Financial Surge

Fast-paced expansion of the digital loan portfolio fueled recurring revenue growth and enhanced customer value.

Ongoing integration of advanced financial technology supported scalable operations and reduced time-to-market for new services.

Rising client acquisition rates, underpinned by diversified offerings, deepened user engagement and strengthened network effects.

Resilient risk controls and compliance protocols enhanced Monzo’s credibility ahead of potential public listing.

Operational efficiency gains led to improved margins and reinvestment capabilities within the business.

IPO Prospects and Industry Implications

With sustained profitability and a broadening market footprint, Monzo is considered well positioned for a potential IPO. The digital bank’s financial performance, combined with disciplined strategy execution, may attract significant institutional attention upon public debut. Industry observers note that Monzo’s ascent from fintech disruptor to sector leader signals evolving investor attitudes towards digital-first financial services in the UK (GBP).

Comments

This reflects a broader trend where smart capital deployment drives transformative change

Long-term growth in tech increasingly depends on smart bets in automation