Let's see how this IPO shapes the connected TV advertising landscape.

Exciting times ahead for MNTN as they prepare to make their mark on the public stage!

MNTN Inc., an advertising platform for connected television, is on the brink of a significant development phase, possibly initiating its initial public offering (IPO) as early as next week. After postponing its plans due to market volatility resulting from tariff changes, the company has updated its filings with the U.S. Securities and Exchange Commission, revealing new financial information.

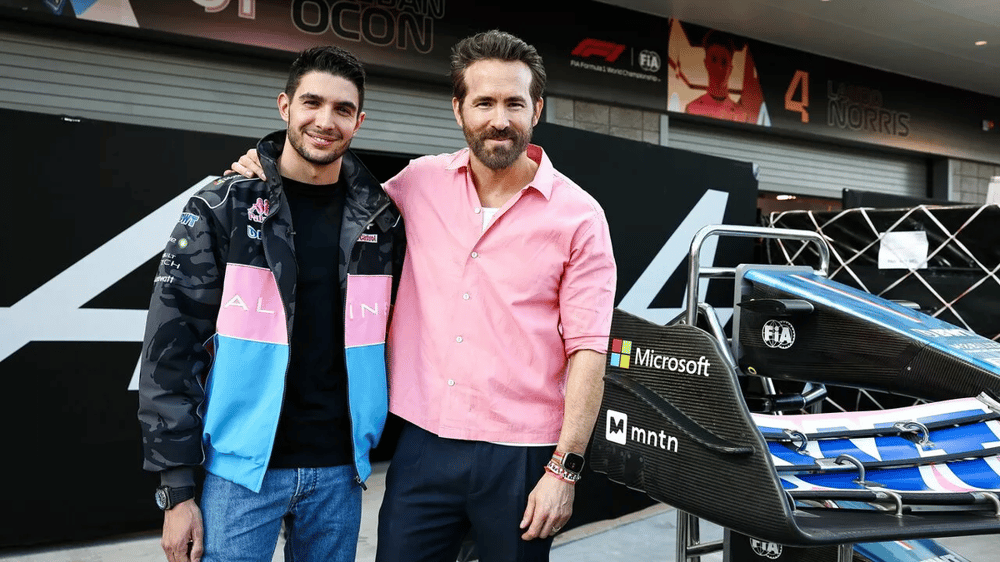

Based in Austin, Texas, MNTN Inc. actively develops its technologies and products in the realm of digital advertising and television content. The company is creatively directed by the well-known Hollywood actor Ryan Reynolds, adding extra appeal to the brand and its offerings.

According to the latest report, MNTN reported a net loss of $21.1 million for the first three months of 2025, with revenue totaling $64.5 million. This marks a stark decline compared to the same period last year when the company reported a net loss of $15.7 million on a revenue of $43.8 million.

Key Financial Metrics:

Net Loss: $21.1 million (Q1 2025) compared to $15.7 million (Q1 2024)

Revenue: $64.5 million (Q1 2025) compared to $43.8 million (Q1 2024)

These results, while not particularly encouraging, demonstrate revenue growth, which may be regarded as a positive indicator for public offerings.

The stock market is currently facing challenging times due to various factors putting pressure on stock prices, and consequently on companies' willingness to go public. One of MNTN Inc.'s responses was to temporarily delay its plans due to volatility driven by tariff changes. It is essential to monitor such changes closely, as they can significantly impact business strategies and financial outcomes.

An IPO is not just an opportunity to raise capital but also a way to establish investor trust and strengthen market positions. However, before MNTN Inc. definitively decides to proceed with public offerings, the company should consider several key factors:

The state of financial metrics and their trends;

Overall market conditions and investor confidence;

Strategy for further growth and business development;

Competition in the digital advertising sector.

MNTN Inc. stands at the threshold of significant changes and opportunities. If the IPO occurs as soon as next week, it could enable the company to not only attract essential investment but also solidify its standing in the digital advertising market. Continuous updates should be monitored, as financial results and market conditions will play a pivotal role in this process.