Medtronic to Spin Off Diabetes Unit Amid Profit Forecast Cut

Medtronic Plc $MDT, a global leader in medical technology, announced on Wednesday its decision to separate its diabetes business into a standalone public company. This move comes alongside a lowered adjusted earnings forecast for fiscal 2026, signaling a major realignment of its corporate strategy to concentrate on more profitable operations such as cardiovascular and surgical technologies.

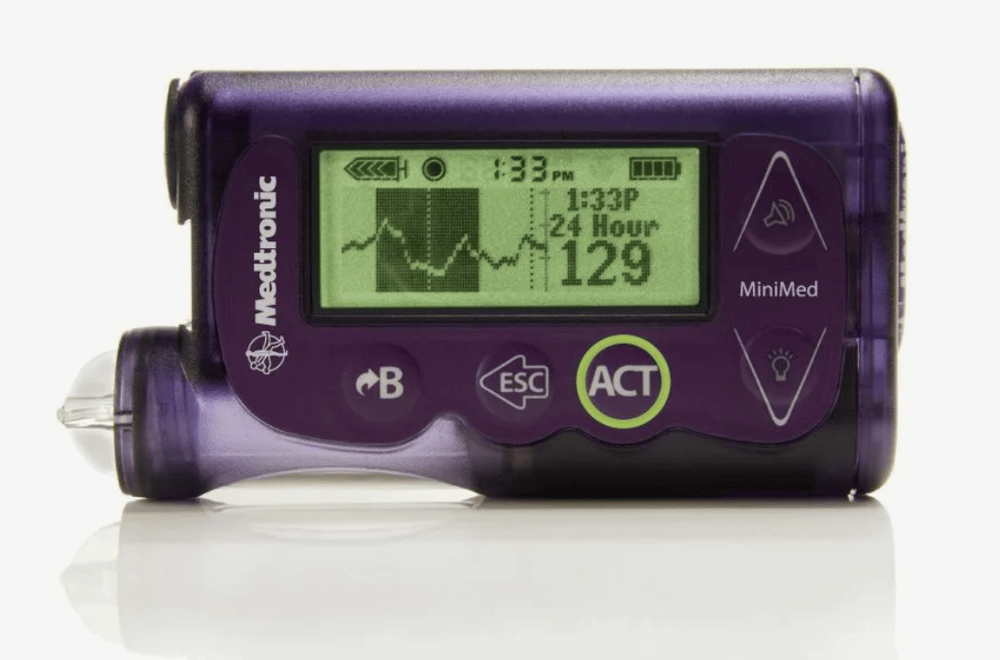

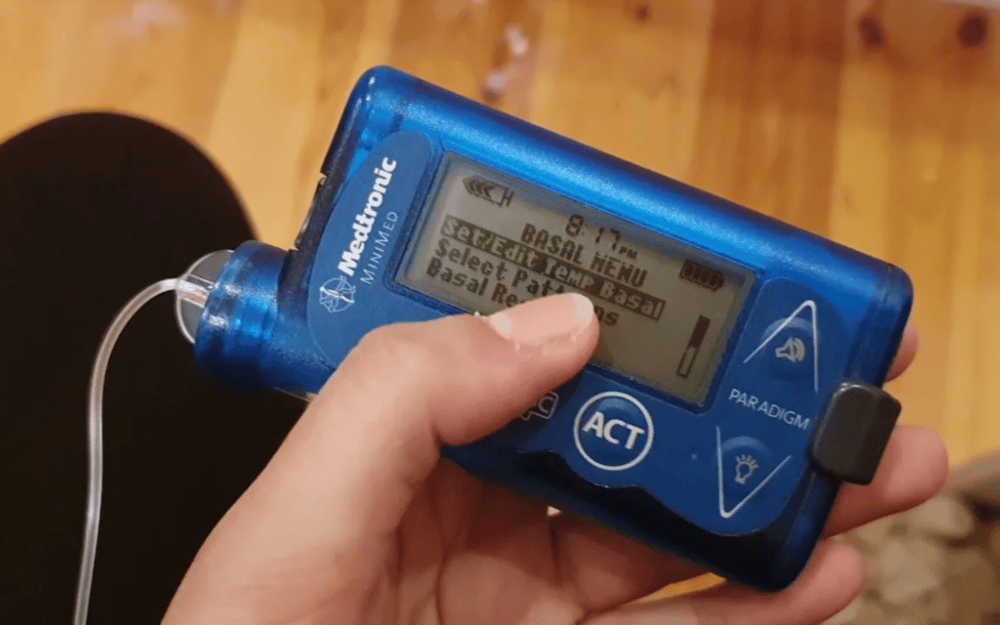

The diabetes division, which manufactures insulin pumps and continuous glucose monitoring (CGM) systems, has faced mounting regulatory scrutiny over quality control and cybersecurity vulnerabilities. The spin-off is intended to allow both entities to focus more narrowly on their respective strategic priorities and markets.

Analysis: Why Medtronic Is Restructuring Now

The spin-off reflects a wider industry trend of medical technology companies optimizing operational efficiency by divesting lower-margin or more regulatory-intensive business segments. For Medtronic, this restructuring allows its core business to sharpen focus on high-growth, high-return segments, particularly in the cardiovascular and neurovascular device markets.

The diabetes unit, once considered a potential growth driver, has struggled with regulatory hurdles and product recalls in recent years. Challenges around FDA compliance and cybersecurity risks have affected investor confidence and slowed innovation within the segment.

Meanwhile, the global diabetes care market remains highly competitive, with established players like Dexcom $DXCM, Abbott $ABT, and newcomers rapidly advancing in sensor and AI-driven solutions. Spinning off the business could provide the agility and autonomy required to compete effectively in a niche but evolving sector.

Quick Facts:

Parent Company: Medtronic

Spin-Off Target: Diabetes business (insulin pumps, CGM systems)

Strategic Motive: Refocus on high-margin cardiovascular and surgical technologies

Regulatory Challenges: Quality assurance and cybersecurity issues in diabetes segment

Earnings Forecast: FY2026 adjusted profit expected below Wall Street estimates

Market Reactions and Expert Commentary

The market responded cautiously to the news. Shares of Medtronic Plc experienced slight volatility during early trading, reflecting mixed investor sentiment about the long-term impact of the spin-off and the guidance downgrade. Analysts noted that while the divestiture adds clarity to Medtronic’s operational focus, the earnings forecast cut may weigh on near-term valuation multiples.

Industry experts view the spin-off as a necessary recalibration. Medtronic’s diversification strategy had reached a point of diminishing returns, especially in complex segments with elevated regulatory exposure. Narrowing its scope to scalable, lower-risk product categories is expected to improve both profitability and investor confidence.

At the same time, the future independent diabetes company may benefit from faster decision-making, dedicated leadership, and greater investment in R&D tailored to competitive pressures in diabetes technology.

Key Points:

Portfolio Optimization: Medtronic aims to streamline operations and exit low-margin, high-risk segments.

Profit Warning: FY2026 adjusted earnings outlook revised downward due to expected restructuring costs.

Spin-Off Strategy: The diabetes business will be established as a separate public company to increase agility.

Regulatory History: The unit has faced scrutiny over device safety and cybersecurity, impacting brand perception.

Investor Outlook: Analysts are split; some welcome the focus on high-margin devices, while others remain cautious due to lowered guidance.

Spin-Off Marks Strategic Inflection Point for Medtronic

Medtronic’s plan to separate its diabetes unit signifies a pivotal transformation in its corporate strategy. With pressure mounting from regulatory bodies and shareholders alike, the company has chosen to double down on its core competencies—particularly high-growth areas like cardiac rhythm management and surgical robotics.

While the diabetes spin-off introduces near-term earnings dilution and operational complexity, it holds the potential to unlock greater value through specialization. The success of this move will depend on execution, investor confidence in the future earnings path, and the ability of both companies to navigate complex regulatory landscapes independently.

As the medtech sector continues to evolve, streamlined business models and focused innovation pipelines are becoming essential for long-term competitiveness—a shift clearly embodied in Medtronic’s latest strategic decision.

Comments

It reflects how innovation and investment are increasingly intertwined in driving industry evolution